The coming weeks will show Bitcoin's reaction to the Fed meeting and determine the further movement of the asset's price in the coming months. Most forecasts are pessimistic, as the cryptocurrency market has become one of the main beneficiaries of the policy to stimulate the global economy during the coronavirus crisis. An important signal about the likely beginning of the second stage of the bear market of the main cryptocurrency was the actions of long-term investors.

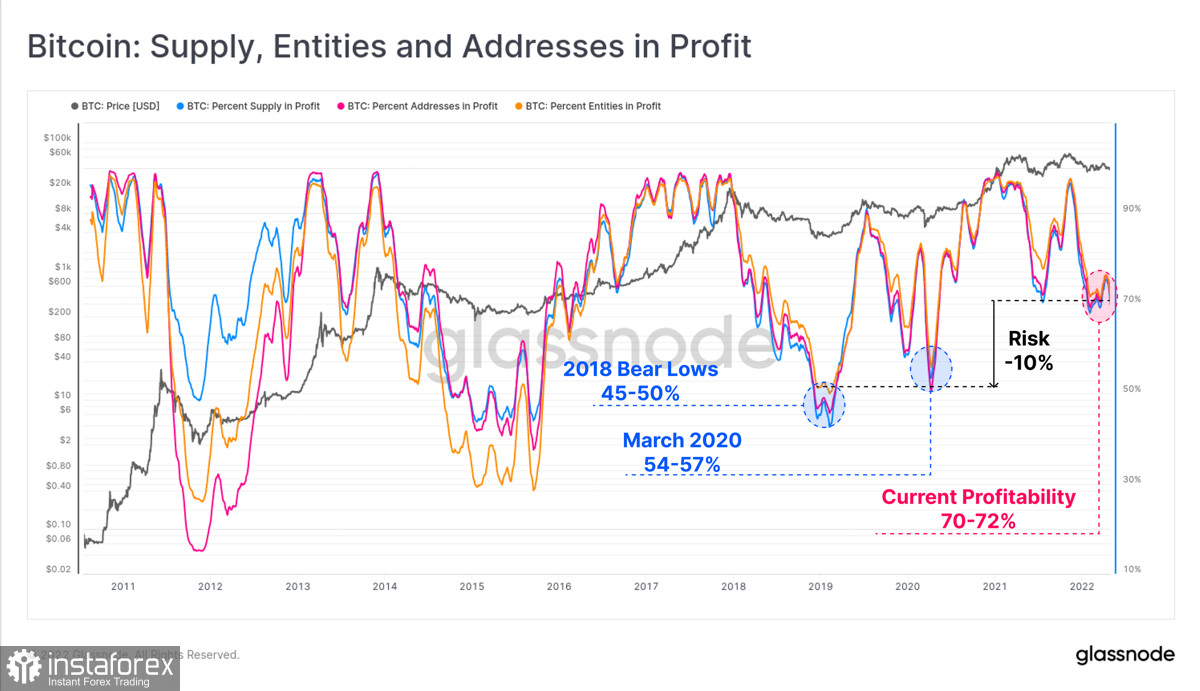

Over 80% of investor addresses were in profit when the price of Bitcoin was above $40k. Dropping prices past the round mark brought that figure down to 70%–72%, according to Glassnode data. However, despite the high percentage of coins in profit, investors provoked a new wave of profit-taking.

