Market on standby

Hi, dear traders!

Yesterday, EUR/USD traded in a narrow range, as the market awaited the policy meeting of the Federal Reserve and the following press conference of Fed chairman Jerome Powell. The market is pricing in a 50 basis point interest rate hike. Furthermore, investors expect the US regulator to reduce its balance sheet by about $95 billion per month. If the Fed's policy decision does not match expectations, it could be both a positive and a negative factor for the market. However, the US central bank is more likely to match expectations of market players, with Jerome Powell continuing his hawkish rhetoric.

In this situation, the market reaction would be important - the expected Fed decisions have already been priced in by traders. However, it should be noted that the reaction of market players to long-anticipated events frequently does not match the outlooks and expectations preceding them. Furthermore, traders can often react to said events illogically. Today's data releases are the EU retail sales data and the US ADP payroll report.

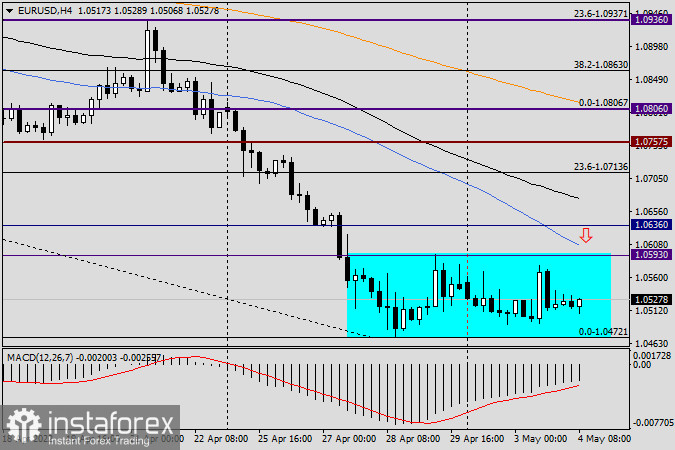

H4

There were hardly any noticeable changes on the daily chart. According to the H4 chart, EUR/USD is trading in a narrow range of 1.0593-1.0472. Important events in the economic calendar often push the pair out of the price channel and lead to breakthroughs and trend reversals. EUR/USD is very likely to break out of the highlighted range today. Furthermore, the pair could perform false breakouts above the price range through the resistance at 1.0593-1.0613.

If EUR/USD climbs into the highlighted area, it could reverse downwards and resume its downwards movement. Even if Jerome Powell's hawkish rhetoric continues or even intensifies, the market could find a 50 basis point hike to be insufficient, pushing the pair down somewhat. However, EUR/USD could move in any direction today. The main trading strategy at this point is opening short positions after the pair reaches 1.0590, 1.0607, 1.0636, and 1.0675. A period of particularly high volatility or a very advantageous situation for the euro could even steer the pair briefly into the 1.0700-1.0720 area. Opening new short positions can be considered near all levels mentioned above.

Good luck!