The EUR/USD currency pair finally started some kind of correction on Friday. During the last trading day of the week, the euro managed to add about 50 points, so this movement is pulling the maximum back. The pair is still located below the moving average line, which allows it to resume falling almost at any time. We have already said in previous articles that the fall of the European currency in recent weeks and even months is logical since almost all factors remain in favor of the dollar. However, we also said that the fall of the euro over the past 5-6 days looks too strong. In other words, there was not a single new factor in the fall of the euro currency during this period, but for some reason, the market began to get rid of the EU currency with tripled force. It is this moment that worries us. We believe that in some way traders have already exceeded the euro sales plan. In the last week, sales were already carried out by inertia, and not based on new factors or data. Thus, in the medium term (for 2022), we continue to support the option with a planned decline in the pair. However, in the near future, we may see a strong and prolonged correction, since one currency cannot constantly fall in tandem with another.What can help the European currency at this time? As strange as it may sound, its oversold status can help. The euro has been sold off by market participants for too long and sooner or later they should start taking profits on shorts. The fundamental background remains the same negative, but if suddenly what Luis de Guindos announced a week earlier starts to come true (an ECB rate hike in the summer), this factor may support the euro. The fact is that the current dollar rate has already included at least three increases in the Fed's key rate. FOMC members have been talking about multiple rate increases for so long that the market has long worked out these statements. Therefore, the more the euro falls, the more chances for its growth. As usual, we do not recommend trying to guess the trend reversal and trying to buy at the very lows. It is better to wait for a clear formation of an upward trend (at least consolidation above the moving average) and only then start buying.

Macroeconomic statistics play a small role now.

I would like to note right away that important reports last week were ignored by the market. We are talking primarily about GDP reports in the US and the EU, as well as inflation in the European Union. If we can still say about European statistics that it was neutral, since the actual values of both indicators almost coincided with forecasts, then in the case of American GDP, the market was completely disappointed. In recent months, the popular opinion has been that the US economy is strong, and the Fed, accordingly, can afford to raise the rate to at least a neutral level. However, the first estimate of the GDP of the first quarter showed that the US economy itself is not going through the best months. GDP shrank by 1.4%, which is a serious drop. I want to believe that this is an isolated case that will not affect the Fed's plans globally. But if not, then you will have to forget about a massive rate increase. Because no one raises the rate if the economy is in recession.

In the new week, secondary data will mainly be published in the European Union. On Monday, the index of business activity in the manufacturing sector will be published. On Tuesday, the unemployment rate. On Wednesday - retail sales and business activity index for the service sector. And that's it. There will also be a speech by ECB President Christine Lagarde on Tuesday, to which there is increased attention now, as the market wants to know whether the regulator is ready to raise the rate, as de Guindos said, or was it false information? Therefore, we believe that Lagarde's speech will be the most important for the euro, which is not the fact that she will touch on the topic of monetary policy at all. In terms of the number of statements made by officials, the topic of inflation is now in the first place. Therefore, Lagarde can again talk about the crisis in Ukraine, sanctions against Russia, and high prices for hydrocarbons. The market has known all this for a long time.

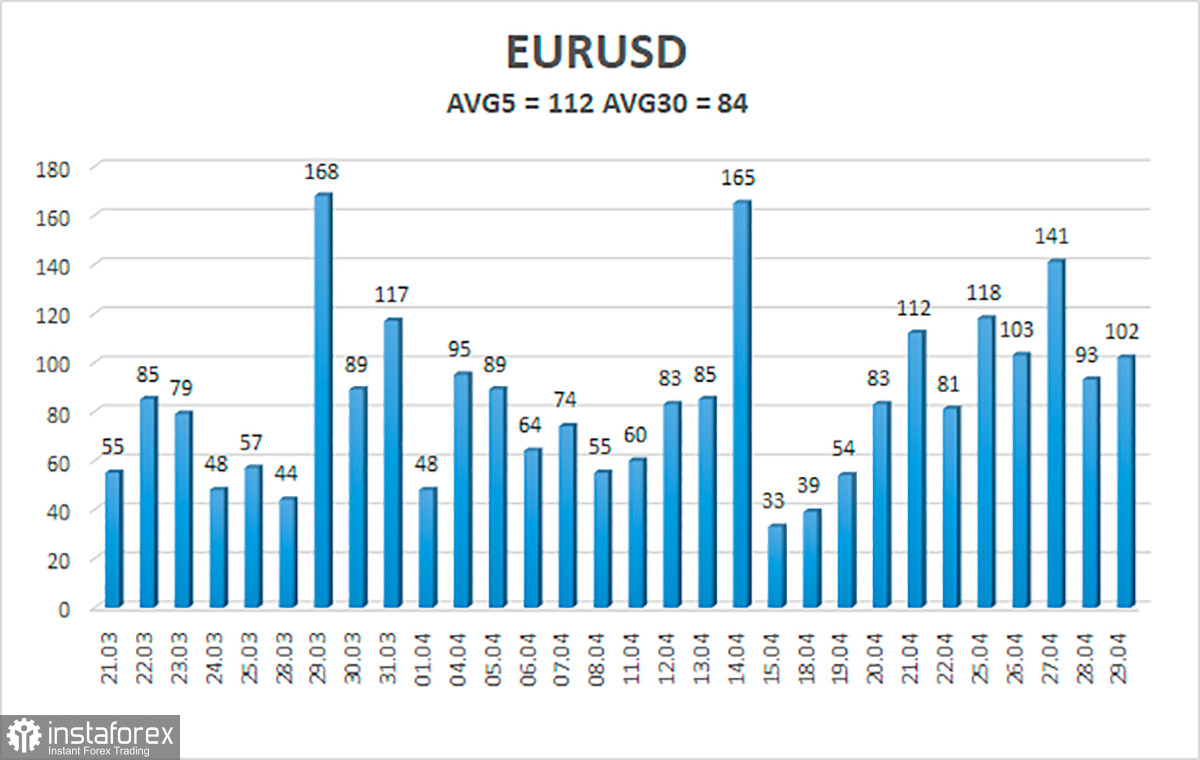

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 2 is 112 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0432 and 1.0658. The upward reversal of the Heiken Ashi indicator signaled the beginning of an upward correction.

Nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading recommendations:

The EUR/USD pair has started a round of correction. Thus, now we should consider new short positions with targets of 1.0409 and 1.0376 after the reversal of the Heiken Ashi indicator down. Long positions should be opened with a target of 1.0742 if the price is fixed above the moving average line.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.