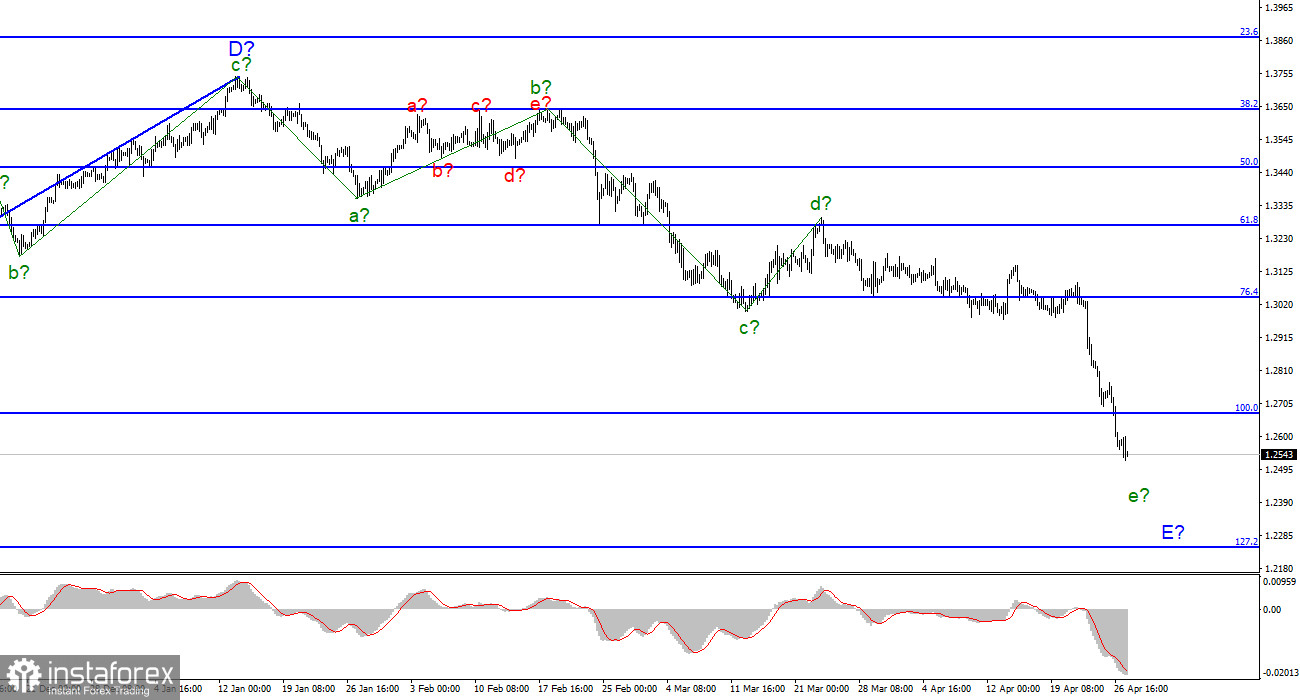

The wave layout of GBP/USD still looks convincing and doesn't require amendments. The downtrend section is still underway within wave e inside E. Its internal wave layout looks complicated. Thus, this wave cannot get shorter. Demand for the sterling is going down. Wave e already looks lengthy. Nevertheless, wave e inside E is the final wave of the downtrend section. The whole section is either coming to an end or should turn into a more complicated and lengthy shape. Everything will depend on the news environment in the coming months which is clearly divided into geopolitical and economic. The military conflict between Russia and Ukraine could persist for long months and even years, some military analysts warn. The war is sure to entail serious economic repercussions for the UK and the EU. In terms of economy, the Bank of Englandlooks softer in its intention to tighten monetary policy than the Federal Reserve. Nevertheless, these two factors could not subdue demand for the sterling forever. The Bank of England could increase the key interest rate to 1% on May 5. It might begin selling bonds following the rate hike.

GBP/USD is trading without big losses on April 27. Demand for the pound sterling is still the same. It is nice that demand is not fading at least. The market is shifting focus towards the policy meeting of the Bank of England scheduled for May 5. Most analysts reckon that the key policy rate willbe increased to 1% at this policy meeting. Let me remind you that last week, Andrew Baily's rhetoric did not sound too hawkish. His comments raised doubts among market participants that the regulator will raise interest rates at the fourth meeting in a row. However, the pessimistic sentiment is ebbing away this week.

