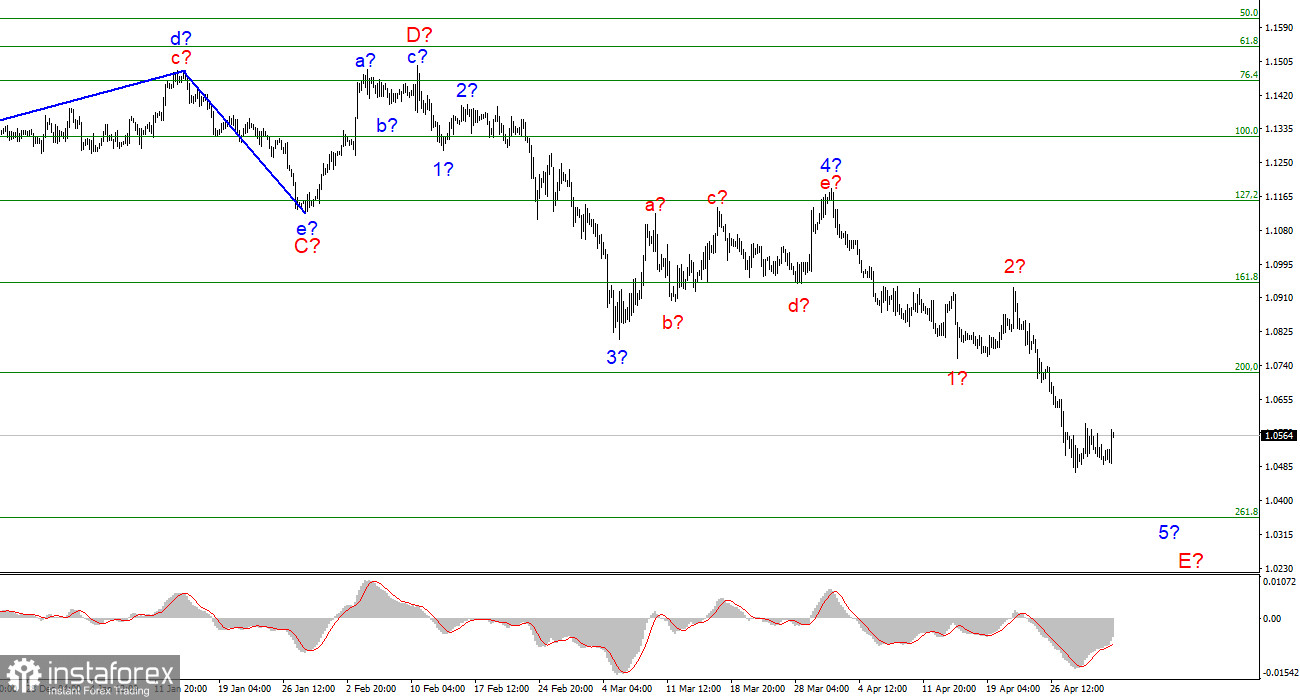

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The instrument continues to build a descending wave 5-E, which may be the last in the structure of the descending trend segment. If this is true, then the decline in the quotes of the euro currency may continue for another one or two weeks, since this wave may turn out to be a five-wave in its internal structure. At the moment, three internal waves are visible inside this wave, so I'm counting on building another pulse wave. A successful attempt to break through the 1.0721 mark, which equates to 200.0% by Fibonacci, indicates that the market is ready for further sales of the euro currency. In the coming days, the instrument may decline to the level of 1.0355, and there only 350 basis points will remain to price parity with the dollar. Presumably, the construction of the current downward wave and the entire downward section of the trend can be completed near this mark. If the breakout attempt of 1.0355 turns out to be successful, then the instrument will further complicate its wave structure.

The European Union will still abandon Russian oil

The euro/dollar instrument rose by 70 basis points on Tuesday. This increase may be the fourth, corrective wave consisting of 5-E. If this is true, then we are waiting for at least one more decline of the instrument, which may begin and end this week. To consider wave 4 completed, the instrument must go up a few dozen more points to go beyond the previous high. After that, the instrument can begin to decline again. The news was very weak today. The unemployment rate in the European Union decreased by 0.1% but remains quite high - 6.8%. In the US, unemployment is much lower. One could assume that the increase in demand for the euro currency today is due to this report, but I do not think so. Unemployment reports are rarely taken into account by the market.

Much more important is the news from Bloomberg. The agency said that the sixth package of EU sanctions against Russia will include an oil embargo. But not momentary, but gradual. Bloomberg expects that 100% of the embargo will work by the end of 2022. It is expected that a complete ban on oil imports will be introduced in November-December, and until then the European Union will reduce oil supplies from Russia. It is reported that tanker oil will be banned first, and then pipeline oil. The agency also believes that Belarus will also fall into the sixth package of sanctions, as it assisted the Russian army in the process of invading Ukraine. Thus, within the next 7-8 months, the EU can completely abandon oil from Russia and start buying it from other countries. Against this background, oil quotes may take off even more, but the prices that are currently being set on the stock exchange and the prices at which oil is sold are very different now. There have been repeated reports that Moscow has offered big discounts to India. In any case, even with discounts, if Russia finds new importing countries for the entire volume of oil, it will lose practically nothing from the European embargo. Oil is now so expensive that even with discounts, the Russian budget will receive huge sums, which is positive for the Russian economy.

General conclusions

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0355 mark, which corresponds to 261.8% Fibonacci, for each MACD signal "down". Now the construction of an internal correction wave 5-E can proceed, which can be interpreted as the fourth.

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which turns out to be as long as wave C. The European currency will still decline for some time.