Analysis and tips on how to trade GBP/USD

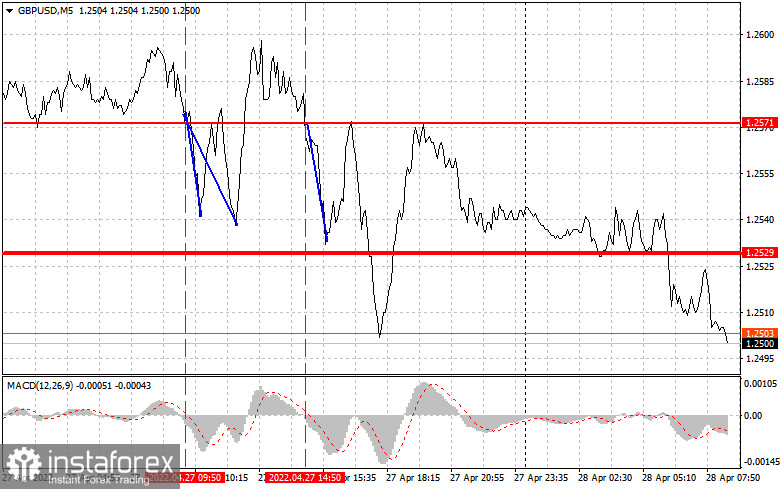

As soon as the MACD started to move down from the zero level, the price tested the 1.2571 mark for the first time, confirming the sell signal. As a result, the quote fell by more than 30 pips failing to touch the target level of 1.2529 on the first try. By the middle of the day, the price tested the mark once more. The MACD confirmed the accuracy of the sell entry point. As a result, the instrument fell by 40 pips. I decided not to buy the pound against the trend because the pair had once again failed to reach 1.2529.

As expected, the pound showed no reaction to the CBI distributive trades report. Although bulls continuously tried to protect yearly lows, the levels were updated during the North American session despite disappointing data on the goods trade balance and pending home sales in the United States. This fact had once again confirmed the bear market. Today's macroeconomic calendar contains no important releases in the United Kingdom, which is a positive factor for bulls who would use any reason to buy out the instrument from the current lows. I recommend trading based on Scenario 1 to buy the instrument. Today, the United States will publish its Q1 GDP report. The greenback might react to the results with a slowdown of the uptrend. The report is forecast to log a decrease in economic growth. However, should GDP fall even more than expected, pressure on the dollar will increase. Meanwhile, weekly jobless claims data will be of no importance today.

Buy signal

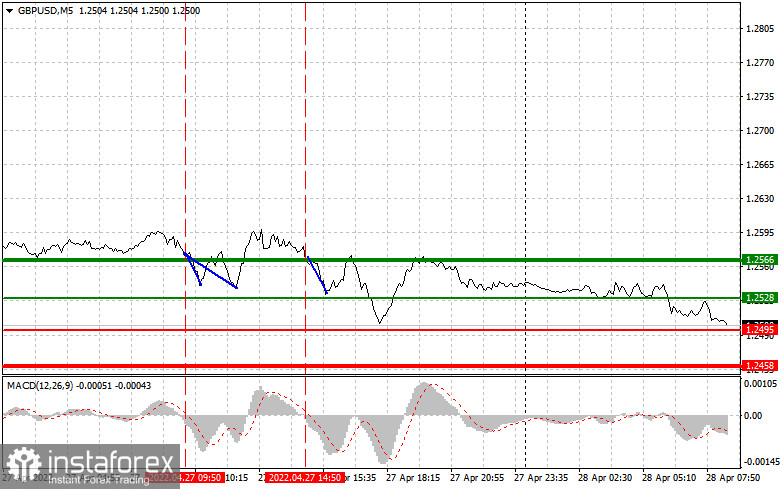

Scenario 1: You could go long today after the price has reached 1.2528 (the green line on the chart), with the target at 1.2566 (the thicker green line on the chart). You should consider closing long positions at around 1.2566 and selling the pound, allowing a 20-25 correction. The pound may somewhat retrace up today after the release of Q1 GDP in the US. Important! Before buying the instrument, make sure the MACD is above zero and just starts moving up from this level.

Scenario 2: Likewise, long positions could be opened today if the quote touches 1.2495 when the MACD is in the oversold zone. This could limit the pair's downside potential and lead to an upward reversal in the market. The price may head either towards 1.2528 or 1.2566.

Sell signal

Scenario 1: You could go short today after the price has updated the 1.2495 level (the red line on the chart). If so, the pair may go down to the key target at 1.2458 where you should consider closing your positions and buying the euro, allowing a 20-25 pips correction. Pressure on the pound could return at any moment. However, given its oversold status, you should be extra careful opening new short positions at current yearly lows. Important! Before selling the instrument, make sure the MACD is below zero and just starts to move down from this level.

Scenario 2: Likewise, short positions could be opened today if the price reaches 1.2528 when the MACD is in the overbought zone. This could limit the pair's upside potential and lead to a downward reversal in the market. The quote may go either to 1.2495 or 1.2458.

Indicators on the chart:The thin green line indicates a buy entry point.

The thick green line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to grow above this level.

The thin red line indicates a sell entry point.

The thick red line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to fall below this level.

MACD. When entering the market, it is important to pay attention to the overbought and oversold zones.

Remember that novice forex traders should be very careful when deciding to enter the market. Before the release of important fundamentals, you should stay out of the market in order to avoid sharp fluctuations in the rate. If you decide to trade during news releases, make sure to always place a stop-loss order to minimize losses. Without it, you may quickly lose your entire deposit, especially if you do not use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.