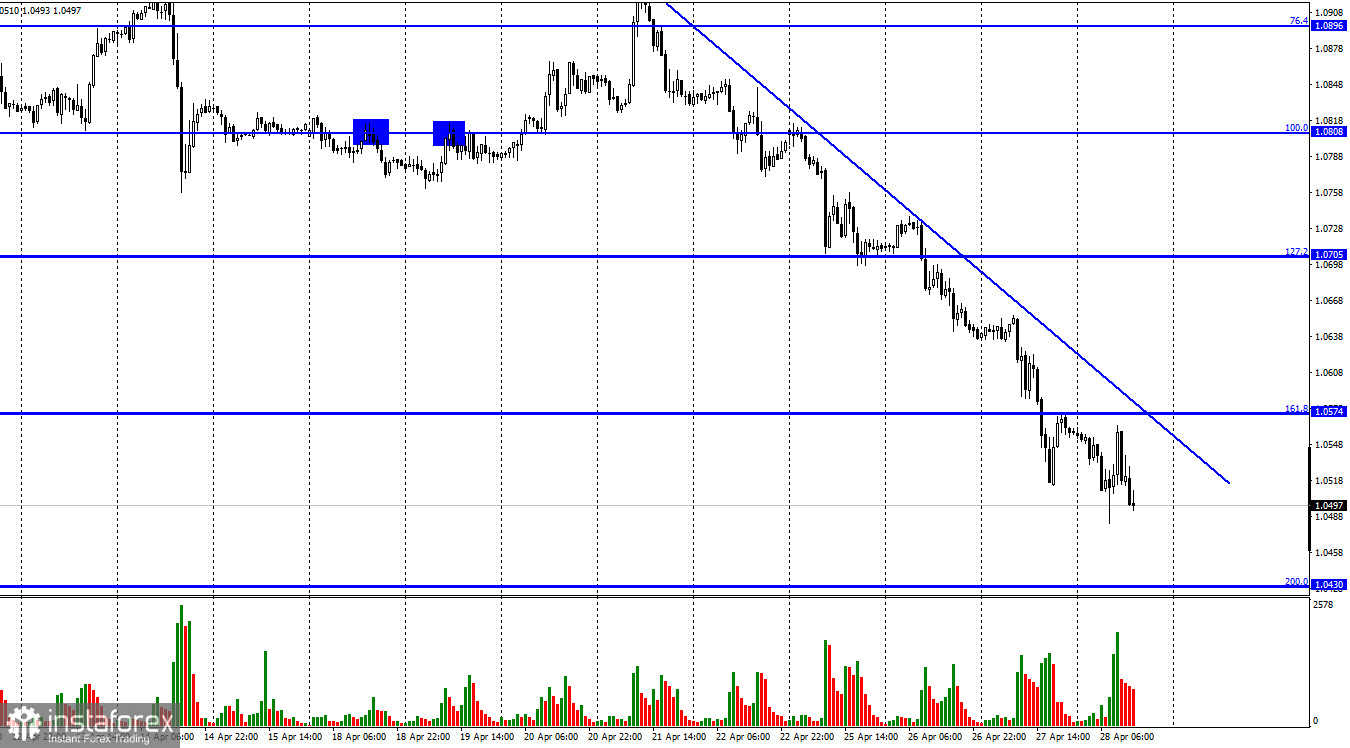

Greetings, dear traders! The EUR/USD pair extended its losing streak on Thursday after it dipped below 1.0574, the Fibonacci correction level of 161.8%. It may further fall to 1.0430, which corresponds to the Fibonacci correction level of 200.0%. The downward trend line indicates that bears are holding the upper hand. However, it is now clear even without this trend line. Today, the economic calendar for the euro area is uneventful. Nevertheless, the euro is moving within the bearish channel. It followed the same trajectory on Wednesday, Tuesday, and Monday. It may seem that the euro is dropping for no particular reason. Personally, I am more surprised with the pace of a drop but not with the drop itself. The fact is that relations between Russia and the European Union are getting worse every day. In this article we are analyzing the euro and the US dollar, we will not touch upon the topic of the Russian economy and the consequences of the sanctions. The European economy may face serious problems due to the energy crisis which has already begun.

