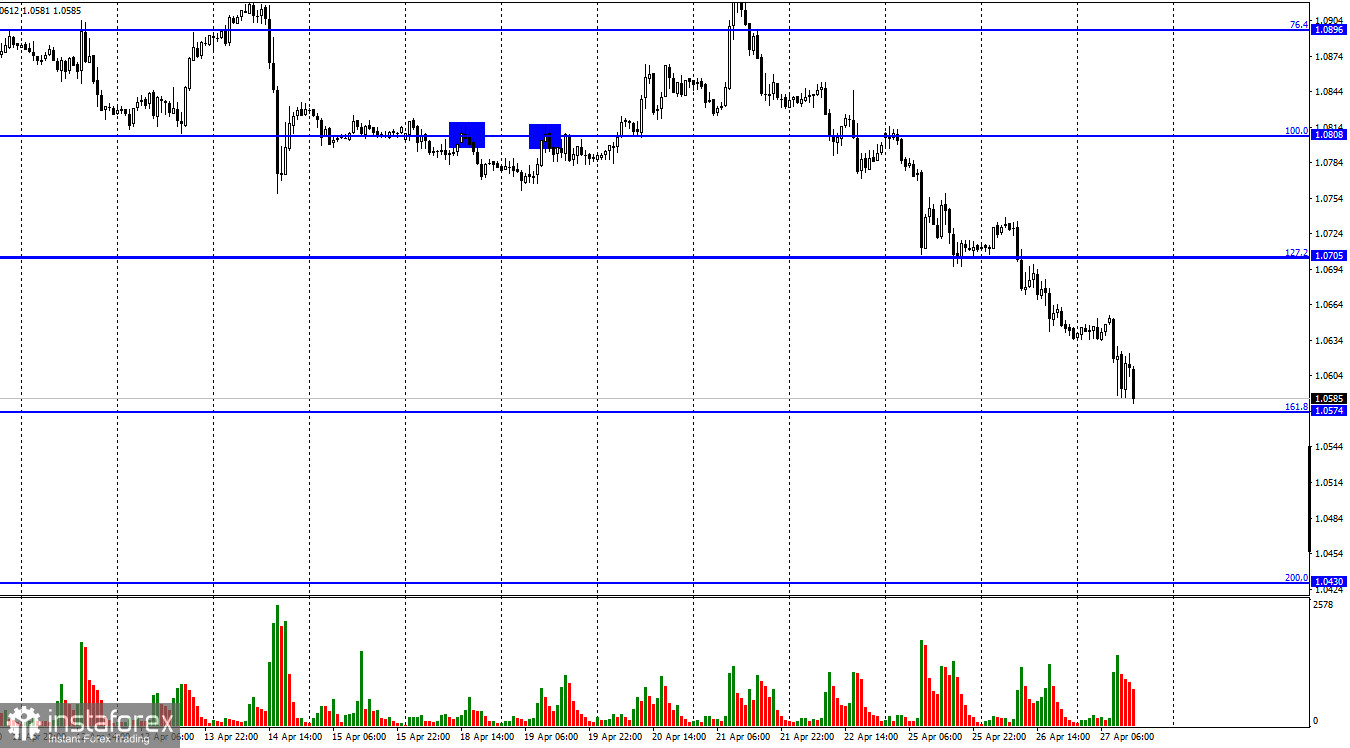

On Wednesday, the EUR/USD pair continued the process of falling towards the corrective level of 161.8% (1.0574). A rebound from this Fibo level will allow traders to count on a reversal in favor of the euro currency and some growth in the direction of the corrective level of 127.2% (1.0705). Fixing quotes below the level of 161.8% will increase the chances of a further fall in the direction of the next corrective level of 200.0% (1.0430). At first glance, the title of this article may seem strange, since what relation can the Kremlin have to the euro or the pound? However, the movement shown by both these currencies in the last two months, when the Kremlin's special operation in Ukraine began, no one doubts how traders react to the escalation of the military conflict. The euro and the pound may not be falling in value, the dollar may be rising in value. But both processes look the same on the charts, so it does not matter what is happening with supply and demand in the foreign exchange market right now.

