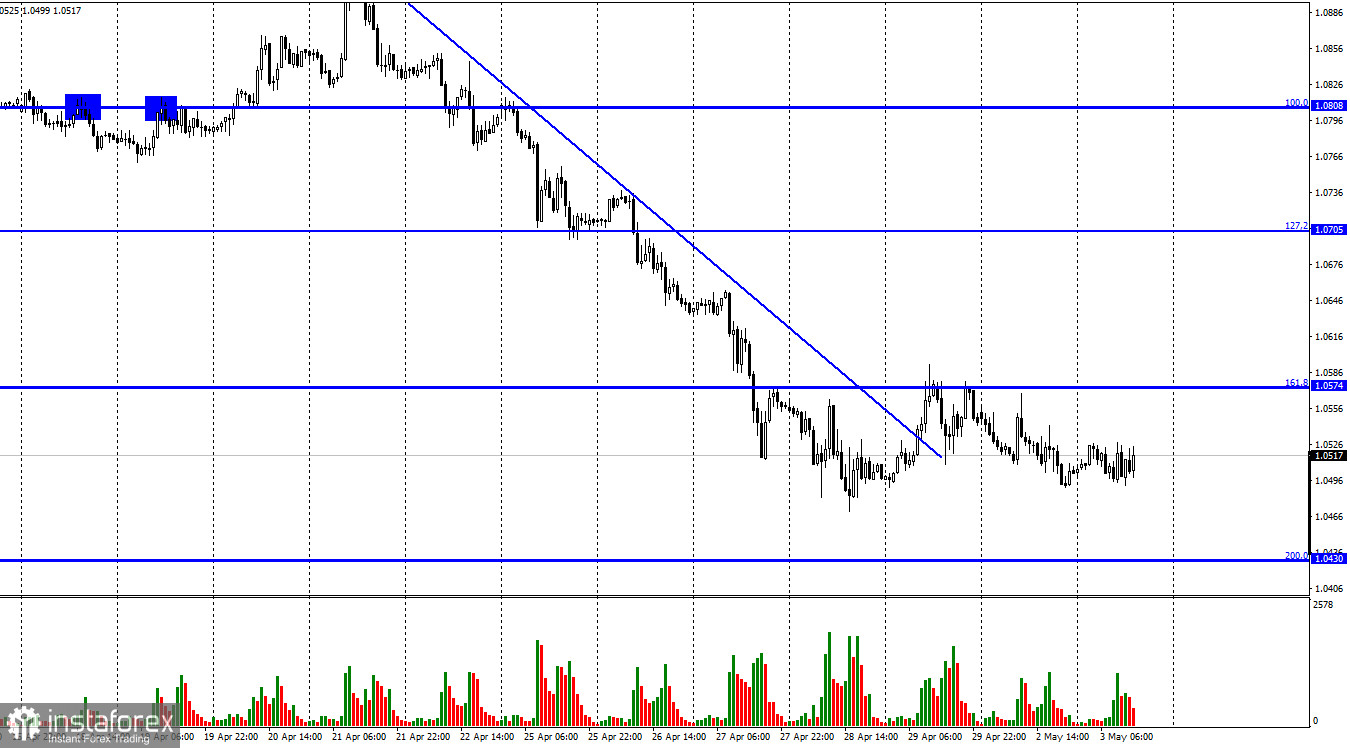

The EUR/USD pair was trading in the range of 1.0490-1.0570 on Monday and Tuesday. This range is located below the important corrective level of 161.8% (1.0574), the rebound from which allows us to expect a further drop in quotes in the direction of the next Fibo level of 200.0% (1.0430). Nevertheless, it was not possible to continue the fall yesterday and today, but bear traders are not retreating from the market and are waiting. They are waiting for new reports or news that will emphasize the feasibility of new euro sales. However, the very fact that the pair cannot close even above the 1.0574 level closest to it, from my point of view, says a lot. And it says specifically that traders are not in the mood to buy euros right now for sure. Sales have been suspended for the time being, but they can resume at any time before closing above the 1.0574 level. A lot of interesting things are going to happen this week. A new package of sanctions against the Russian Federation should be approved by the European Union, which will include the disconnection of several more banks from the SWIFT system, as well as the gradual refusal of EU countries from buying oil and gas in Russia.