A few weeks ago, market participants widely discussed the possibility of the embargo on Russian oil and gas. However, analysts were sure that it would be an extreme measure. However, nobody would have expected that Russia could shirt to such measures faster than the EU. Yesterday the country cut gas supplies to Poland and Bulgaria as they refused to pay for commodities in rubles. Moscow understands that the embargo may be imposed in the near future as the European Union has almost used all leverage against Russia in its conflict with Ukraine. The EU has already stated that they are considering various plans to reduce dependence on energy resources from Russia in the coming years, so it is only a matter of time. Moscow decided not to wait but took the first step itself. It was rather a wide move. So, the energy crisis in the EU is looming on the horizon.

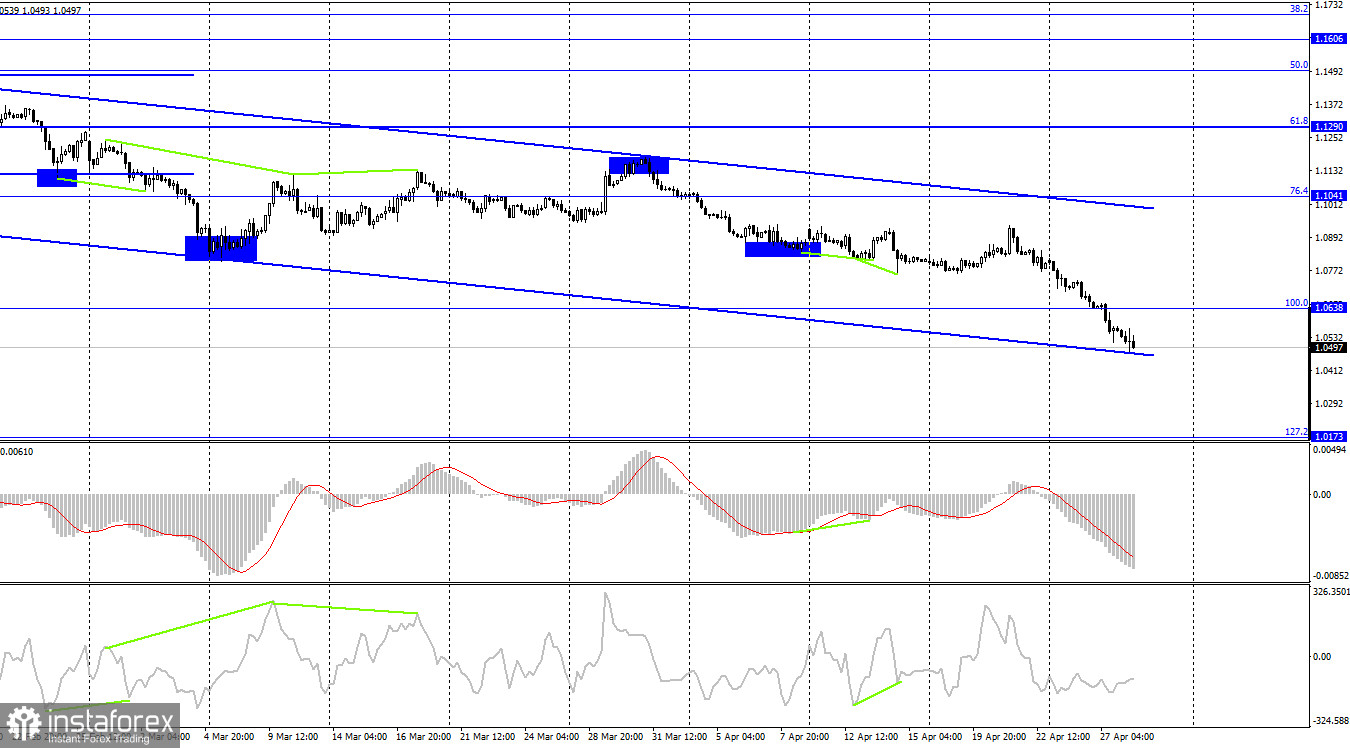

On the 4H chart, the euro/dollar pair dropped below 1.0638, the Fibo correction level of 100.0% It may hit 1.0173., which corresponds to the Fibonacci correction level of 127.2%. The downward trend line indicates a strong bearish movement. There are currently no buy signals.

