GBP/USD 5M

The GBP/USD currency pair also continued its downward movement on Thursday, ignoring the disappointing US GDP report. For a long time it was assumed that the American economy is very well on its feet, and the Federal Reserve can thereby raise the rate to the values it needs. But, as practice shows, the reality is completely different. Of course, another report on GDP in the European Union will be released today, and we will see how good the European economy is now. But the main thing now is – if this is not some kind of mistake or a one-time drop, then the Fed simply will not be able to raise the rate even to a neutral level – the economy may slip into recession. Formally, it has already done this, since its growth rates have not just fallen, they have disappeared, the economy has shrunk. Thus, it is at least strange to see further growth of the dollar now. Nevertheless, the market is clearly paying more attention to the geopolitical background now, because even the foundation does not support the dollar so unambiguously.

Two trading signals were generated yesterday. The pair rebounded from the 1.2493 level at the beginning of the European trading session and went up 55 points. There were 160 points to the nearest target level, so it was hardly necessary to count on such a powerful movement – the deal should have been closed manually. The next sell signal was formed when the price was settled below the level of 1.2493. After that, the pair had already gone down 70 points, but there was an even greater distance to the nearest target level from below. This transaction should also have been closed manually. It was possible to earn at least 50 points on these two signals.

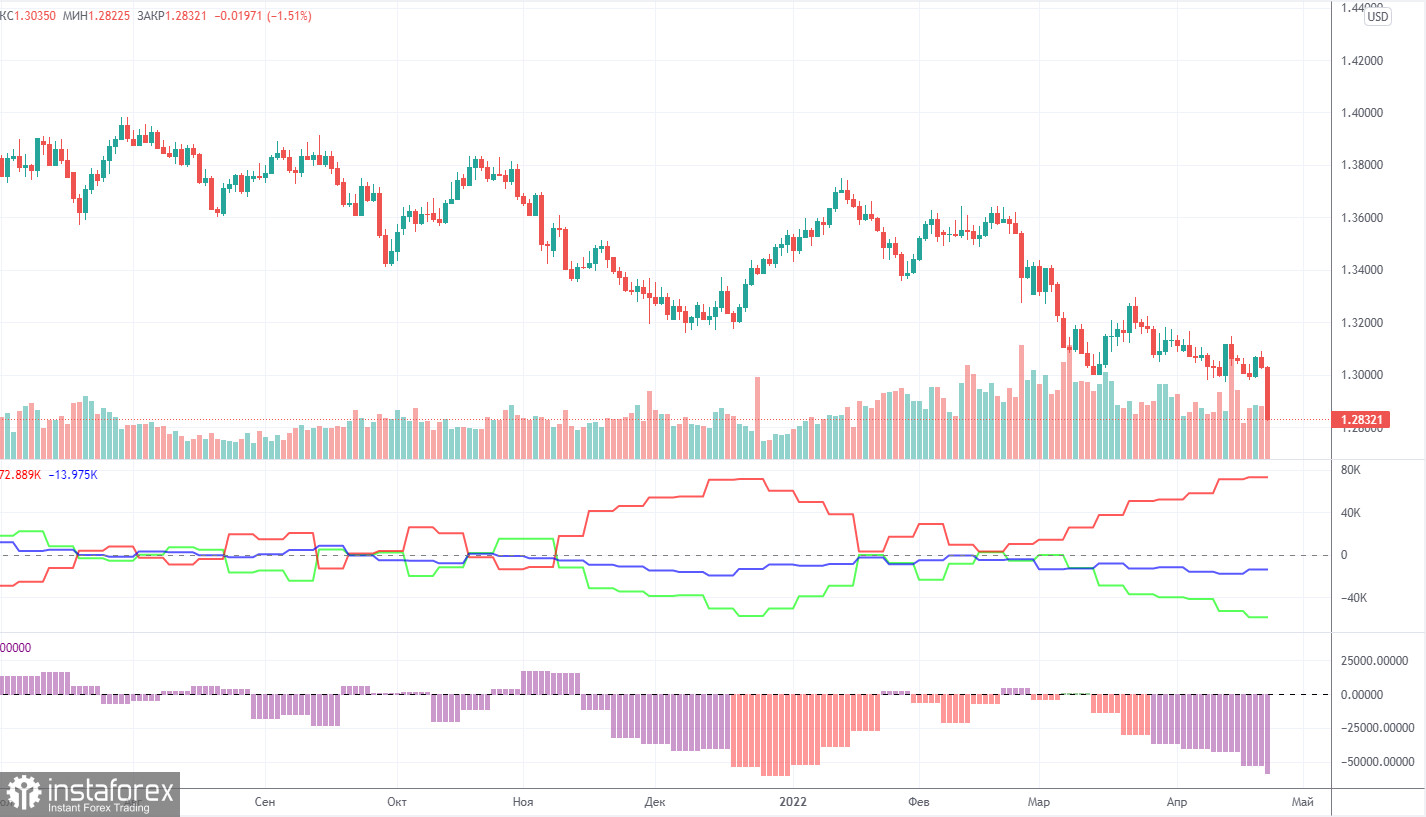

COT report:

The latest Commitment of Traders (COT) report on the British pound has witnessed a new strengthening of the bearish mood among commercial traders. During the week, the non-commercial group opened 1,300 long positions and 7,100 short positions. Thus, the net position of non-commercial traders decreased by another 6,000. Such changes are significant for the pound. The non-commercial group has already opened a total of 95,700 short positions and only 36,800 long positions. Thus, the difference between these numbers is almost threefold. This means that the mood of commercial traders is now "pronounced bearish". Thus, this is another factor that speaks in favor of the continuation of the pound's decline. Note that in the pound's case, the COT report data very accurately reflects what is happening in the market. According to the pound, the mood of the major players changes every couple of months, but at this time it fully corresponds to the movement of the pound/dollar pair. The net position of the "non-commercial" group has already fallen to the levels where the last round of the pound's fall ended (the green line on the first indicator). Thus, we can even assume that in the coming weeks the pound will try to start a new ascent. However, the current fundamental and geopolitical background does not give good reasons to expect a strong growth of the British currency.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. April 29. The energy crisis can drive a tank through the European economy. But it is inevitable.

