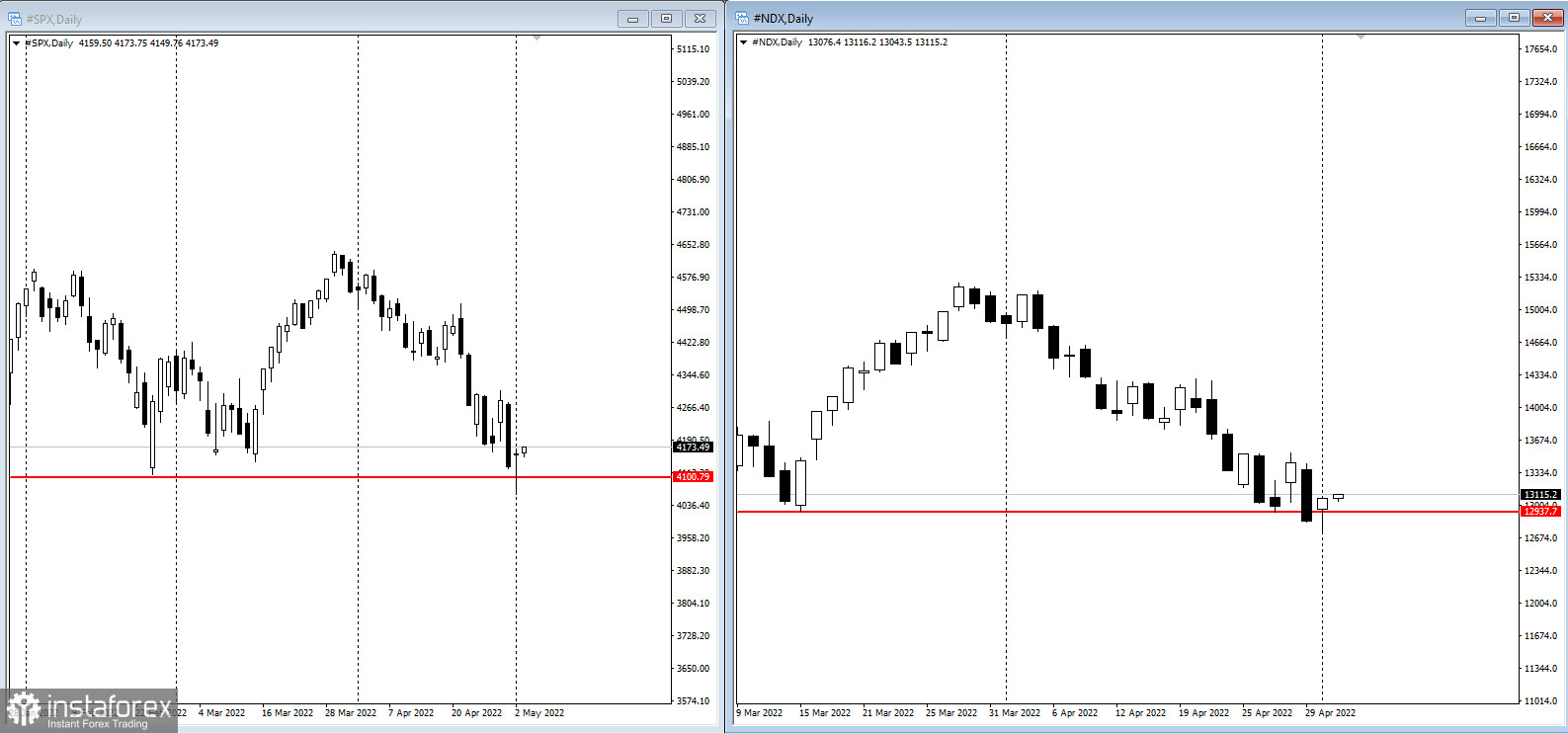

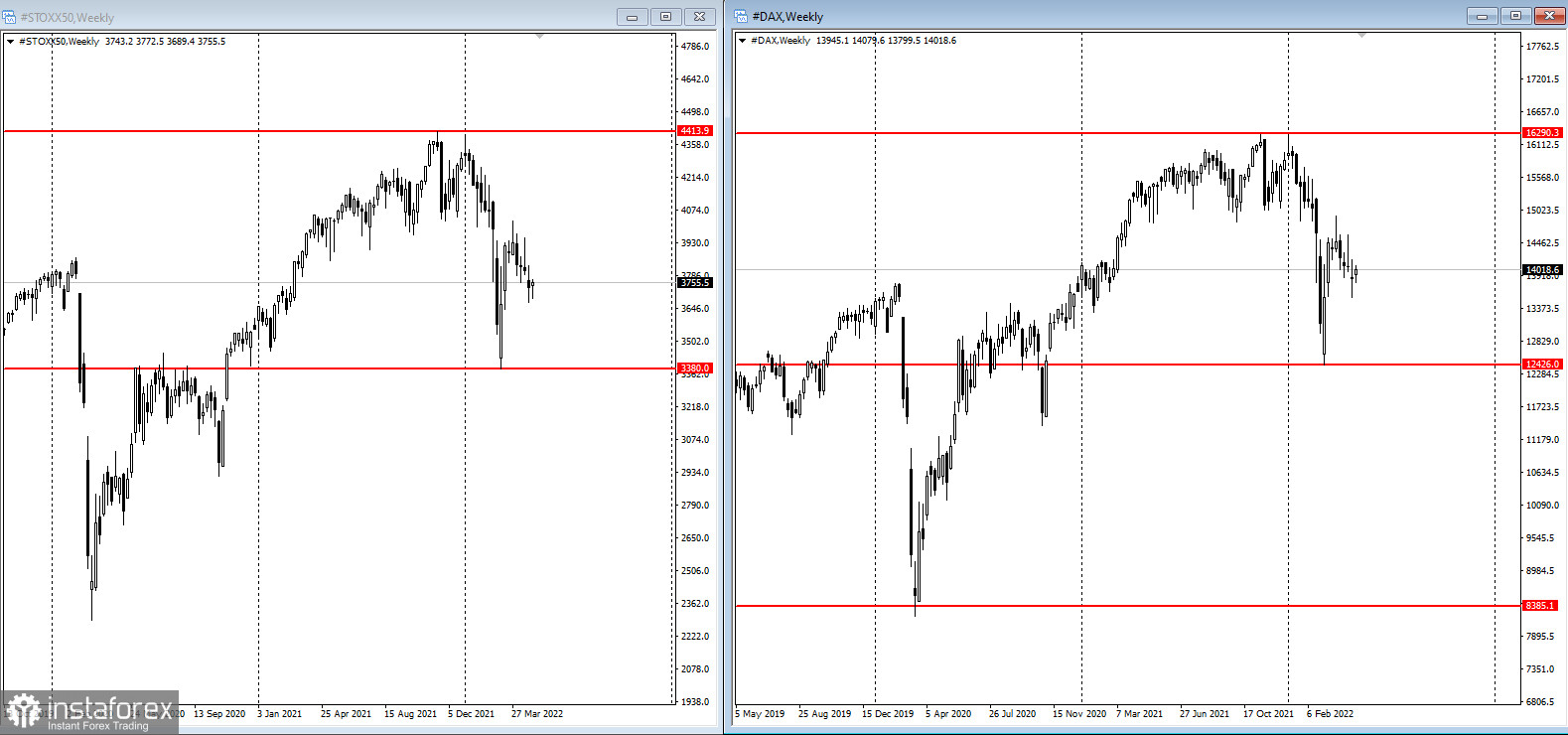

Bonds fell around the world as investors braced for the biggest US rate hike since 2000 and a wave of policy tightening by other central banks. The drop in prices sent stocks and futures on US indices higher.US 10-year bond yields traded around 3% after hitting a milestone on Monday. Germany's benchmark rate rose above 1% for the first time since 2015, while the corresponding UK bond yield climbed above 2%. Australian bonds slid, and the currency jumped, after the nation's central bank increased borrowing costs by more than many had expected.Meanwhile, investors betting that global bonds are still expensive took shelter in equities.Futures on the S&P 500 and Nasdaq 100 indices were up at least 0.1%, while the European benchmark Stoxx50 added 0.6%. However, trading was volatile amid growing nervousness about rising yields.

Markets are getting whipsawed between concerns around persistent inflationary spirals and risks to global growth from rising yields, China's Covid lockdowns and Russia's war in Ukraine.

"The right strategy right now is to position for inflation - a clear and present fact - rather than recession, which is still only a possibility," Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, wrote in a note.

- US factory orders, durable goods, Tuesday

- Fed rate decision, briefing with Chair Jerome Powell, Wednesday

- EIA crude oil inventory report, Wednesday

- Bank of England rate decision and briefing, Thursday

- OPEC+ convenes virtually for a regular meeting, Thursday

- US April jobs report, Friday