US 10-year treasuries passed the 3% barrier on Monday evening for the first time since November 2018, indirectly indicating that markets expect the Fed on Wednesday evening to confirm a more aggressive pace of monetary policy normalization.The Fed should hurry up. The ISM manufacturing index in April was much worse than expected (55.4 vs. 57.6) and the employment sub-index fell sharply. If markets see a similar pattern in the services market tomorrow, they will inevitably conclude that recession is fast approaching. The Fed needs to curb inflation before a recession, otherwise there will be stagflation.We assume that the Fed sees this danger and will show a confidently hawkish stance at Wednesday's meeting. The dollar remains the dominant currency in forex.

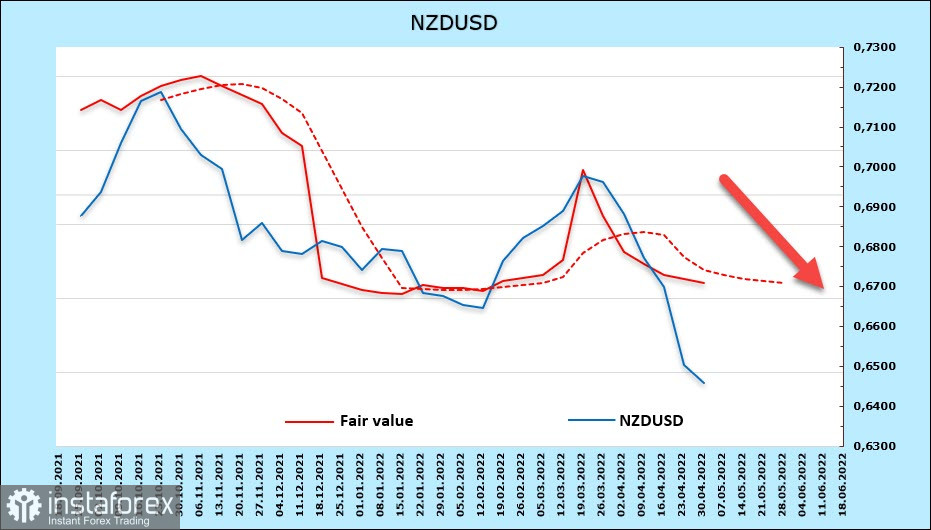

NZDUSD

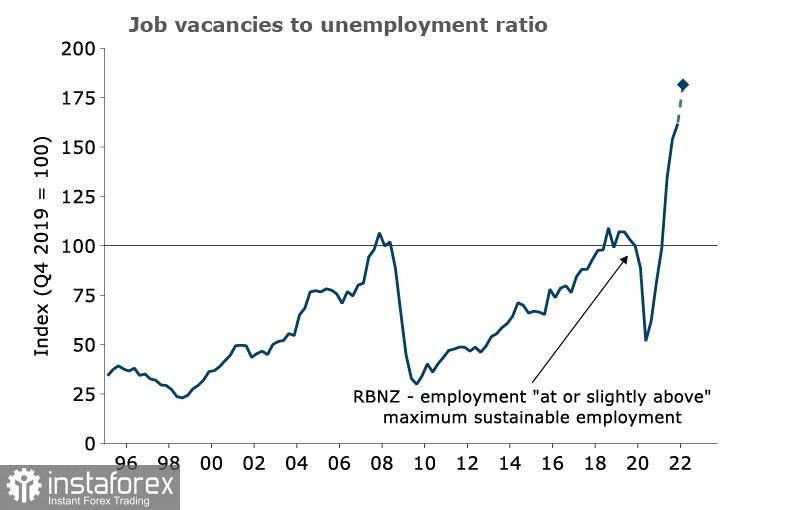

The RBNZ will meet again on May 25. A rate hike of a further 0.5% is expected. The bank needs to curb rising inflationary pressures without causing a recession. There are a number of preconditions for such an outcome. Last year, the housing market grew rapidly, and house prices set records, which entailed a significant contribution to inflation from the construction sector (up to +1.6% y/y). Now the opposite process is underway, with March house prices 4.1% lower than last year. However, this is probably the only positive thing in the price trend.The main problem, however, is the labor market. The demand for labor is off the charts, with the number of vacancies far exceeding the pre-pandemic level.

