Analyzing trades on Tuesday:

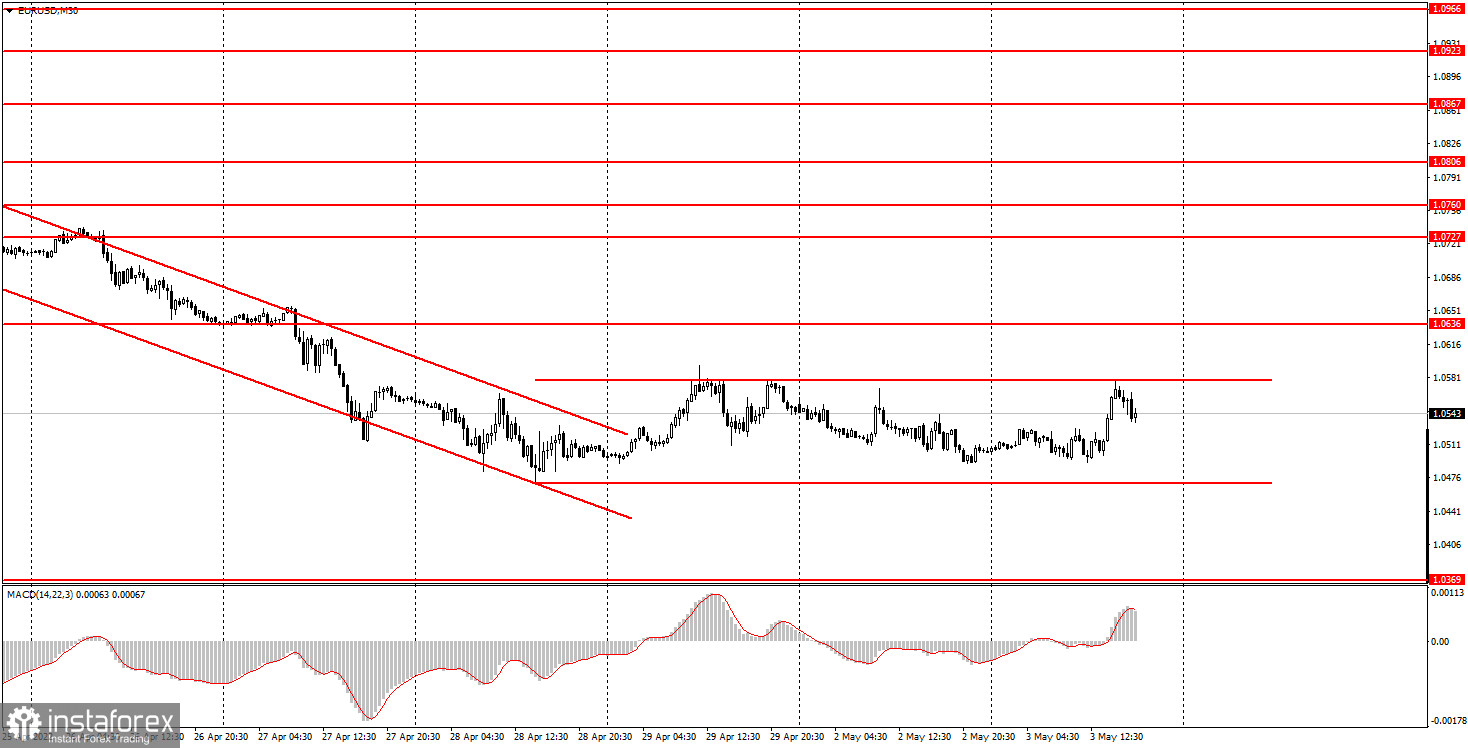

EUR/USD on 30M chart

On Tuesday, EUR/USD was trading in a rather narrow range. For your convenience, we built a sideways channel that perfectly illustrates the movement of the pair in the last few days. Thus, the market is currently trading flat at the very bottom. The price is still holding near its 5-year lows and is aiming at 20-year lows. Even though the euro has made such a deep decline, there are still no signs of an upward correction. This suggests that markets are either waiting for the Fed's meeting, after which they will make a decision, or they are preparing for a new sell-off. The outlook for the euro remains gloomy as many factors are still against it. The military conflict in Ukraine continues, more Western sanctions are imposed on Russia, and the macroeconomic data is almost ignored by the market. Moreover, the difference in the monetary policies of the ECB and the Fed clearly plays on the side of the US dollar. In general, the only factor that may promise growth is the technical correction that should take place sooner or later.