At the same time, the European Union is still not ready to block all energy supplies from Russia, but I believe that it is moving towards this step in full swing. The European Union understands perfectly well that it will have to give up, because otherwise, after the next elections, other politicians will be at the helm of the euro block. The level of support for Ukraine in the EU countries is off the scale, many countries believe that if Ukraine falls under the onslaught of the Russian Federation, then Russian troops will move to the Baltic States or Poland. For this reason, Finland and Sweden may submit official applications for NATO membership in the near future, as the events of the last two months show a high probability of new "special operations". The Finnish authorities want to build a fence on the border with Russia. I would also like to note that the process of Europe's rejection of Russian oil and gas has already begun since Gazprom itself refused further supplies to Poland and Bulgaria last week. The Ukrainian-Russian conflict persists, but recently there is only no advance of Russian troops, but even attempts to move forward everywhere except the Donetsk region.

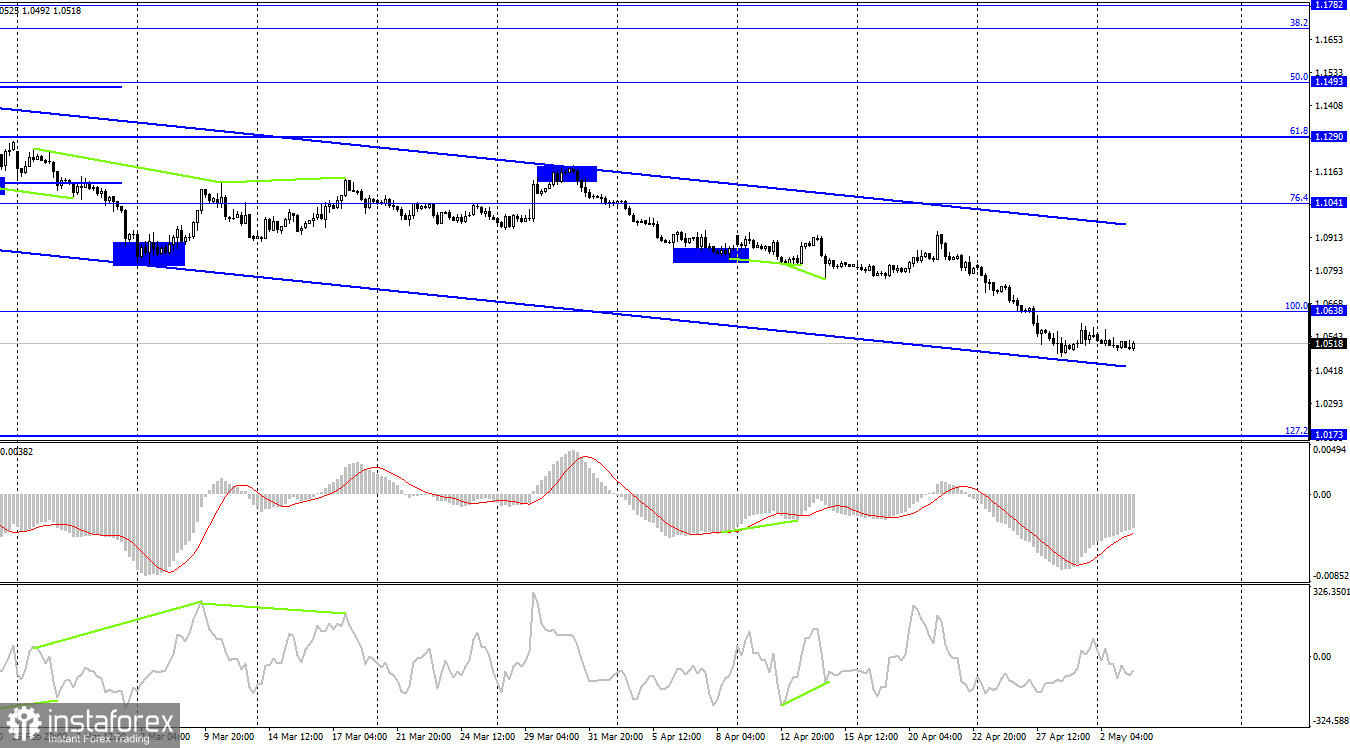

On the 4-hour chart, the pair secured under the corrective level of 100.0% (1.0638). Thus, the process of falling can be continued in the direction of the corrective level of 127.2% (1.0173). The downward trend corridor still characterizes the mood of traders as "bearish". There are no signals for the growth of the pair at this time. There are no brewing divergences.

