Wall Street analysts are once again optimistic about gold. However, according to the latest results from the weekly gold survey, sentiment among retail investors has weakened.

The change in investor sentiment on Main Street is due to the strength of the US dollar. Last week, the US dollar index rose to 103.92 points, its highest level in almost 20 years. After briefly falling below 100 points on April 19, the index rose by 3.5%.

According to some economists, the US dollar has gained strong momentum as the Federal Reserve prepares to raise interest rates by 50 basis points.

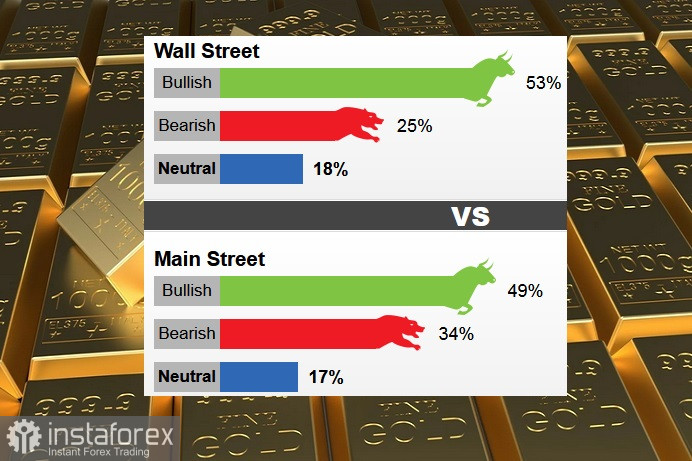

Last week, 17 Wall Street analysts took part in the gold survey. Among the participants, nine analysts, or 53%, voted for gold prices to rise during this week. At the same time, four analysts, or 25%, were bearish, and three, or 18%, were neutral on prices.

In online polls on Main Street, 904 votes were cast. Of these, 446 respondents, or 49%, expect gold to rise. Another 306 voters, or 34%, said prices would decline, while 152 voters, or 17%, were neutral.

This is the first time since the end of September that bullish sentiment has fallen below 50%.

Looking ahead, we can say that the meeting of the Federal Reserve System on monetary policy remains the most significant event for the precious metal. The Fed has signaled that it is preparing to aggressively tighten monetary policy.

According to Equiti Capital market analyst David Madden, the US dollar has slightly outperformed ahead of the monetary policy decision. Accordingly, any neutral or dovish tone from the central bank could lead to a decline in the US dollar, and this will lead to an increase in the price of gold.

Monetary factors are optimistic for gold.

The dollar has probably already peaked; in addition, the dynamics of monetary policy means that gold is the only asset that can be trusted.