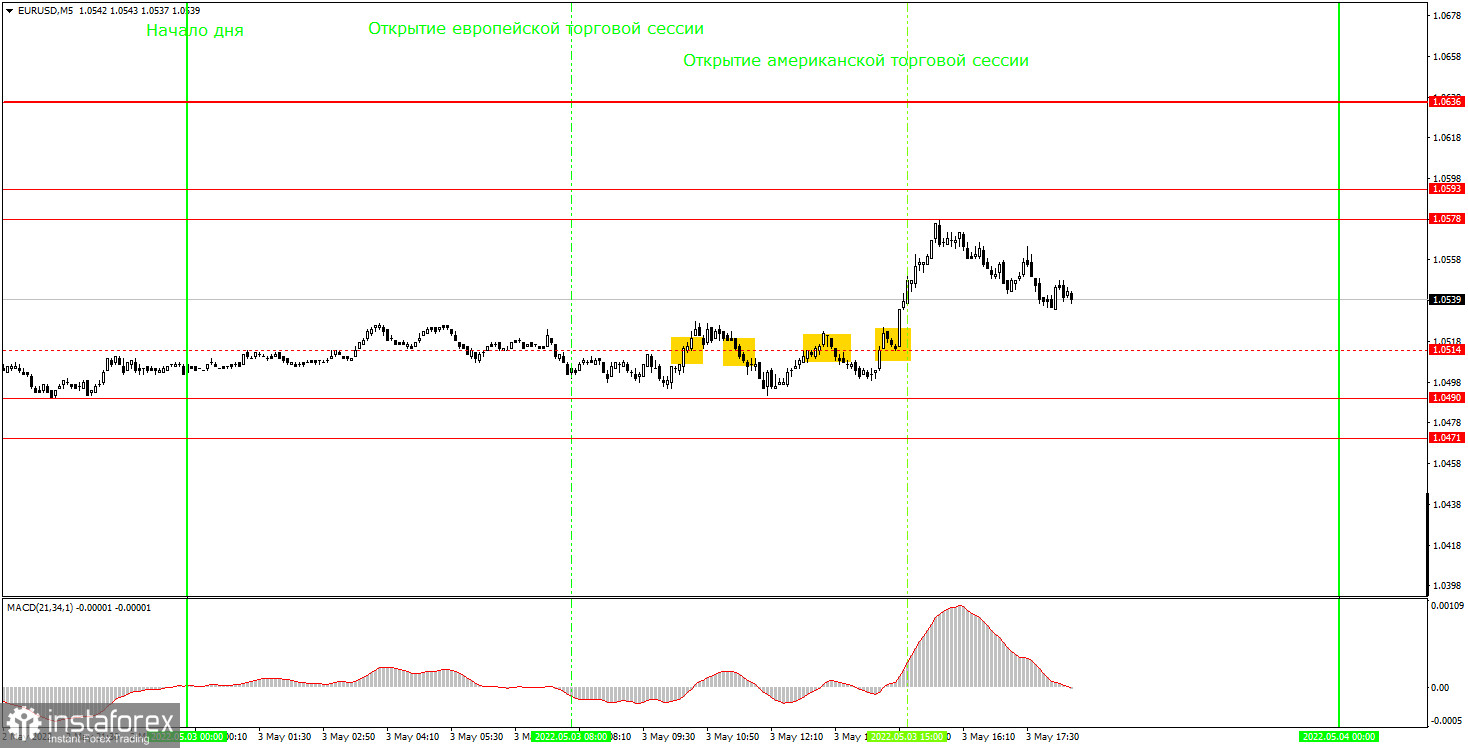

EUR/USD on 5M chart

On the 5-minute time frame, the technical picture looked bad. In the European session, the pair was trading flat. Later, there was a rise in the quotes between the European and US sessions which was hard to predict. The pair moved up before the speech by Christine Lagarde and after the publication of the unemployment report in the EU. Therefore, this was the only moment during the day when beginners could have gained profit. Before that, the pair formed four signals near the level of 1.0514, which was later recognized as irrelevant. Only the first two signals should have been followed since at that time, it was not yet clear that the pair was trading flat. Both signals did not bring any profit, and both trades closed with a minimal loss. This is normal because not every single trade should be profitable. The daily volatility rate was 83 pips, which is very good for the euro/dollar pair. Therefore, there are no problems with volatility now. Yet, we should take into account the flat channel that is formed on the 30-minute time frame.

Trading tips on Tuesday:

On the 30-minute timeframe, the downtrend is still in place although the price has left the descending channel and formed a flat channel. Usually, when there is a long-lasting flat movement, the volatility is much lower, and the channel itself is not formed at price extremes. Now it seems that the market just took a break to decide whether to sell the euro/dollar pair. On the 5-minute chart on Wednesday, it is recommended to trade at the levels of 1.0369, 1.0471-1.0490, 1.0578-1.0593, 1.0636, and 1.0697. You should set a Stop Loss to breakeven as soon as the price passes 15 pips in the right direction. On Wednesday, the key event of the day will be the Fed meeting and a press conference with Jerome Powell. However, these events will only take place late in the evening when beginners will have to leave the market. There will also be many important reports during the day. For example, the European Union will publish the data on retail sales and the business activity index in the services sector. In the US, markets expect the ADP report on the number of people employed in the private sector and the business activity index in the services sector. Traders are likely to pay attention only to the ISM index in the US.

Basic rules of the trading system:

1) The strength of the signal is determined by the time it took the signal to form (a rebound or a breakout of the level). The quicker it is formed, the stronger the signal is.2) If two or more positions were opened near a certain level based on a false signal (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours, when all positions must be closed manually.5) You can trade using signals from the MACD indicator on the 30-minute time frame only amid strong volatility and a clear trend that should be confirmed by a trendline or a trend channel.6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that can be found on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.