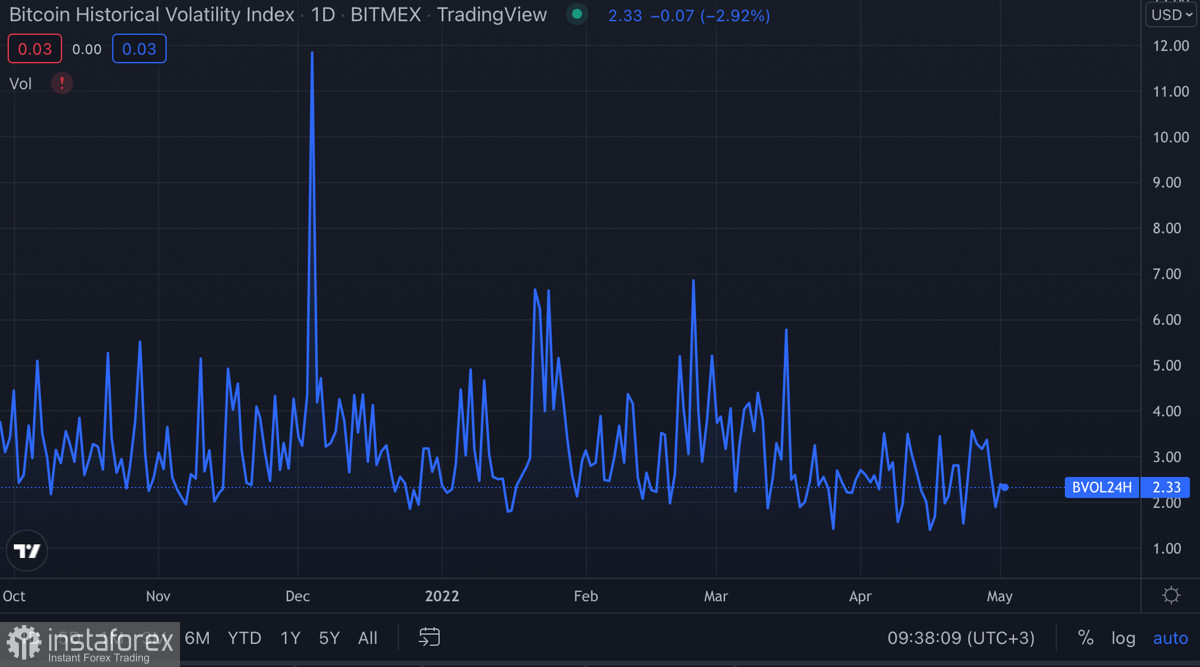

As expected, the main cryptocurrency spent the first day of May without any significant changes. The asset finally consolidated below $40k in the area of $37.5k-$39k. At the same time, investor activity continues to decline in parallel with the volatility of the cryptocurrency market. By the end of Sunday, Bitcoin managed to defend the support zone around $37.4k, which has become the main benchmark level of the current uptrend. However, an ongoing tendency shows that Bitcoin is losing ground.

