This is going to be a super important week for USD

Hi, dear colleagues!

In this overview, we will once again outline the stances of both central banks, touch upon the main events of the week, and summarize the results of April trading and the previous week. Let's begin with Friday's macro events. Reports on consumer prices and GDP in the eurozone came in mixed. Thus, inflation in the region is still on the rise. Consumer prices showed an uptick to 7.5% in April from the March reading of 7.4%. The number of ECB members in favor of tightening is increasing. At the same time, skyrocketing energy prices are the main driving force for record inflation. ECB Chief Economist Philip Lane warned that the eurozone had no other choice but to adjust to high energy prices. He also addressed the supply chain issue due to the Covid-19 lockdown in China.

All in all, in spite of President Lagarde's stance on monetary policy, a number of ECB board members admit the necessity of tapering and rate hikes to tame persistent inflation. Overall, the US Federal Reserve looks more determined in its actions than its European counterpart, which is confirmed by the hawkish statements of most FOMC officials made last month. On Wednesday, May 4, the Fed will announce its interest rate decision and Chairman Powell will hold a press conference. In addition, the closely-watched labor market report for April will be released on Friday. These are perhaps the most important events this trading week. Clearly, they will set a further trend for the dollar. So far, let's see how the market traded during the last week of April and analyze the monthly performance.

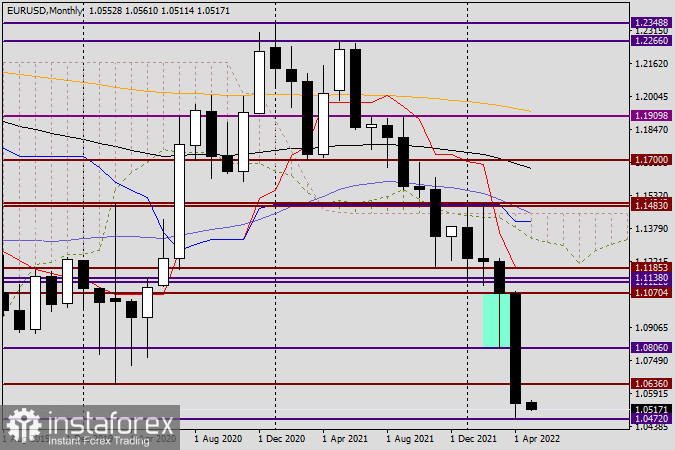

Monthly

The expected reversal of EUR/USD did not occur in spite of a relatively long lower shadow of the March candlestick. In April, the most popular currency pair descended, breaking many key technical levels on its way. At the end of the month, the quote closed well below support at 1.0636, in line with the March 2020 lows. The fact that bulls did not allow their opponents to close below the psychological level of 1.0500 in April can be seen as their only achievement. Anyway, taking into account the April closing price of 1.0544, the trend is unlikely to reverse. The only development we may expect is a corrective move to 1.0600, 1.0636, 1.0700, and maybe to the historical level of 1.0745. If so, the downtrend is highly likely to resume.

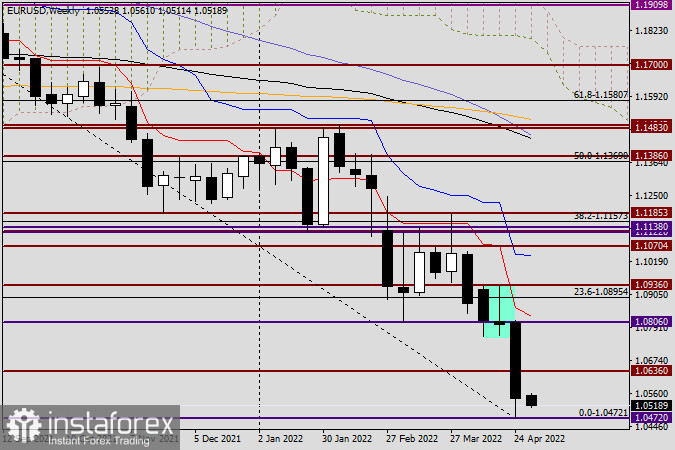

Weekly

During the week ending on April 29, the pair was bearish. Although the previous Doji candlestick signaled an impending correction, nothing actually happened. The above-mentioned macro events may well affect the price this week. Should the Fed's interest rate decisions disappoint market participants, the greenback will face pressure. Given that the currency used to show growth on expectations of aggressive Fed and the possibility of a 75 basis points rate hike, a decision of a 50 basis points increase will unlikely be welcomed. In addition, market players will focus on Chairman Powell's statement at the press conference. Above all else, the labor market report scheduled for Friday will be of utmost importance. This is all I've wanted to discuss with you today. Technically, it would be wiser to buy the dollar at the moment, and this is going to be a super important week for USD.

Have a nice trading day!