Hi, dear traders! GBP/USD is sensitive for two crucial events: central banks of both countries are due to make policy decisions. Let me remind you that the Federal Reserve is unveiling its decision on interest rates at 18:00 GMT tonight. The consensus suggests that the FOMC will raise the federal funds rate by half a percentage point. Besides, investors expect the Fed to begin reducing its balance sheet roughly by $95 billion per month. The next day, the Bank of England is due to announce its policy update. Market participants also await a move towards monetary tightening with a rate hike of 25 basis points.

In my viewpoint, the rhetoric of the leaders of both central banks is worthy of attention. The Federal Reserve is expected to come up with clearly hawkish rhetoric. Unlike it, the Bank of England is likely to express a cautious stance with dovish notes. A lot of analysts consider this difference inrhetoric to be the main factor in the greenback's strength against the pound sterling. Another event of major importance is the US nonfarm payrolls for April which will be released on Friday. Thus, we suggest that GBP/USD is set to trade with high volatility for the next three days. Meanwhile, the currency pair is trading quietly.

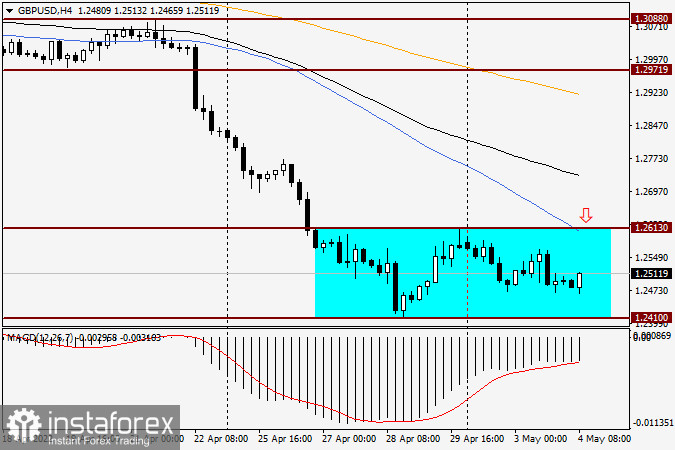

H4

Like EUR/USD, GBP/USD has been locked inside a narrow range between 1.2613 and 1.2410. The blue 50-day moving average puts a lid on the price, preventing it from leaving the range upwards. The 50-day moving average is located right above the upper border which coincides with resistance at 1.2613. If the sterling bulls are able to break the upper border upwards, the next target will be the area of 1.2700-1.2735. It is a strong technical level that also matches the black 89-period exponential moving average. If any bearish reversal candlestick patterns appear below 1.2613 and/or in the area of 1.2700-1.2735, it will produce a sell signal.

At this stage, the main trading recommendation remains to sell. Interestingly, all the above-said events are able to wreck the technical picture and make unexpected changes in the GBP/USD dynamic. The Bank of England lacks that hawkishness intrinsic to the Federal Reserve. Therefore, the Fed's related events tonight are sure to be pivotal to this trading instrument. Let's wait for the FOMC decisions. Tomorrow, I'm going to give you an insight into what happened and set new priorities for GBP/USD.