Traders should avoid trade decisions

The pound/dollar pair is showing almost the same dynamic as the euro/dollar pair. The US dollar continues receiving support from the Fed's aggressive policy. In addition, demand for the greenback as a safe-haven asset is being boosted by the new wave of pandemic in China and military operation in Ukraine. Today, a speech provided by Governor of the Bank of England Andrew Bailey will be the main event that may affect the pound/dollar pair. However, Andrew Bailey will hardly provide any hawkish comments. He is expected to call on officials to keep a cautious approach. Nevertheless, the BoE governor is likely to tackle the inflation issue and offer some measures to cap its surge, without taking any radical steps. Notably, the US GDP data for the first quarter will also affect the market situation.The indicator may fail to rise by 1.0% due to exports and inventories. However, the growth is likely to remain strong. In this case, the market situation will be shaped by market players. The fact is that traders have been ignoring fundamental data for a long time already. However, today's GDP report may influence the Fed's decision on the key interest rate that is going to be unveiled during a meeting in May.

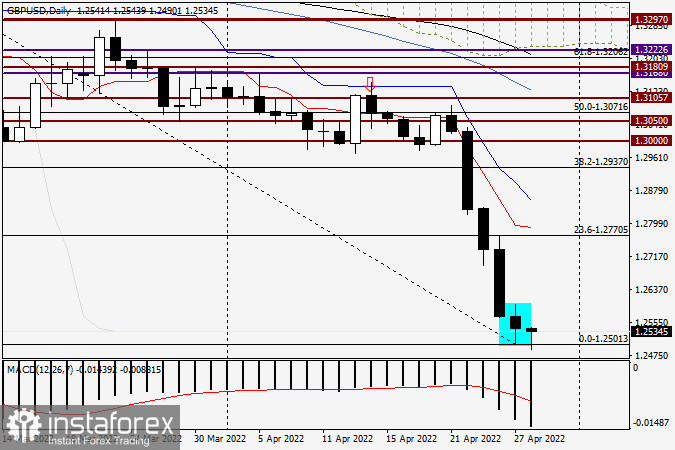

Daily

On the daily chart, we see that yesterday, the pound/dollar pair lost less than in the last several days. This could be explained by the fact that the pair hit the psychological level of 1.2500. It seems that bears failed to break this level. However, today, the pair slid to 1.2490, but managed to rebound. At the moment, the pair is trading at 1.2522. Yesterday's candlestick with a relatively small bearish body and almost equidistant shadows can be considered a reversal patterns of a candlestick analysis. This assumption could be proved by the fact that on April 27, the candlestick formed amid attempts to push the price below the important level of 1.2500. If the US GDP report disappoints traders, the greenback may show an upward correction after a significant jump. In this case, traders should remain cautious. Traders should also avoid opening buy positions against the current string bearish trend and sell order after a slump. In addition, it will be wise to avoid entering the market near 1.2500. It is quite possible that it is high time to see a correction in the pound/dollar pair. In any case, it is just a presumption.

Good luck!