European stocks have stabilized after three bearish days. Investors have faced the consequences of cuts in gas supplies from Russia, rising Covid-19 concerns in China, and aggressive monetary tightening by the US Federal Reserve.

The S&P 500 and Nasdaq 100 contracts are retracing up slightly today, indicating calmer trading. Amid a plunge in tech stocks, the main US indicator hit its 6-week low.

The dollar trades at its 2-year high. The 10-year bond yield remains at around 2.78% this week.

Credit Suisse Group AG reported losses, while Deutsche Bank AG saw modest growth.

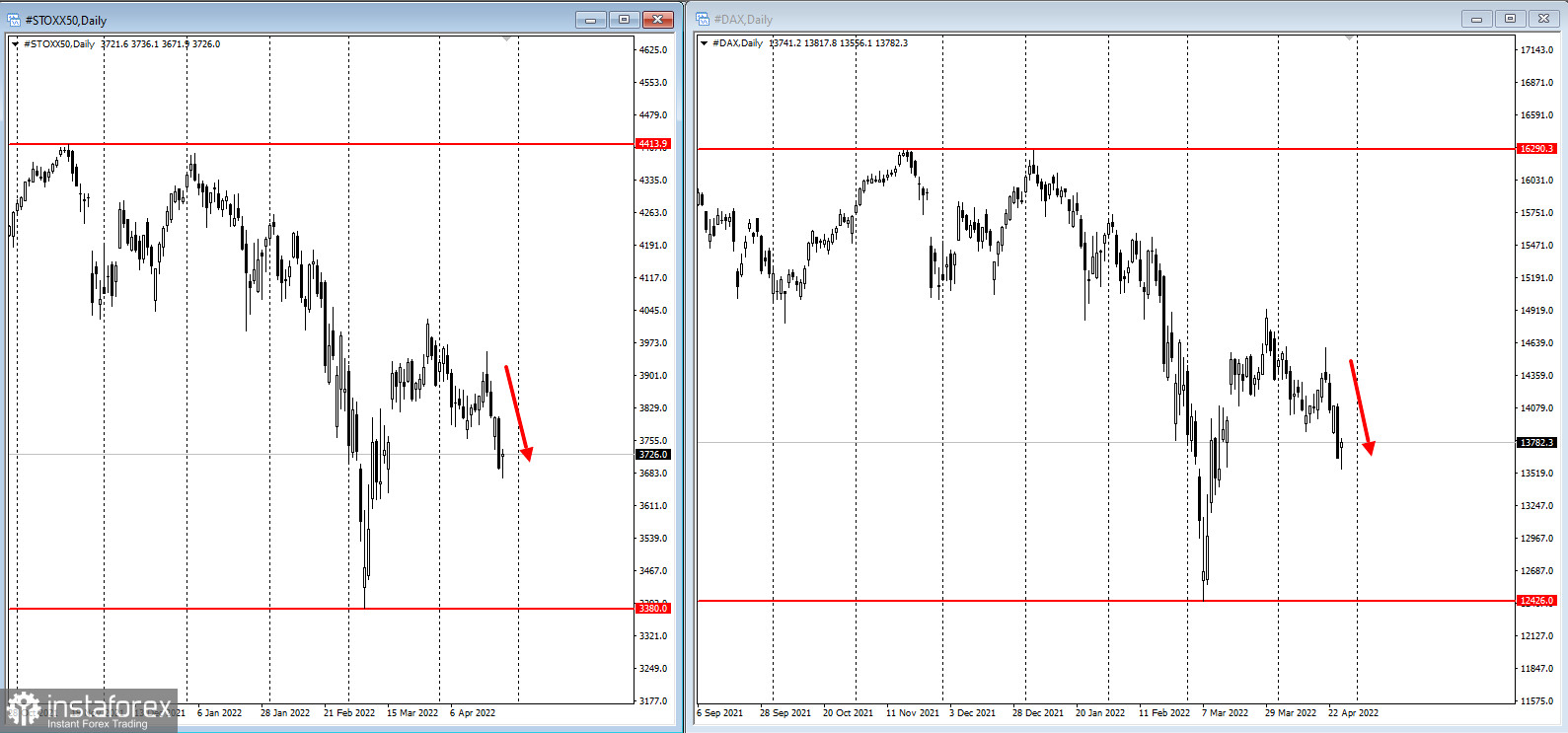

The Stoxx50 Europe index is also retracing up today after yesterday's plunge:

The euro touched its lowest level since 2017 versus the dollar amid fears that Moscow might reduce gas supplies to Europe, thus hurting the region's economy.

Russia halted gas exports to Poland and Bulgaria over the countries' refusal to pay for supplies in roubles. European gas soared by as much as 24%. Oil prided exceeded $102 per barrel.

The energy crisis along with disappointing earnings results of Alphabet Inc. and Texas Instruments Inc. have been weighing on the market, which is already under pressure from the Fed's policy tightening and the ongoing lockdown in China.

Amid rising energy prices and halted oil supplies from Russia, the MOEX Russia Index has been on the rise for two days:

- On Wednesday, the EIA will report on inventories.

- On Thursday, the Bank of Japan will announce its monetary policy decision. In addition, the United States will report on Q1 GDP and weekly jobless claims, and the ECB will present its Economic Bulletin.