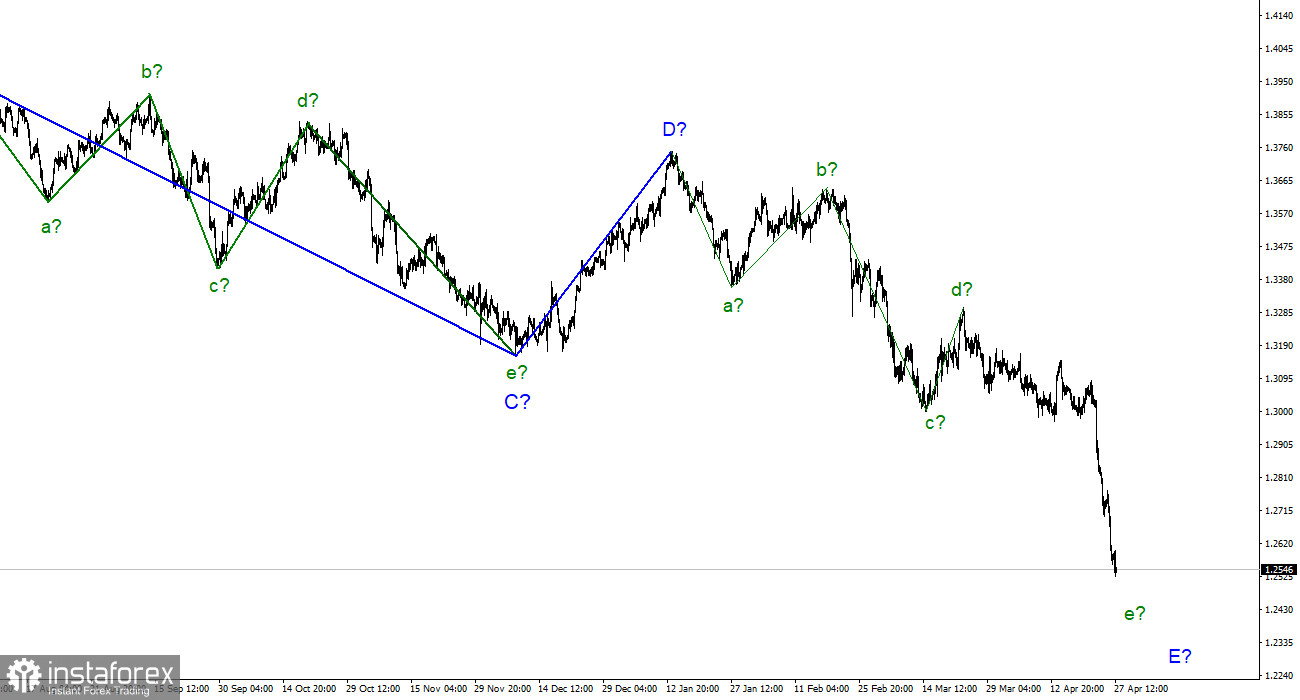

Here is a weird prediction. Let's imagine that the Bank of England will not raise interest rates next week. It means that the pound sterling would be set to extend weakness. The British pound has lost 500 pips for the last 4 days. Therefore, I assume that traders are going to cut on short positions on GBP/USD in the run-up to May 5 and consider long positions. The wave structure of the British pound clearly indicates that the downtrend section will be complete soon. So, GBP/USD has already worked out economic and political factors. In this context, I think the odds are that the currency pair will begin a new uptrend next week, though it could be a correctional climb. Let meremind you that if the Bank of England raises the key interest rate, it might launch a bond-selling program in the nearest months. The US Fed has the same plans for asset selling. The British central bank tries to follow suit of the Federal Reserve. It means that the sterling has fewer reasons for a decline than the euro. To sum up, I guess the pound sterling will be trading lower fora short while.

Conclusion GBP/USD wave layout still supposes that wave E should be built. I still recommend sellingthe currency pair with downward targets at 1.2246 which matches the 127.2% Fibonacci level. MACD is signaling a downward move. However, I don't see the sterling below this mark. From my viewpoint, the downtrend section will be complete soon.

On a longer time frame, wave D looks complete but the downtrend section does not. I still expectthe trading instrument to decline with targets at around 1.22. Wave E is developing a five-wave structure but still doesn't look round-shaped. It will look complete in a short time.