The Bank of England is ready to raise the main interest rate for the third time in a row, but against an extremely ugly background. Were it not for the highest inflation in three decades, falling retail sales and the worst cost-of-living crisis in more than half a century would require lower borrowing costs. The futures market believes that BoE will be one of the first among the world's leading central banks to start using monetary expansion. This will happen in 2024 against the backdrop of a slowdown in GDP growth and disinflation.

The fact that the BoE was in an extremely difficult situation, and stagflation is likely to come first to the UK and only then to other major economies of the world, contributed to the fall of GBPUSD by 4% in April, which was the worst monthly result for the pair since the Brexit referendum in 2016. Against the US dollar, the sterling has fallen to the lowest levels since the start of the COVID-19 pandemic, and there is no break in the clouds yet.

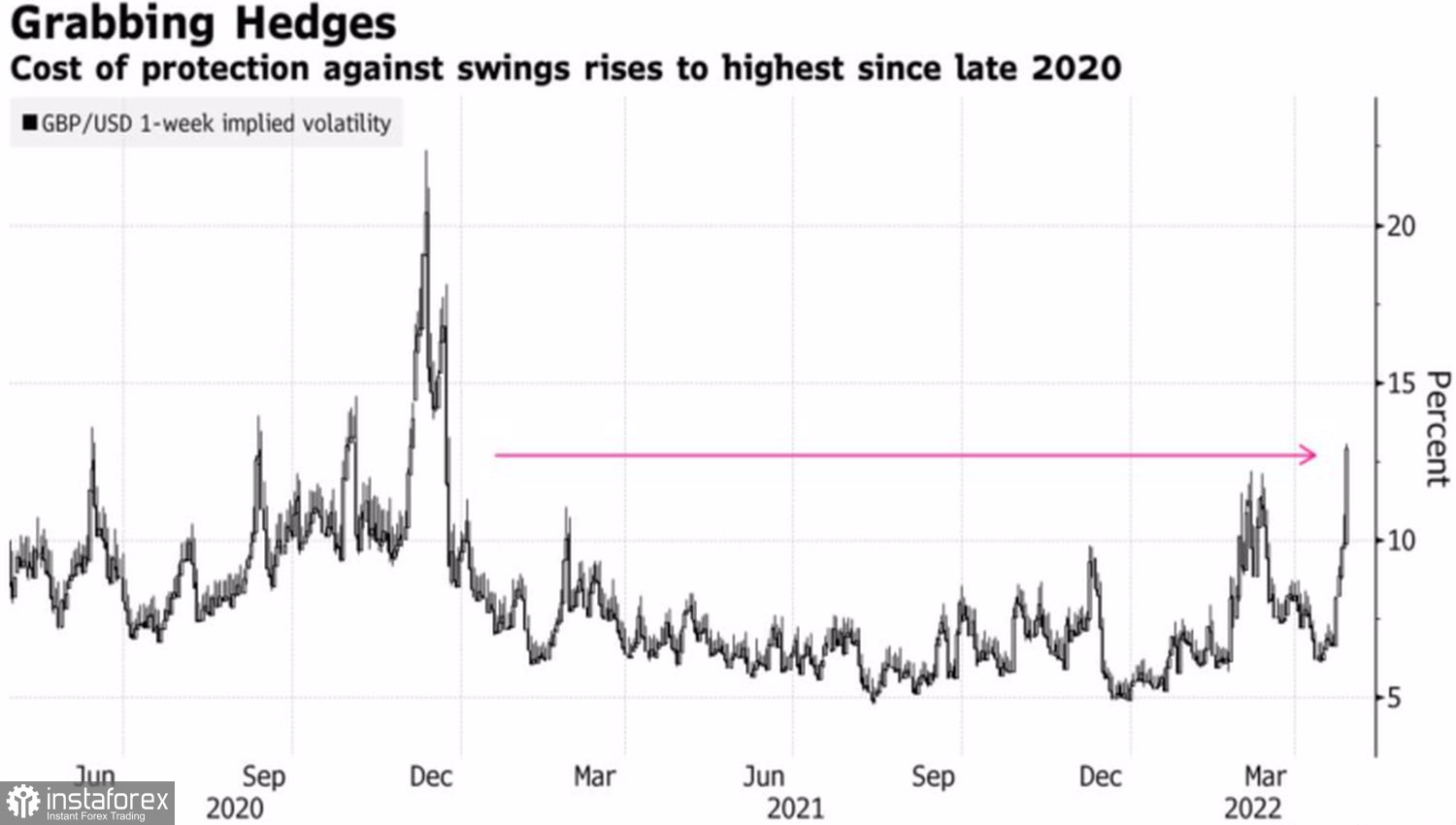

The growth of volatility in the foreign exchange market and the weak results of British stock indices increase the risks of capital outflow from the country and the continuation of the pound's peak to $1.2. The 19% growth of the FTSE 100 within 12 months, expected by Bloomberg experts, is the lowest among its peers.

