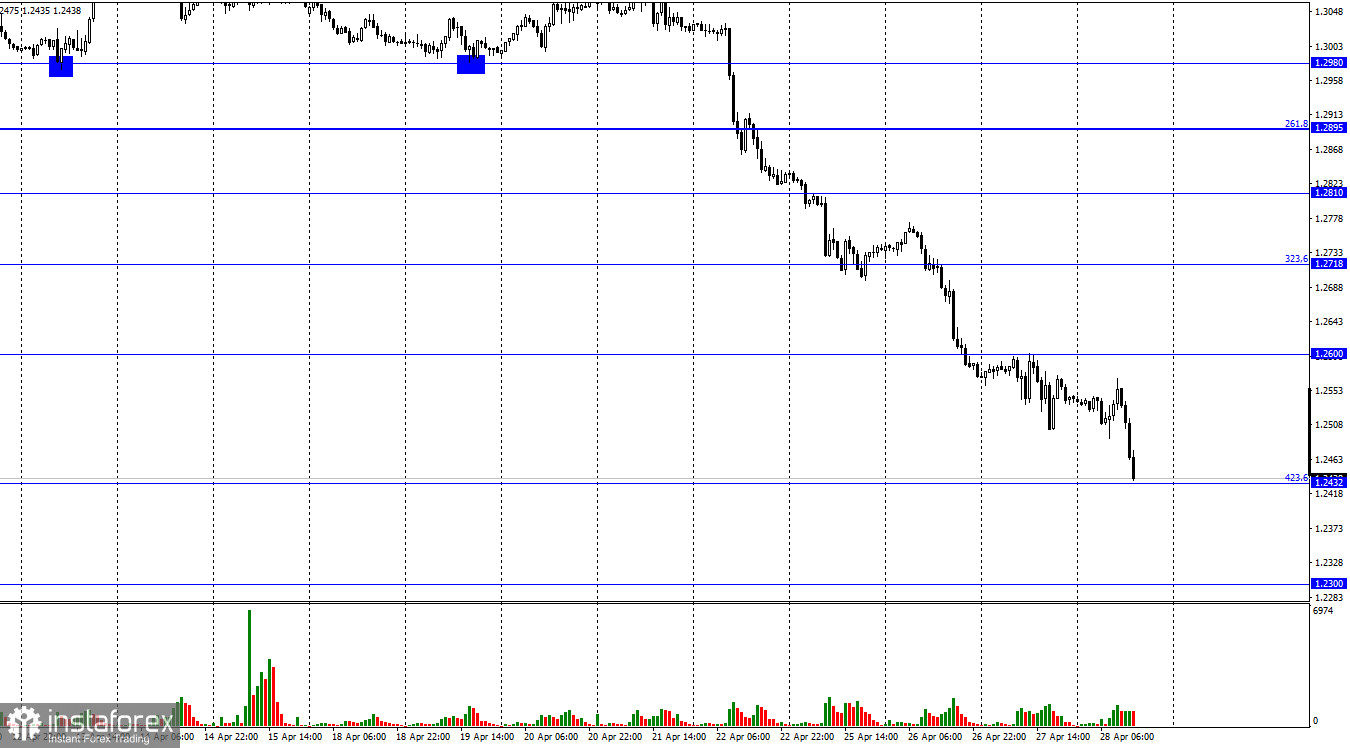

According to the hourly chart, the GBP/USD pair on Wednesday and Thursday continued the process of falling in the direction of the corrective level of 423.6% (1.2432), which was worked out today. We can even say that traders took a break yesterday, as the British dollar fell by only 20 points during the day. Well, today the fall resumed with renewed vigor. The information background is still empty, as there are very few events in the UK and the USA this week. There are no speeches by the presidents of central banks, there is no new information on the PEPP, and there are no important geopolitical messages. There is nothing at all that directly concerns the pound or the dollar. In the case of the European currency, everything is easier, since the European Union is on the verge of an energy crisis due to the refusal of gas supplies from the Russian Federation. However, in the case of the UK, this problem is not a problem, since the country itself announced a month ago that it would complete the import of oil and gas from Russia in 2022. It's even easier in America. It has already refused to import Russian energy carriers.

