Bitcoin managed to rebound off support at about $38,900 amid growing buying pressure. However, the market rule worked out perfectly. The more frequent the price tests support, the more odds that it will be broken. The crypto benefitted from the bulls' interest and climbed to $40,000. Later on, the sellers entered the market and wrecked the upward bias. Earlier, analysts predicted that the BTC trading range is getting tighter and its borders are turning lower in parallel.

As a result, the bears stepped up the pressure at about $41,000. The price faced fierce resistance at this level and went down. As of April 27, bitcoin formed a bearish engulfing pattern. The price managed to settle at about the key support of $37,400 from where it rebounded to $38,000. The body of the red candlestick came into being at this level. Here are the major reasons for the downtrend in crypto assets. Investors are withdrawing their capital from the crypto market due to the Fed's monetary policy. Investors brace for a steeper downturn in digital tokens.

I've already mentioned that large liquidity is amassed in the area of $32,000-39,000. Bearing in mind monetary tightening, large investors are divided into two categories in terms of their investment strategy. The first camp united long-term holders. The second camp consists of aggressive speculators of available liquidity volumes. Let's look into the second category. They play a key role in the gradual BTC price decline to the lower border of the rangebetween $32,000-39,000. Low liquidity volumes force large market players to bet against bitcoin to squeeze weak traders away from the market. I assume BTC's price will extend its decline to $30,000 per token.

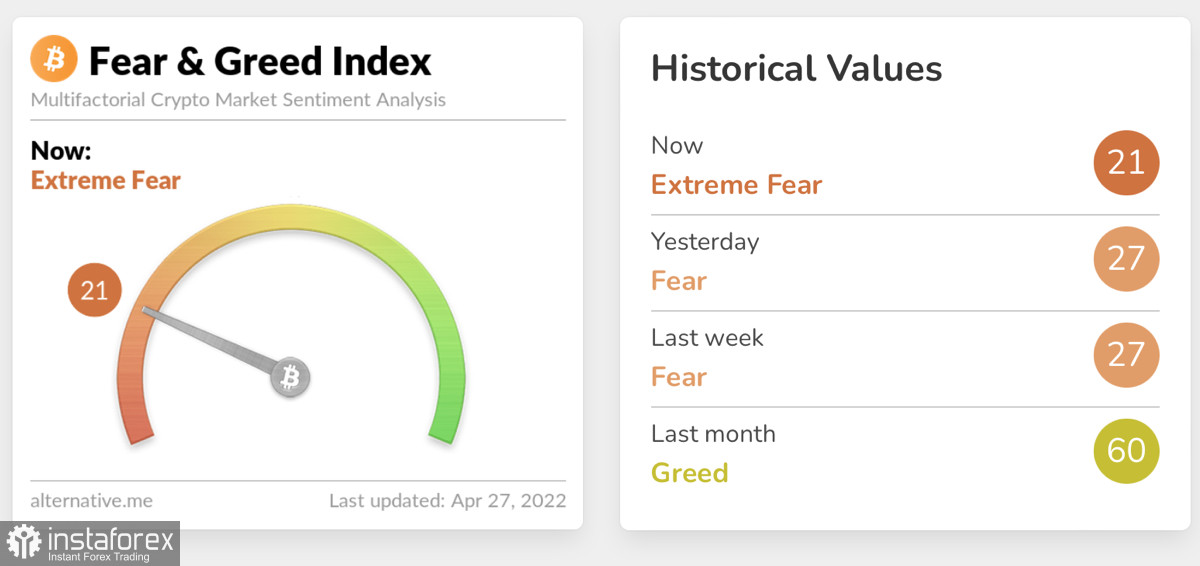

Market sentiment also indicates a further bearish trend. Institutional investors have already set particular targets for fixing profits and buying BTC. This is evident from large limit orders that are kept open until $32,000. The only obstacle to the ultimate targets could be BTC correlation with US stock indices. So, following a bounce in the equity market, crypto might gain a bullish trend instantly. On the whole, the crypto market is still trading on a pessimistic note. A decline to $32,000 is just a question of time.

The first category of investors focuses entirely on long-term BTC holdings. Such market players are taking advantage of low prices to accumulate crypto and diversify their investment portfolios. Judging by soft price bounces, such investors are trading sluggishly despite big BTC purchases.The trade volume of Bitcoin has shrunk by 30% this year with prospects of further contraction. It makes no sense to use an asset that is vulnerable to the QE program.

As of April 27, Bitcoin is now in the key support zone of about $37,400-38,100. No doubt, moving inside this price range, BTC will try to recover to $40,000. Technical indicators signal that the price will fail to gain traction. The MACD is moving deeper below the zero mark. The RSI and stochastic are indicating a local bounce that is obviously not enough for a strong upward move. The bitcoin market is about to enter the bearish stage. Nevertheless, the token is expected to consolidatein the near time. It is likely to make efforts to climb above $40,000 and settle there.