GBP volatility dynamics

Dynamics of potential profit from stock indices

Sterling's main problem is the explosive mixture between a strong labor market, like in the US, and an energy crisis, like in the EU. As a result, inflation runs the risk of rising even higher and gaining a foothold at high levels for a long time, while the cost-of-living crisis that it provoked seriously slows down GDP. Against such a background, more doves may appear within the Monetary Policy Committee and let the REPO rate be raised in May. However, if the number of MPC members who voted against this step increases, GBPUSD risks falling into a new wave of sales. In this scenario, the futures market will change its outlook: it is now signaling a 25 basis points increase in borrowing costs at every meeting of the Bank of England until the end of 2022, however, there may be information about a pause in August or in another month of the year.

Naturally, when the US dollar, armed with high demand for safe-haven assets and American exceptionalism, rushes in full sail, the GBPUSD bulls only have to retreat. Expectations of a rise in the federal funds rate at the FOMC meeting on May 3–4 support their opponents, however, no matter how the old market principle, "buy the "dollar" on rumor, sell the fact" does not work. Against the backdrop of Jerome Powell's speech at a press conference, the risks of profit-taking on short positions are growing, which will lead to a temporary increase in pound quotes. After that, the sellers will take over again.

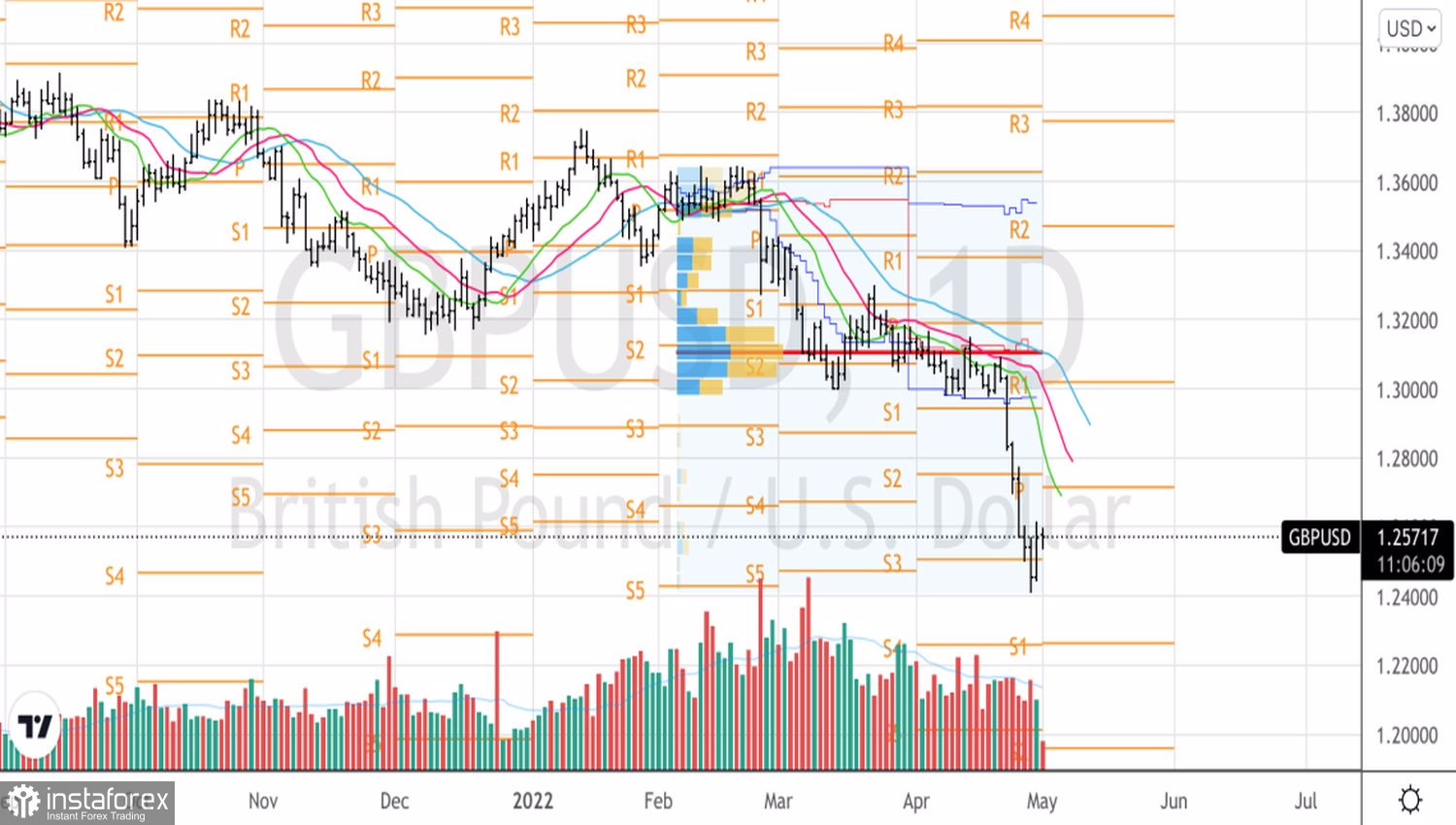

Technically, GBPUSD bulls managed to catch on to a combination of important pivot points in the area of 1.242-1.25. It will be possible to update the local low at 1.261, and the probability of the pair going to the moving averages will increase. Thus, it makes sense to move from the strategy of short-term purchases to medium-term sales on the rebound from the resistance at 1.271 and 1.275.

GBPUSD, Daily chart