The situation may reverse at any moment.

Hello, dear traders!

Today, we are going to summarize the April trading results of AUD/USD and outline the top events this week, namely the interest rate decisions of the two central banks – the Reserve Bank of Australia and the US Federal Reserve. The former held the board meeting yesterday. As a reminder, the RBA was expected to raise the benchmark rate to 0.25% from 0.01. However, the decision to hike rates to 0.35% beat economists' forecast. In addition, the Australian regulator is preparing to reduce the balance sheet drastically. All in all, the RBA has followed the Fed's suit. Nevertheless, the US central bank could be even more hawkish, announcing its decision on the interest rate today. Chairman Powell will hold a press conference right after the meeting. A 50 basis points increase is anticipated as well as hawkish statements by Mr. Powell at the press conference.

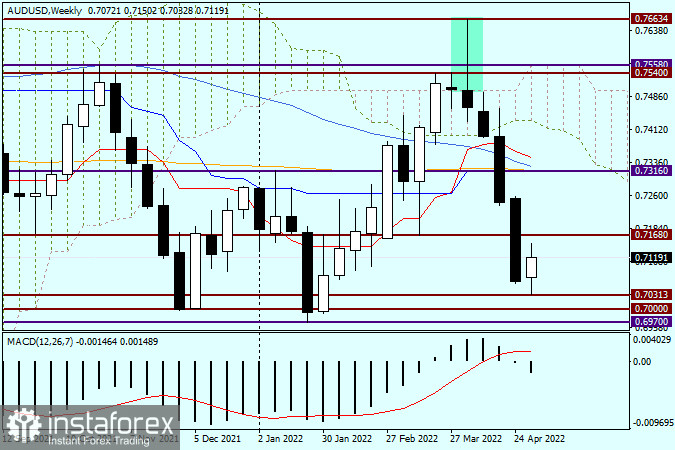

Weekly

It is a little too late to show you the weekly chart. So, those willing may look at the higher time frame themselves and see the bearish Aussie dollar. In the last week of April, AUD/USD showed a steep fall. However, this week, the technical picture has started to change in favor of the Australian dollar. Nevertheless, it is still too early to talk about it. The thing is that in addition to the Fed's decision, US labor market results for April will come out on Friday. Such data usually have a strong influence on all the dollar pairs. So far, the quote may retrace up to support at 0.7168 and then reverse downward again. Should market players feel disappointed with the Fed's decision and the NonFarm Payrolls report, the pair would close above 0.7168 at the end of the week. This should be interpreted as a false breakout. So, we might see the Aussie dollar strengthening versus the greenback. Bears will try to break through a row of strong and important technical levels of 0.7030, 0.7000, and 0.6970. In our view, the downtrend will be able to extend only after a true breakout at 0.6970 and the weekly close below the mark.

Daily

The highlighted candlestick combination in the daily time frame shows an impending reversal. However, we will be able to find out whether it is actually a reversal or just a correction when this busy trading week is over. In the face of the upcoming interest rate decision and labor market results, it would be unwise to make any forecasts. The situation may reverse at any moment. Therefore, let's not rush and better trade wisely.

Have a nice trading day!