Overview of the GBP/USD pair. April 29. Scholz's ban on the supply of weapons to Ukraine does not suit the Germans. Lend-Lease, rearmament of the Armed Forces of Ukraine.

Forecast and trading signals for EUR/USD on April 29. Detailed analysis of the movement of the pair and trading transactions.

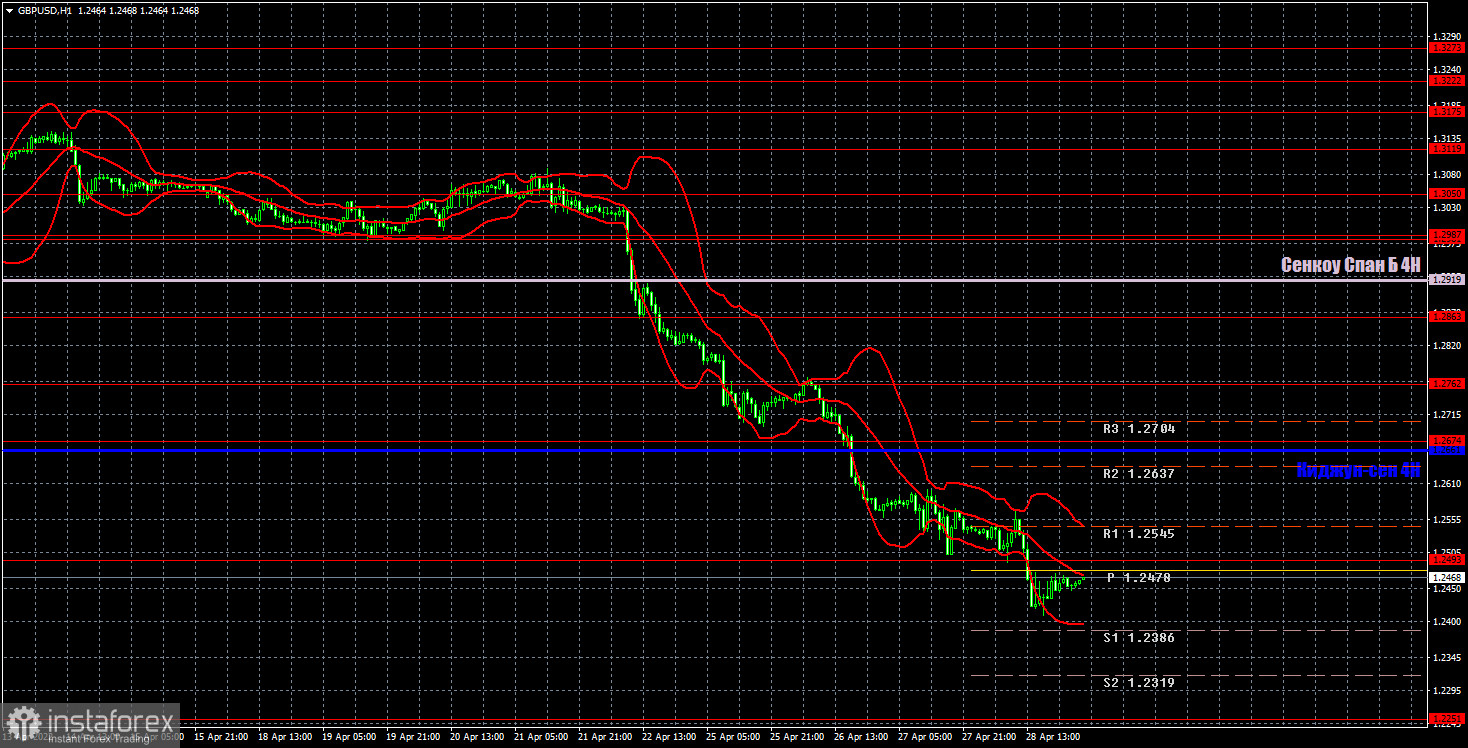

GBP/USD 1H

The hourly timeframe clearly shows how much the pound has fallen in the last five days. The whole downward movement no longer fits into the chart without changing the scale. The British currency continues to fall and it is not yet clear why it continues to do so and when it is going to end. Now everything is turning to the fact that it will end abruptly and unexpectedly with a strong growth of the pair. We highlight the following important levels on April 29: 1.2251, 1.2493, 1.2674, 1.2762. The Senkou Span B (1.2919) and Kijun-sen (1.2661) lines can also be signal sources. Signals can be "bounces" and "breakthroughs" of these levels and lines. It is recommended to set the Stop Loss level to breakeven when the price passes in the right direction by 20 points. The lines of the Ichimoku indicator can move during the day, which should be taken into account when determining trading signals. There are also support and resistance levels on the chart that can be used to take profits on transactions. There are no important events and reports scheduled for Friday in the UK. There are only secondary reports on personal income and expenses of Americans in the US, which will definitely not cause any market reaction. We warn you: the current downward trend may end abruptly and unexpectedly, so the more the pair falls, the more carefully you need to prepare for a possible strong growth.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.