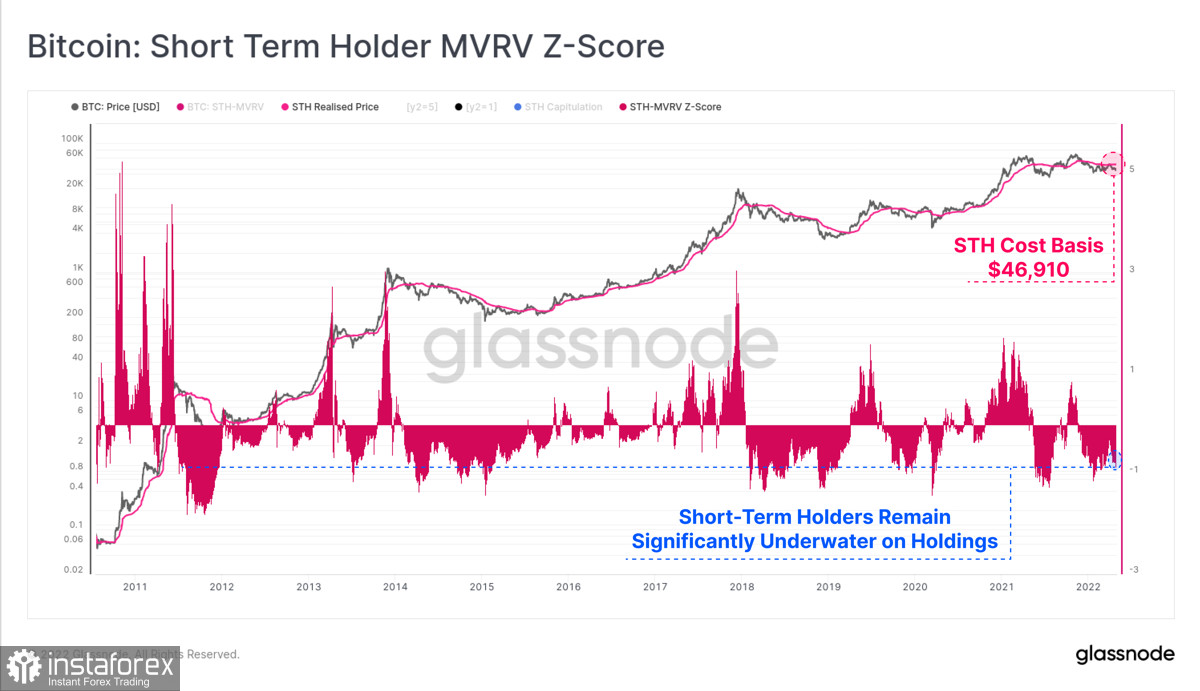

Short-term investors make up the main layer of traders who massively take profits, realizing short-term goals or trying to save their capital. In market and macroeconomic turmoil, this is a classic reaction from most retail audiences. For Bitcoin, it was the position of the long-term owners that remained the fundamental factor of stability.

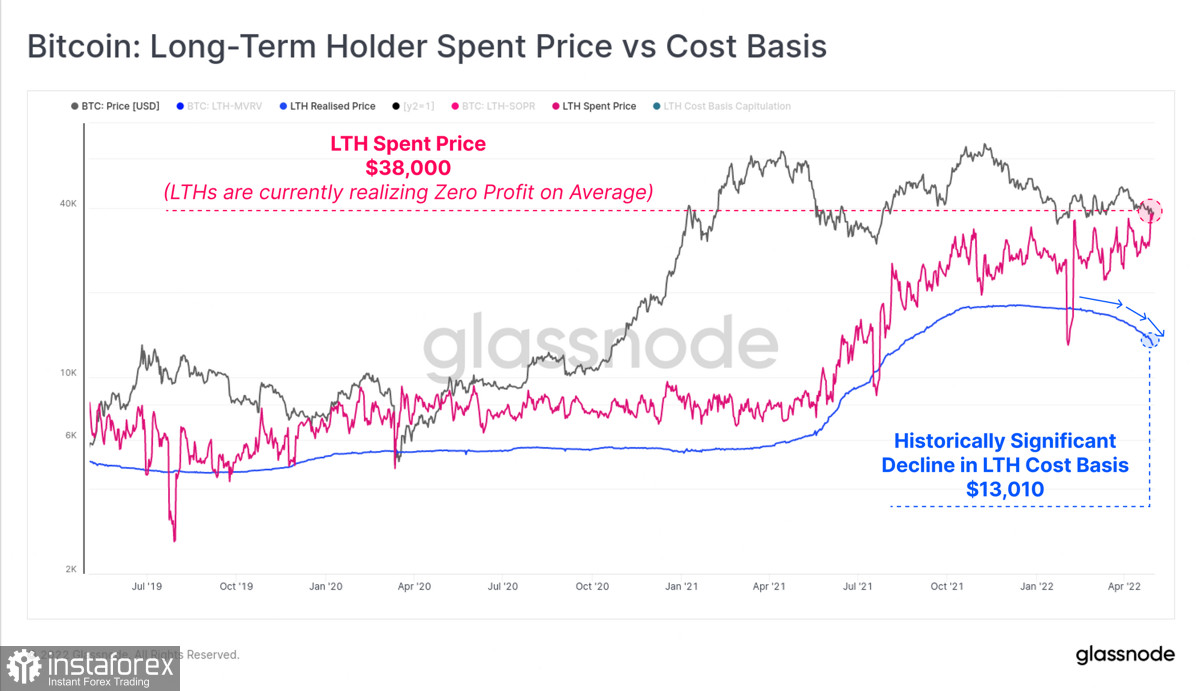

However, over the past three months, there have been many large-scale and negative events that have changed the priorities of large long-term owners. The same Glassnode notes that the average realized price of BTC among large traders began to decline in February. This suggests that large holders have begun to massively fix insignificant profits or go to zero. Given the current market and economic situation in the world, this is a negative signal for the main cryptocurrency. Investors are losing faith even in the long-term prospects of Bitcoin, as evidenced by the massive fixation of local profits.

Given the large-scale policy to tighten inflation control from the central banks of several countries and the Fed, investors do not see prospects for the growth of cryptocurrencies in the foreseeable future. The fixation of insignificant profits also indicates that Bitcoin and cryptocurrencies continue to be regarded as high-risk assets with falling returns. And here a natural dissonance arises, because the profitability of the cryptocurrency has fallen due to its gradual stabilization and reduced volatility. But even with this in mind, large investors do not consider the asset as a reserve or hedge against inflation. In other words, Bitcoin is in a semi-position where it does not function as a highly profitable instrument, but at the same time does not represent a more fundamental value for the market.

In the current situation, the only option that can provoke an increase in Bitcoin quotes may be a pause in the Fed's policy. The volume of stablecoins on the market continues to grow, which means that there is an investment potential in relation to cryptocurrency. However, on May 4, the asset is at a crossroads: the current rate of profit-taking is leveled by the activity of other long-term owners, which significantly eliminates the dominance of sellers.

If the results of the Fed meeting turn out to be more deplorable for the market, then there is every reason to believe that BTC will break through the $37.4k support level. This will lead to a gradual decline into the $32k–$35k range as part of the price consolidation, as it is happening now.