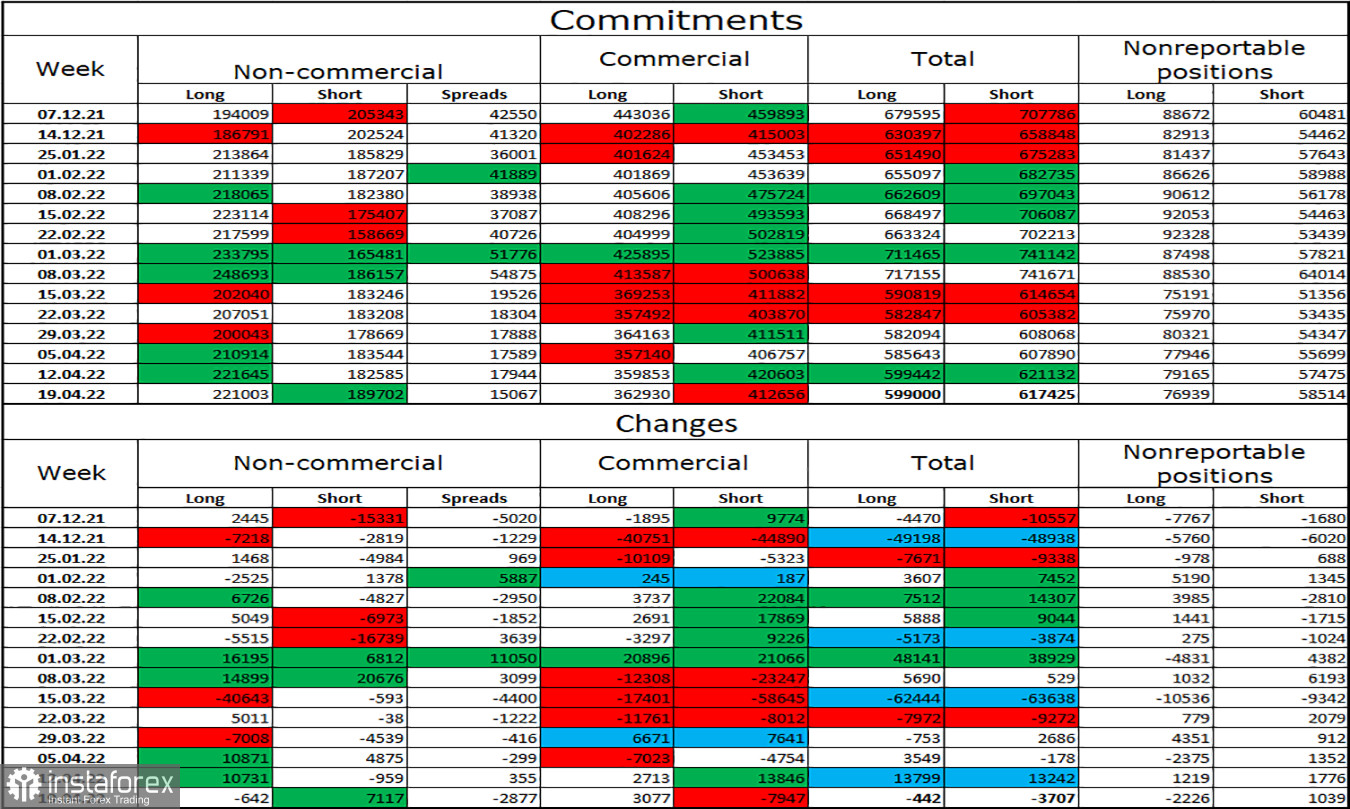

Commitments of Traders (COT):

Last week, speculators closed 642 Long contracts and opened 7,117 Short contracts. It means that the bullish bias has weakened a little. The total number of Long contracts amounts to 221K and the number of Short contracts totals 189K. Thus, the mood of the "Non-commercial" category of traders is still bullish. So, the euro is supposed to rise. Notably, it should have been growing already for several weeks and even months. Instead, it continues to fall further. It appears that COT reports do not reflect the real market situation. The likelihood of the prolonged military actions in Ukraine, the deterioration of relations between Europe and Russia, new sanctions against Russia, and the ECB's dovish stance are dragging down the euro.

Economic calendar for the US and EU

US – GDP for the first quarter (12:30 UTC).

US- Initial and continuing jobless claims (12:30 UTC).

On April 28, the economic calendar for the EU is empty. The US is going to reveal GDP data for the first quarter, which may affect market sentiment.

Outlook for EUR/USD and trading recommendations:

It would be appropriate to open short positions if the pair declines below 1.0574 on the 1H chart with the target level of 1,0430. Now, traders should keep these traders open. It is better to refrain from opening long positions.