The main thing is that the euro and the pound are falling. And they are falling because of the Kremlin's actions in Ukraine. And the longer this conflict persists, the more the euro and the pound may fall, as relations between Russia and Europe deteriorate more and more every day. Yesterday, it became known that Moscow itself refuses to supply gas to Bulgaria and Poland, although previously the popular opinion was that the Russian Federation is afraid of imposing an embargo on the oil and gas sector. However, in reality, Moscow itself is ready to refuse to supply energy resources to unfriendly countries. And there are many of them now because only the lazy ones did not impose sanctions against the Russian Federation. Well, China, North Korea, Syria, and Libya are considered allies of Russia. Accordingly, the longer the military operation in Ukraine continues, the lower a European and a Briton can potentially fall. They simply do not have any factors holding back the fall right now. Meanwhile, Kyiv openly declares that the war may last at least until the end of this year. Some officials say that this is a war for many years. We are preparing for the worst.

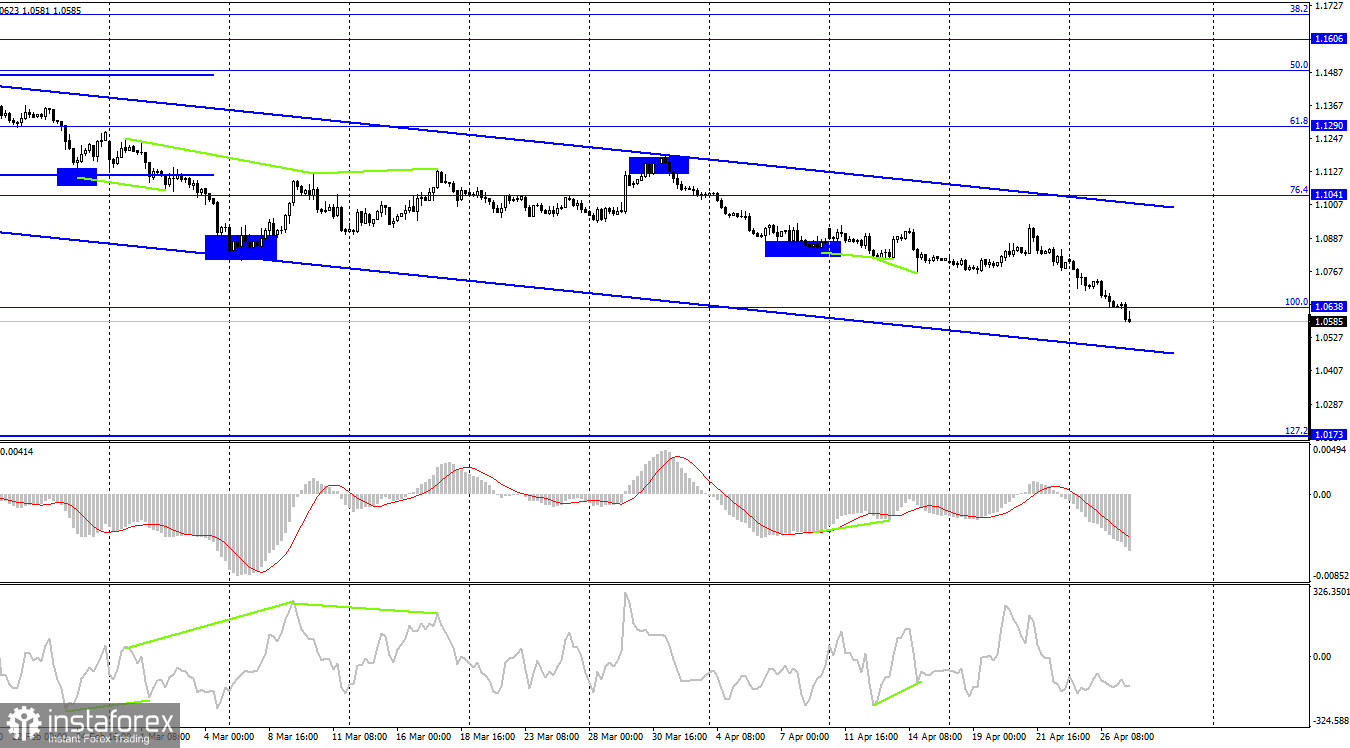

On the 4-hour chart, the pair secured under the corrective level of 100.0% (1.0638). Thus, the process of falling will continue in the direction of the next Fibo level of 127.2% (1.0173). The downward trend corridor still characterizes the mood of traders as "bearish". There are no signals for the growth of the pair at this time.