Thus, why the pound falls is an open question. I can assume that it's all about the Fed, which continues to actively move in the direction of raising rates in May, June, and July by 0.5%. However, let me remind you that the Bank of England has already raised the interest rate three times, and in May it may raise it for the fourth time. Therefore, there is practically no difference between the DCP of the Fed and the Bank of England. Of course, the Fed has more ambitious plans to tighten the PEPP, but plans and real solutions are different things. It is unlikely that a Briton can lose 600-700 points in 5-6 days just on the expectations of traders. It's illogical and it doesn't happen that way. Thus, the reasons for the fall of the Briton should already be sought more deeply. The UK is certainly closer to a military conflict in Ukraine than the US. Therefore, the dollar is growing not unreasonably. But it's growing too much and too fast. A report on GDP in the first quarter will be published within the next hour, which may show a significant slowdown. A slowdown in economic growth may significantly reduce the "hawkish" mood at the Fed.

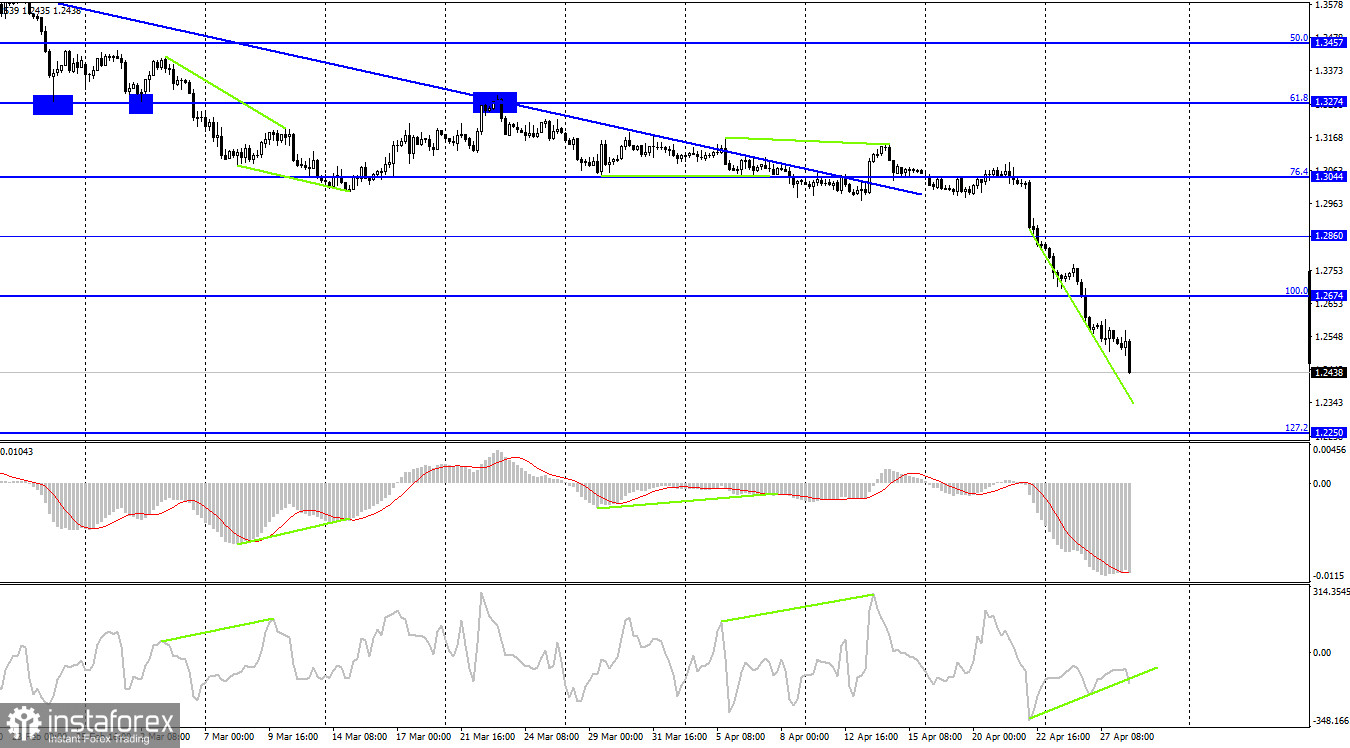

On the 4-hour chart, the pair closed under the corrective level of 100.0% (1.2674). Thus, the process of falling continues now in the direction of the next corrective level of 127.2% (1.2250). The brewing bullish divergence may allow a reversal in favor of the UK currency and start the growth process. But, most likely, it will be canceled in the near future - the downward trend is too strong.