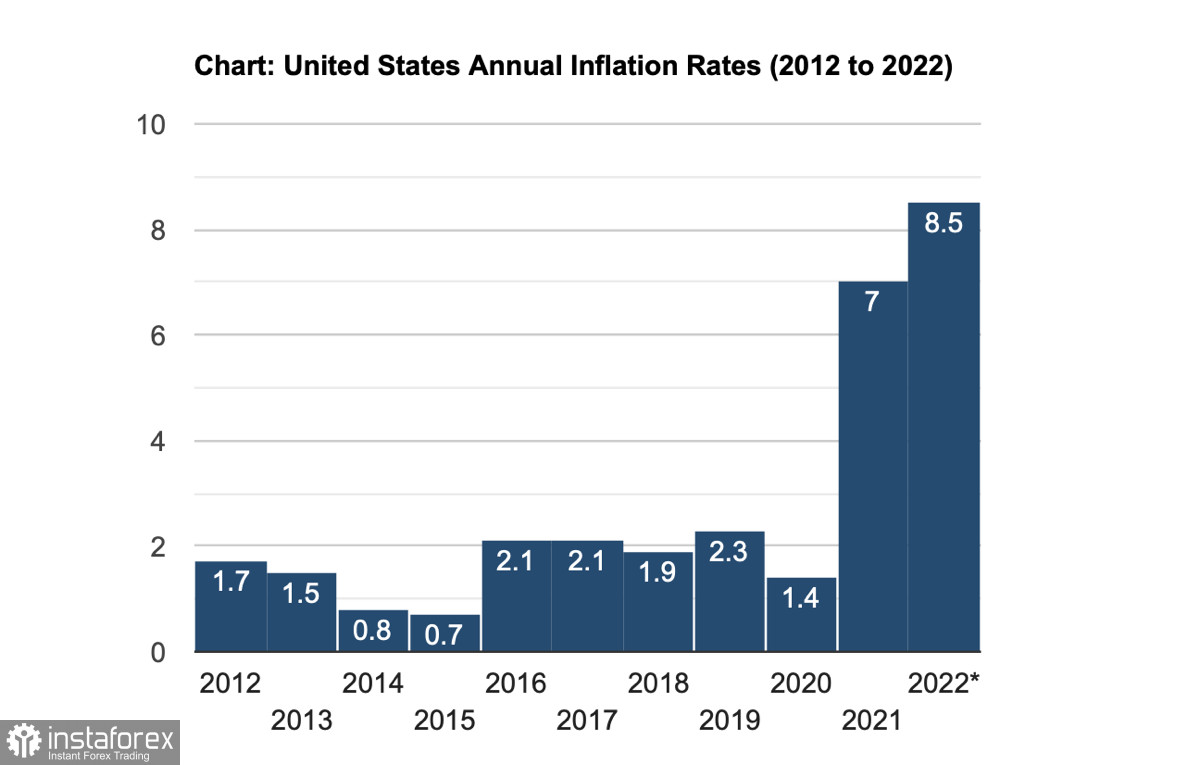

Lower trading activity can be explained by some major macroeconomic events. In addition, April 2022 was the worst month for Bitcoin in terms of gains over the last 10 years. For the most part, this is due to rampant inflation that major central banks including the Fed are now fighting with. At the same time, the correlation between cryptocurrencies and the stock market is still high. This also negatively affects digital currencies since investors perceive them as high-risk assets that should now be avoided in the investment portfolio.

As a result, volatility in the crypto market is decreasing, and trading volumes have reached $29 billion, which is a new local low. In a few days, on May 4, theFed may raise the key rate by as much as 50 basis points at its meeting on Wednesday. Such a big rate hike is explained by the conflict in Ukraine which theFed could not take into account when planning its policy. The Russia-Ukraine crisis has significantly contributed to accelerated inflation in the US. Also in May, the quantitative easing program starts. Therefore, the future of the crypto market is more or less clear: volatility will increase sharply due to the panic sell-offs and liquidity outflow.

However, we should keep in mind that Bitcoin has closely approached the local low. At the same time, the trend toward the massive accumulation of BTC coins continues. This suggests that buyers will defend their positions near the local low. This is also evidenced by the growing volumes of stablecoins in the total capitalization of the cryptocurrency market, as well as the minimum volume of BTC coins on exchanges over the past four years. All these facts suggest that investors will try to keep the price near the local low in the $32k-$35k area.

Based on this, we can say that BTC quotes will continue to fall. The completion of the bullish wedge pattern will be the peak point of this downtrend, after which the price will rapidly return above $40k. Judging by the current state of the candlesticks, the asset is approaching its final stage of the downward cycle and will soon go beyond the range. The bullish wedge pattern is a positive signal for growth, and, therefore, the price is likely to break above this area and move upwards.

However, even in this scenario, we should keep in mind that in 2022, Bitcoin's potential will be visible only in the long term. In the current situation, a local surge in the range of $38k-$45k is possible, but not higher. In any case, the start of the Fed's monetary tightening and the rate hike will be too painful for the cryptocurrency market. In the medium term, Bitcoin and other crypto assets are unlikely to leave the current range due to tighter liquidity in financial markets. With this in mind, short-term targets can be reached as part of intraday trading, while the main return will come only from long-term investing.