Key data on inflation growth in Australia released on Wednesday came out in the "green zone," significantly exceeding the forecast estimates. The AUD/USD pair reacted to this report accordingly. Buyers were able to stop the downward price wave by organizing a 70-point correction. However, AUD/USD bulls failed to reverse the trend, and it is unlikely to succeed in the medium term. The US currency is in high demand throughout the market, so the Aussie is forced to settle for little, even despite the inflationary spurt.

But if we ignore the hegemony of dollar bulls, we can come to an unambiguous conclusion: today's release is of crucial importance for the Australian currency. By and large, it is now possible to say with some confidence that the Reserve Bank of Australia will still decide to raise the rate in the second half of the year. This issue has been discussed for a long time. Following the results of the April meeting of the RBA, the regulator allowed such a scenario, but "tied" the issue of tightening monetary policy with the dynamics of key macroeconomic indicators, primarily in the labor market and inflation.

The Australian jobs data published in April left a twofold impression. The unemployment rate in March remained at 4%. At the same time, most experts predicted a further decline in the indicator – to the level of 3.9%. That is, on the one hand, unemployment remained at the level of multi-year lows (the last time the indicator was in this area was in August-September 2008), but on the other hand, the indicator did not justify the optimistic hopes of most analysts. In addition, employment growth was also disappointing, rising only to 17,000 in March (this is the weakest result since October last year), although experts predicted a 30,000 increase. In February, this indicator grew by 77,000 at once.

After the publication of this report, the Australian dollar began to actively lose its position, especially against the background of geopolitical tensions and the outbreak of coronavirus in Shanghai, China. The AUD/USD pair rolled down: in April, the price dropped by more than 500 points, from the monthly high to the current low.

Of course, the US currency plays a key role in the downward trend. The hawkish intentions of the Federal Reserve, as well as a high degree of geopolitical tension, allowed dollar bulls to dictate their terms. Greenback has become a favorite of the foreign exchange market. But for several months – from the beginning of January to the end of March – the Australian dollar showed amazing "stress resistance." The AUD/USD pair was growing despite many factors that, in theory, should have turned the Aussie dollar 180 degrees. This was the period when the market won back the guaranteed 25-point Fed rate hike (which happened in March) and "lived with expectations" of strengthening the hawkish mood of the RBA.

Recall that the Reserve Bank of Australia was gradually approaching the date of a possible interest rate hike. Last year it was about the prospects for 2024. Then, as inflation increased and the economy recovered, this distance gradually shortened. As a result, RBA Governor Philip Lowe allowed a rate increase in March already within the current year.

However, at that time, the US currency was already sweeping away everything in its path, against the background of a more aggressive attitude of the Fed. For example, the probability of a 50-point rate hike at the May meeting is approaching one hundred percent. The probability of a 50-point increase at the next two meetings is also growing. In general, the American regulator demonstrates monolithic determination, against which the RBA looks rather pale. Even considering the fact that after today's release, the rhetoric of Lowe and other representatives of the Australian central bank will noticeably tighten, the Aussie dollar will not be able to reverse the trend.

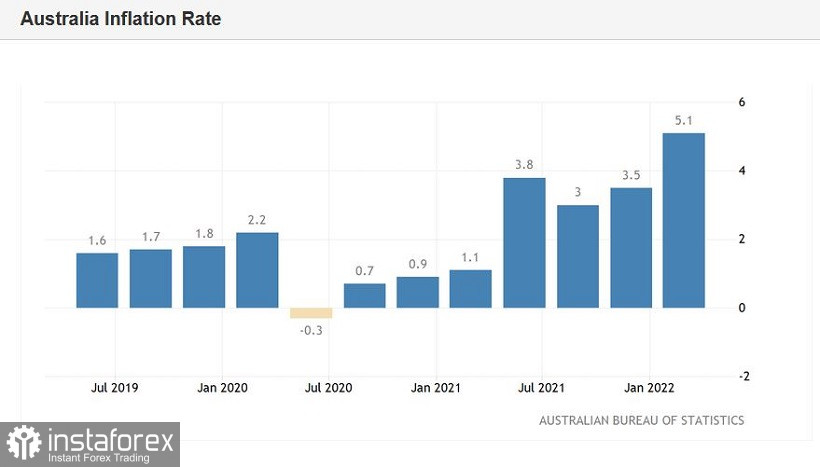

Thus, the current rise in the price of AUD/USD is temporary, corrective in nature. On the one hand, Australian inflation was really impressive: in quarterly terms, the consumer price index jumped to 2.1% (with a growth forecast of up to 1.7%), in annual terms, it rose to 5.1% (with a growth forecast of up to 4.6%). The indicators have approached 20-year highs. According to Treasurer Josh Frydenberg, the strongest price growth was in the fuel sector: fuel rose by 11% in quarterly terms, and by 35% year-on-year. This is the strongest growth rate for fuel in the last 32 years.

The figures, of course, are impressive, but today's report is still not able to reverse the downward trend of AUD/USD. The hype around the US currency does not subside, and it is unlikely to subside before the May Fed meeting (which will take place next week). Therefore, a corrective price increase can be used to open short positions. The main downward target is the lower line of the Bollinger Bands indicator on the W1 timeframe, which corresponds to the psychologically important mark of 0.7000.