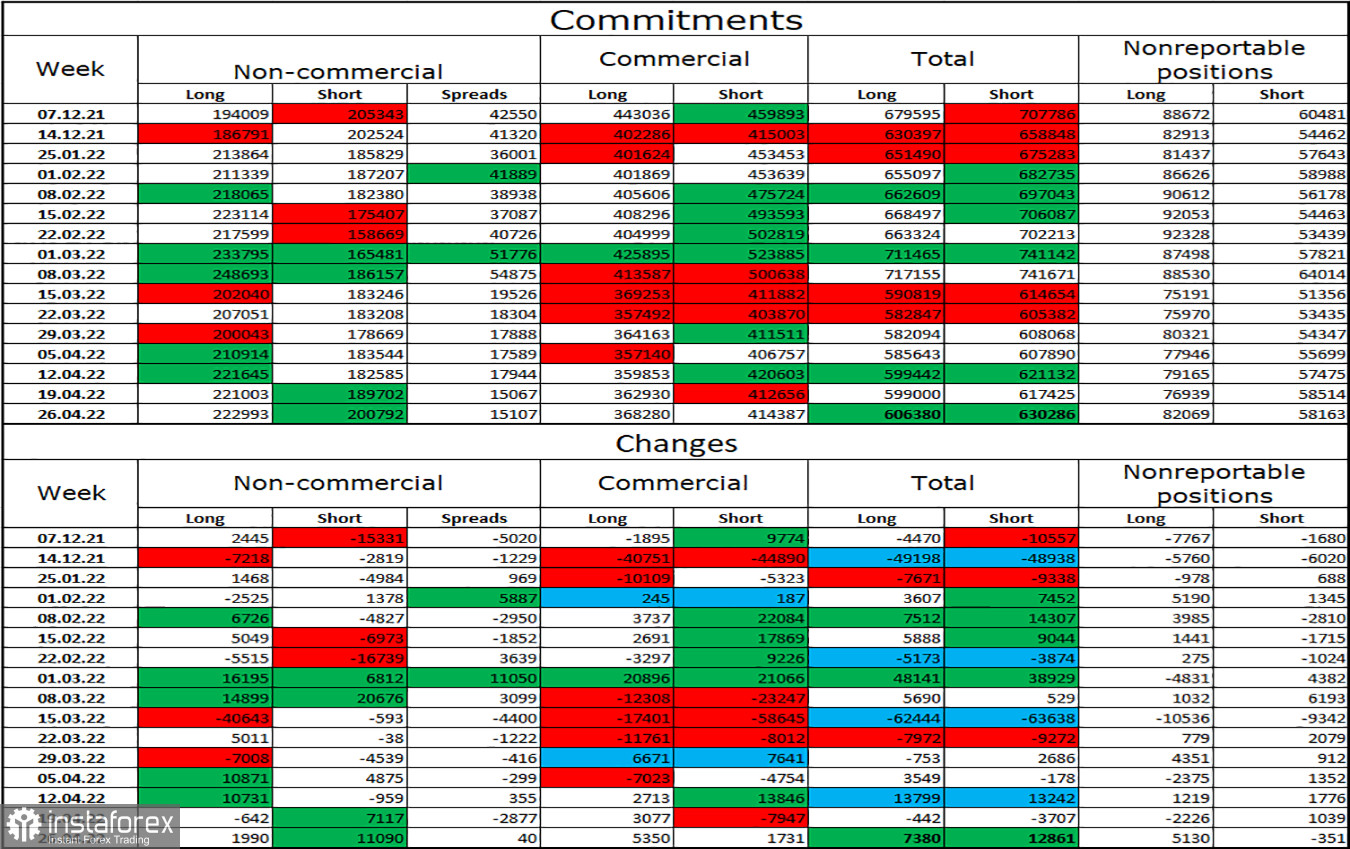

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 1,990 long contracts and 1,1090 short contracts. This means that the bullish mood of the major players has weakened again, for the second week in a row. The total number of long contracts concentrated on their hands now amounts to 223 thousand, and short contracts - 201 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is still characterized as "bullish", and with such data, the European currency continues its decline in pair with the dollar. As I have already said, the COT data indicate that the euro should grow, and this pattern has persisted over the past few months. Thus, it is impossible to draw adequate conclusions from the COT reports now. A very strong influence on the mood of traders is the possible continuation of hostilities in Ukraine, the deterioration of relations between Europe and the Russian Federation, new sanctions against Russia, and the weakness of the ECB's position.

News calendar for the USA and the European Union:

EU - unemployment rate (09:00 UTC).

EU - ECB President Christine Lagarde will deliver a speech (13:00 UTC).

On May 3, the European Union released an unemployment report (decreased from 6.9% to 6.8%), and a little later the speech of ECB Director Christine Lagarde will begin. In America, the calendar of economic events is empty today. The impact on the mood of traders will be present only if Lagarde makes important statements.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair if a close is made under the 1.0574 level on the hourly chart with a target of 1.0430. New sales when rebounding from the 1.0574 level for the same purpose. I recommend buying the pair if a close is made above the 1.0574 level with a target of 1.0705.