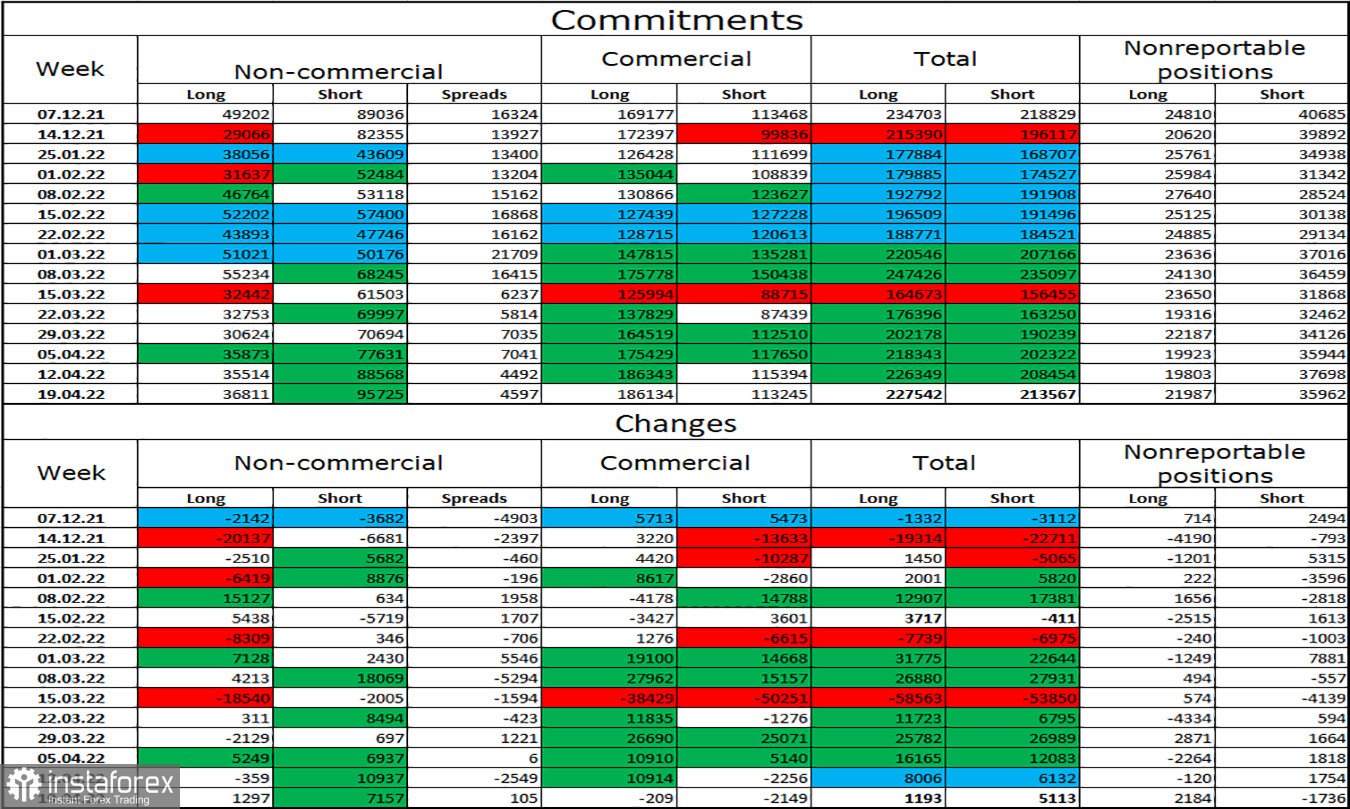

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed a lot again over the past week. The number of long contracts in the hands of speculators increased by 1,297 units, and the number of short - by 7,157. Thus, the general mood of the major players has become even more "bearish". The ratio between the number of long and short contracts for speculators still corresponds to the real state of things on the market - longs are 2.5 times more than shorts (95725 - 36811). The big players continue to get rid of the pound. Thus, I expect the pound to continue its decline. COT reports speak in favor of this option. However, other factors support the fall of the British.

News calendar for the USA and the UK:

US - change in GDP volume for the quarter (12:30 UTC).

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

There is not a single interesting entry in the calendar of economic events in the UK on Thursday. In the US, there is an important GDP report that is about to be released. I believe that the influence of the information background on the mood of traders today will be average in strength.

GBP/USD forecast and recommendations to traders:

I recommended selling the British dollar with a target of 1.2432, as the closing was made under the level of 1.2674 on the 4-hour chart. This level has been worked out. New sales at the close under 1.2432 on the hourly chart with a target of 1.2300. I do not recommend buying a pound at this time.