This means that an increase in average wages is inevitable, which in turn will increase inflation. The problem is largely that the massive stimulus during the Covid fight has made unemployment benefits and anti-Covid welfare benefits look more attractive than wages. So, people don't want to find a job. All this will force the RBNZ to act more decisively, which will be bullish for the kiwi.On the futures, speculative positioning is still around zero. Neither bulls nor bears are outspent. The settlement price is below the long-term average and is directed downwards.

Kiwi has quickly passed support at 0.6520 and 0.6460 (50% pullback from the surge in 2020) and there is no support left until 0.6223 (61.8% Fibonacci level). If the Fed is aggressive enough on Wednesday, NZD/USD is likely to move towards this support. If the market sees signs of weakness, a local low will be formed and a move into a sideways range will take place. There is no reason for an upside reversal yet.

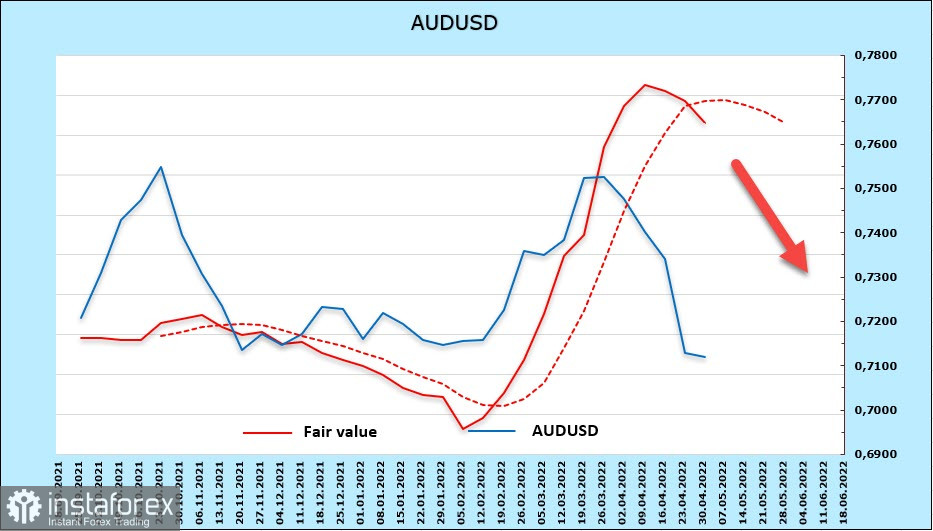

AUDUSD

The RBA raised the rate by 25 basis points this morning. The rate was expected to rise by 15 basis points. The threat of a slowdown in China due to new Covid restrictions is seen as a weaker threat against fast-growing inflation and accelerating average wage growth.According to the accompanying statement, the RBA considers Australia's economy to be sustainable, with unemployment at a low of 4% and a forecast to fall to 3.5% by 2023, which is the lowest in almost 50 years. GDP growth is forecast at 4.5% this year and 2% next year, higher on average than in other countries.A more aggressive policy by the RBA would lead to a reassessment of AUD target levels. There was strong demand for the Australian currency in March and CFTC reports showed a rapid shift in speculators' sentiment in its favour. However, the threat of a slowdown in China appears to have forced a reconsideration of these plans. The latest CFTC report showed a slowdown in the short position contraction. The weekly change is only +157m and the net outperformance remains bearish (-1.97bn). The settlement price, which went well up from the spot, is expectedly reversing downwards.

The threat of further declines persists despite support from the RBA. Main support is at 0.6970. Stronger selling is likely if support is broken. At the same time, as long as the Aussie is above this level, there is still a chance of a local base forming in anticipation of an upward correction. The targets are 0.7180 and 0.7273. However, any strong moves will only start after a reassessment of the dollar outlook, so until the Fed meeting on Wednesday evening, the movement is likely to be in a sideways range.