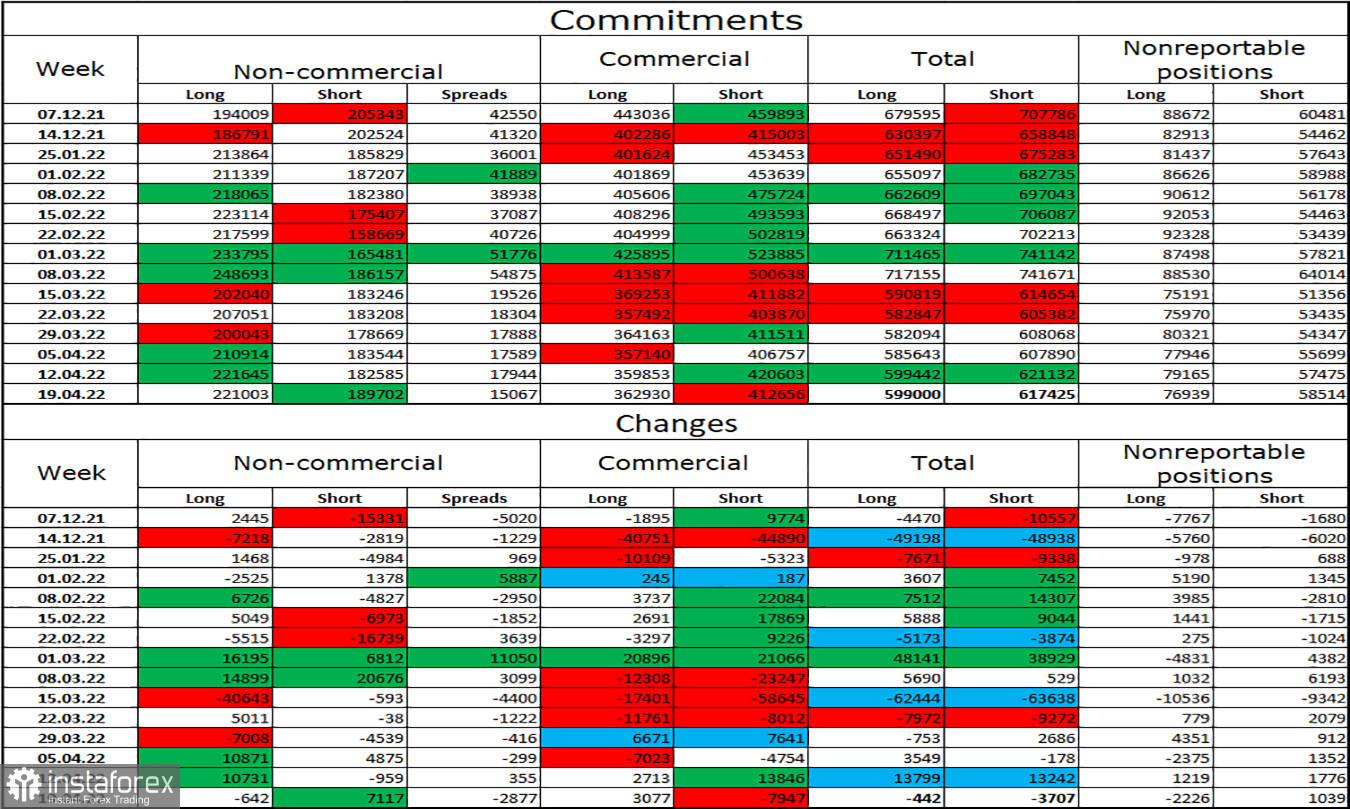

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 642 long contracts and opened 7,117 short contracts. This means that the bullish mood of the major players has weakened, but it has weakened a little. The total number of long contracts concentrated on their hands is now 221 thousand, and short contracts - 189 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is still characterized as "bullish". In this scenario, the European currency should show growth. But it has to show it for several weeks and even months and instead continues to fall into the abyss without any hope of salvation. Thus, it is impossible to draw adequate conclusions from the COT reports now. A very strong influence on the mood of traders is the possible continuation of hostilities in Ukraine, the deterioration of relations between Europe and the Russian Federation, new sanctions against Russia, and the weakness of the ECB's position.

News calendar for the USA and the European Union:

EU - ECB President Christine Lagarde will deliver a speech (11:30 UTC).

On April 27, the calendar of economic events in the European Union contains only the speech of the ECB president. However, there is no exact start time. In America, the calendar of economic events is empty.

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair if a close is made under the level of 1.0705 on the hourly chart with a target of 1.0574. This goal has been achieved. New sales at the close under 1.0574 with a target of 1.0430. I do not recommend buying a pair right now.