The FOMC meeting will be held today, which is expected to raise the Fed funds rate by 0.50%, and, in addition, the beginning of quantitative tightening will be officially announced.

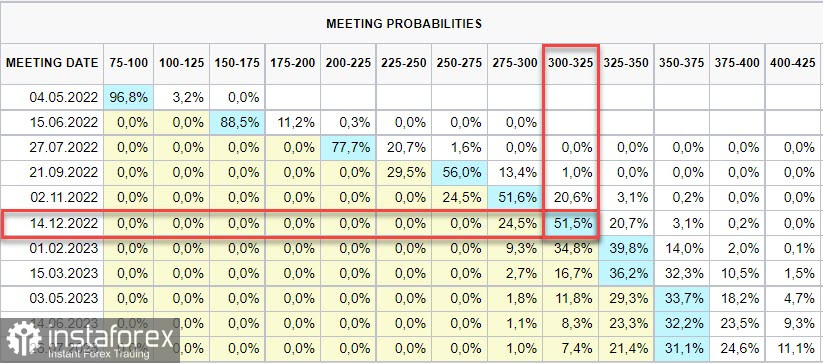

Since these expectations are already included in the quotes, the main focus will be directed to the press conference of Federal Reserve Chairman Jerome Powell. Futures on the rate see four consecutive rate hikes at each of the FOMC meetings, by the end of the year the rate is expected to reach the range of 3-3.25%, this is higher than a week ago and indicates the growing hawkish expectations of market participants.

Players will expect specifics from Powell in the implementation of the quantitative tightening plan, here nuances can play both the benefit of strengthening the dollar and easing. To finance the US budget, the government needs to continue issuing treasuries, and if the Fed withdraws from the number of buyers, then it is necessary to understand who will finance the government, taking into account the inflation rate, the yield on treasuries is deeply negative. There is still some time left, positions worth 950 billion have been accumulated in the Treasury accounts, but with current expenses they will last for several months.

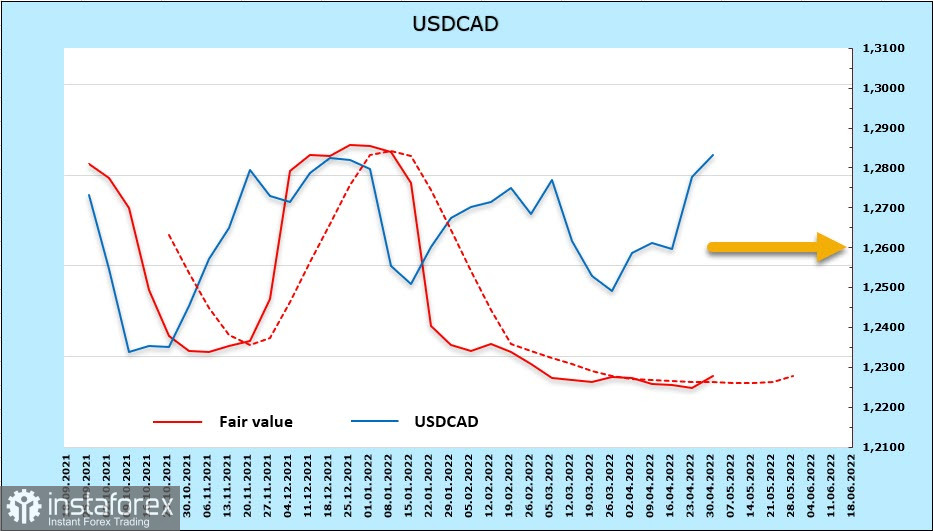

USDCAD

In his speeches last week, Bank of Canada Governor Tiff Macklem sought to emphasize three key points: "the Canadian economy is strong," "inflation is too high" and that higher interest rates are urgently needed in order to suppress inflation. The GDP report confirmed the validity of his position, the growth in February is noticeably higher than forecasts, while it is necessary to additionally take into account the drop in the unemployment rate below the docklike levels, and filling vacancies is difficult even with higher salaries.

The Bank of Canada raises rates without hesitation, by the end of 2022, 2.25% is expected, this is slightly less than the forecast by the Fed, but the real yield will depend on inflation, here the forecasts are just a little better for Canada than for the United States.The CFTC report is neutral for the loonie, the weekly change is -54 million, the total preponderance is +1.63 billion, CAD looks more convincing than other commodity currencies. The estimated price is significantly lower than the spot, that is, the potential for UADCAD movement to the downside remains.

Despite the fact that the loonie is more successful than others in resisting the strengthening of the dollar, USDCAD still reached the upper limit of the channel and has a chance to go further. The resistance of 1.2900 has so far stood, if there is a second attempt to go higher, then long positions at the breakdown are justified, if longs go above 1.2963, it may increase, the target is 1.3010/10. If the channel border holds, then a pullback is likely, in this case the target will be support 1.24, but it is too early to count on one or another scenario until the FOMC decision is evaluated tonight.

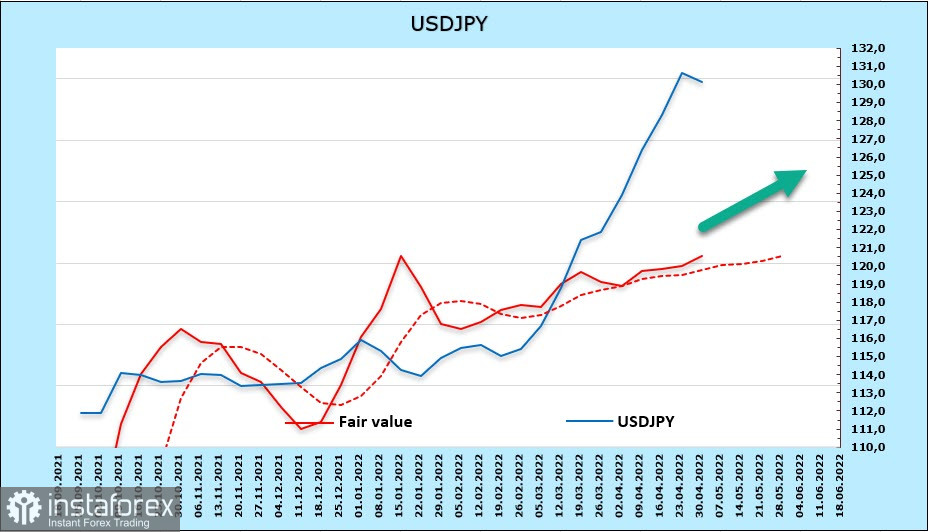

USDJPY

Nothing has changed for the Japanese yen since the Bank of Japan meeting on April 29. All the main parameters of monetary policy have remained unchanged, the target yield on 10-year bonds is no higher than 0.25%, and the BoJ intends to defend this level even more actively than before. Protection means buying an unlimited number of bonds every trading session, that is, the flow of liquidity will continue, which is a powerful bearish factor for the yen.

The GDP forecast for the fiscal year 2022 has been worsened from 3.8% to 2.9%, inflation is expected at 1.9% (previously 1.1%), which is also bad for the yen, since inflation growth will worsen real profitability.

And like a nail in the coffin, the intention to further soften the policy, if necessary, is confirmed. Divergence in monetary policy with other major central banks led by the Fed leaves the yen no chance.

The net short position on the yen has adjusted by +1.008 billion, but the accumulated advantage of -9.39 billion is still too strong. The estimated price continues to grow, there are no signs of a reversal.

On the technical side, the rapid growth above 131 requires a correction, but there are no fundamental reasons for a correction. The multi-year high of 135.19 is still the main benchmark.