The main cryptocurrency continues to smoothly decline as part of the emerging downward trend. The situation has not changed dramatically, but there is every reason to believe that May 4 is the last day of calm before the storm. The two-day Fed meeting will change the state of affairs in the market and launch a large-scale process of liquidity outflow from most markets. The main victim of the interest rate hike was the stock market, but given the correlation of BTC with the NASDAQ, there is no doubt that the crypto market will suffer as well.

Among the most likely targets for the downward movement of the Bitcoin price is the $30k mark. First of all, this is associated with a gradual tightening of the key rate not only by the Fed, but by the central banks of the G7 countries. According to Bloomberg reports, during the pandemic, the volume of economic stimulus by the G7 countries reached $2.8 trillion. The US Federal Reserve will launch a general trend towards a gradual curtailment of liquidity, which will not leave cryptocurrencies a safe place. With this in mind, we should expect increased levels of volatility and trading volumes in the coming weeks, due to the massive movement of capital.

The main beneficiaries of the key rate hike will be precious metals, as well as US dollar-backed assets. The share of gold in the market over the past six months has increased by 6.5%. The volume of stablecoins in the cryptocurrency market also reached a local top, which indicates the absence of short-term or medium-term interest in Bitcoin. With this in mind, the fall of the main cryptocurrency in the range of $32k–$35k looks likely.

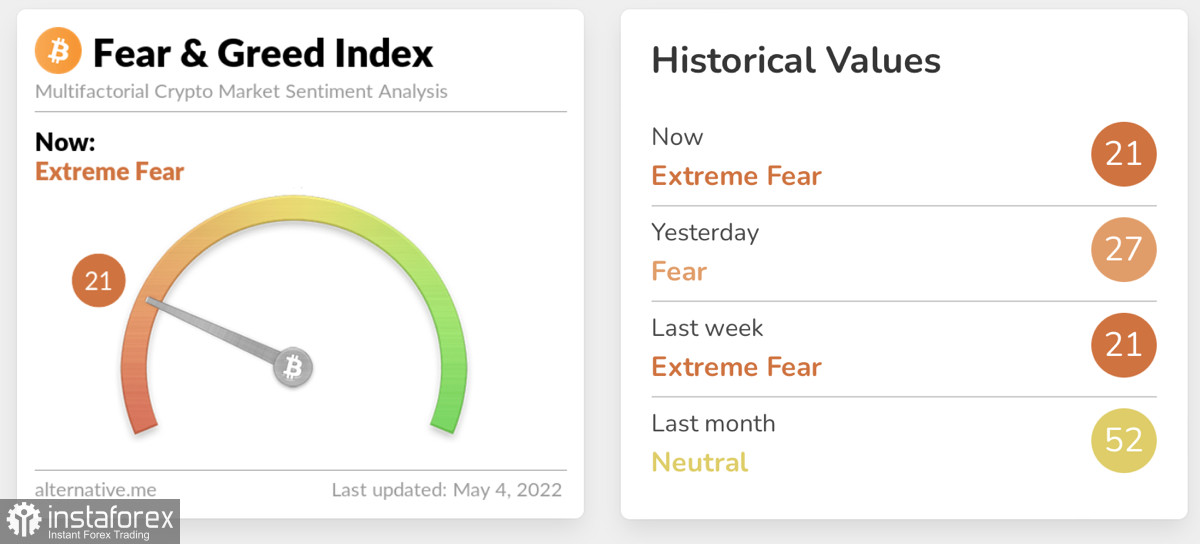

As of May 4, the cryptocurrency market is in a state of extreme fear. After the announcement of the results of the Fed meeting, sales cascades may increase and negatively affect BTC/USD quotes.

The asset has acquired a classic consolidation pattern with a gradual decline to the lower part of the $32k–$45k range. The breakdown of the 0.618 Fibo level is a direct consequence of the complete domination of sellers and the gradual capitulation of investors. Bitcoin's next target will be $37.4k, where buyers have been quite active in defending their positions. However, if the current bearish sentiment worsens, this milestone will be quickly passed and the price will rush to the 0.786 Fibo level at $36.4k.

Technical indicators are currently in a sideways movement, which indicates the absence of active trading. But it is important to keep an eye on the MACD, which continues to be below zero and confirms the strength of the downward trend.

It is important to note that after a long downward movement, a trend reversal pattern has formed on the Bitcoin charts. The "head and shoulders" figure was fully formed and, according to all the rules, should indicate the imminent start of an upward movement. This option is indeed possible, however, for this, the crypto market, and most importantly the stock market, needs to survive the results of the Fed meeting and inflation reporting.

The Fed can evaluate the results of a 50 basis point rate hike and, in order not to permanently cripple the fund, take a pause for one meeting. In this case, high-risk assets will have room to maneuver. However, it is important to understand that the Fed's plan for the year is an interest rate in the region of 3%, and therefore a pause is unlikely.

With this in mind, Bitcoin's decline to $30k looks likely, but doubtful. The cryptocurrency market has been preparing for a rate increase for more than a month. Therefore, one cannot be sure of the reaction of investors to the policy of the agency. In addition, there is every reason to believe that large players will defend their positions in the $35k–$37k range, because this zone became the key one during active accumulation in mid-March.