Hi, dear traders!

First, let us have a look at yesterday's US macroeconomic data. Durable goods orders and the house price index exceeded expectations, while new house sales and the CB Consumer Confidence index data were below market projections. Today's economic calendar is light: the CBI realized sales data in the UK and the pending home sales report in the US. Although yesterday's statistics reports were mixed, USD continued to rise against GBP, fueled by the hawkish stance of the Federal Reserve, as well as investors avoiding risk due to the war in Ukraine and the lack of progress at peace talks between Russia and Ukraine.

Daily

Yesterday, the pair closed at 1.2570 after moving downwards during the session. If the downtrend continues, the pair would reach the key psychological and technical level of 1.2500. GBP/USD could likely perform an upward correction from this level, but it is unclear when it could happen and what could cause such a correction. Finding entry points during such a downward movement is quite difficult, and opening short positions at the very bottom is quite risky. However, the upward correction has still not begun, and the pair is trading below desirable prices for short positions. At the moment of writing, the pair moved downwards, surpassing the yesterday's low of 1.2569.

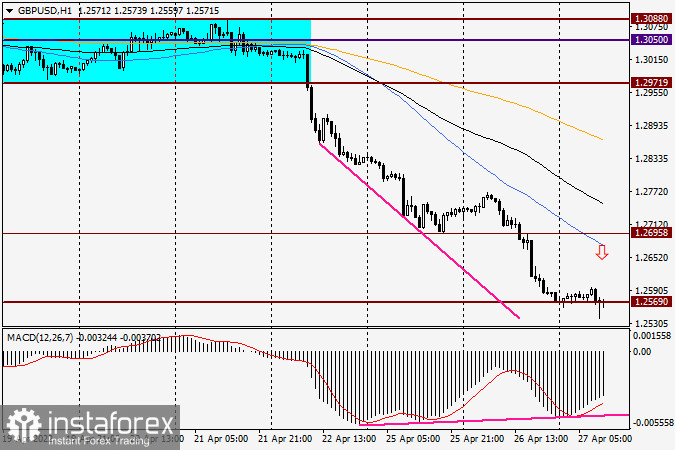

H1

The strength of the ongoing bearish trend can be clearly seen on the H1 chart. After a long period of sideways movement, GBP/USD dropped strongly. However, a correction is clearly overdue. It could be signalled by an MACD bullish divergence, indicating that the pair is oversold. While the pair could clearly dive even lower, short positions could be opened if it rebounds to the blue 50-day SMA line at 1.2675, or if it tries to move above the 1.2600-1.2620 area. In any case, going short near 1.2500 is very risky, even with the strong bearish trend taken into account.

Good luck!