Analysis of trades and trading tips on GBP

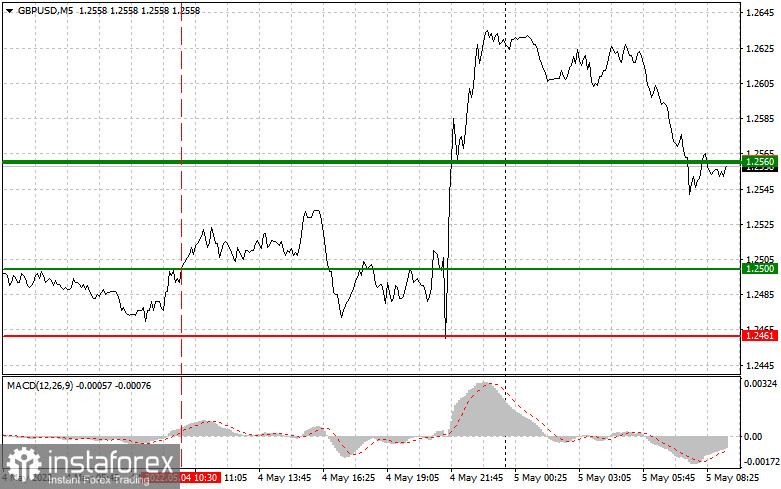

Yesterday, the pound sterling traded sluggishly. Despite volatility, the price tried only once to break through 1.2500. At that time, it seemed to me that the MACD indicator rose considerably from the zero level. It should have limited the upward movement of the pair. For this reason, I refrained from opening new positions. There were no other entry points yesterday.

As expected, the M4 money supply, mortgage approvals, and net lending to individuals reports did not change the trend. Investors were largely focused on the FOMC meeting results. It helped the pound sterling gain ground in the second half of the day. In the Asian session, an increase in the number of long positions was not so impressive. Today, speculators are awaiting the Bank of England's decision on the interest rate as well as the monetary policy summary. The regulator is projected to raise the rate to 1.0%. The trajectory of the pound sterling will depend on the speech of BoE governor Andrew Bailey. If he does not make any hints about the shift to a more aggressive approach in his speech, the pressure on the pound sterling will return. Many analysts believe that this scenario looks likely. They also predict another fall in the trading instrument. In the afternoon, the economic calendar is almost empty. The weekly report on initial jobless claims in the US will hardly significantly change the market sentiment. Therefore, it is better to wait for the market reaction to the BoE meeting results.

Buy signal

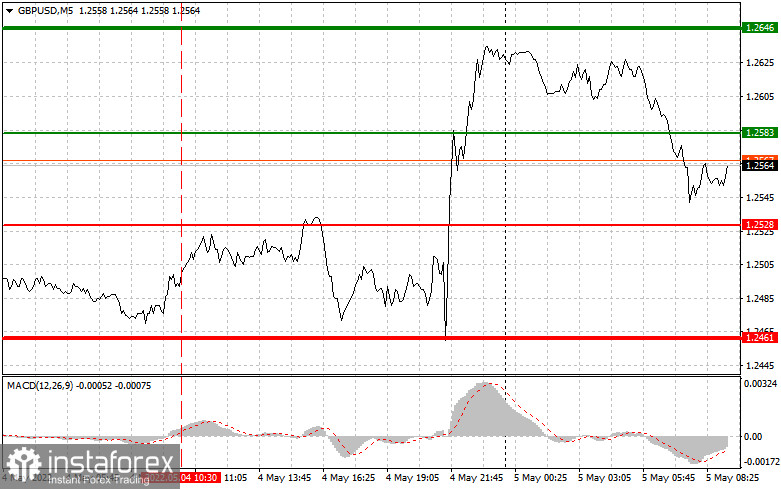

Scenario No.1: it is recommended to open long positions today if the pound sterling reaches the 1.2583 (green line on the chart) with an upward target of 1.2646 (thicker green line on the chart). It is better to close lost positions at 1.2646 and open short ones, keeping in mind a downward correction of 20-25 pips from the given level. The Bris itch currency may rise today only amid strong economic reports and the BoE's hawkish decision. However, the upward correction is likely to be limited. Important! Before opening long positions, make sure that the MACD indicator is above the zero level and it has just started to grow from it.

Scenario No. 2: it is also possible to buy the pound sterling today if the price approaches 1.2528. At this moment, the MACD indicator should be in the oversold area, which will limit the downward movement of the pair. It may also lead to an upward reversal. The pair is expected to increase to the opposite levels of 1.2583 and 1.2646.

Sell signal

Scenario No.1: it is recommended to open short positions on the pound sterling today only if it hits 1.2528 (the red line on the chart). It may trigger a rapid decline of the pair. The main goal of sellers will be the 1.2461 level. It is better to close short positions at this level and open long ones, keeping in mind an upward correction of 20-25 pips points from the given level. The pressure on the pound sterling may return at any moment, especially if BoE governor Andrew Bailey signals a more dovish approach to monetary policy. Important! Before opening short positions, make sure that the MACD indicator is below the zero level and it has just started to decline from it.

Scenario No.2: it is also possible to sell the pound sterling today if the price slides down to 1.2583. At this moment, the MACD indicator should be in the overbought area, which may limit the upward movement of the pair. It may also trigger a downward. The pair is projected to sink to the opposite levels of 1.2528 and 1.2461.

Description of the chart:

The thin green line shows the entry price at which you can buy a trading instrument.

The thick green line is the estimated price where you can place a Take profit order or lock in profit manually as the price is unliketo rise above this level.

The thin red line shows the entry price where you can sell a trading instrument.

The thick red line is the estimated price where you can place a Take profit order or lock in profit manually as the price is unlikelyto decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to the overbought and oversold zones. Important. Novice traders need to make very careful decisions when entering the market. It is better to stay out of the market before the release of important fundamental reports. It helps avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, then always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that if you want to succeed in trading, it is necessary to have a trading plan, following the example of the one I presented above. Relying on spontaneous trading decisions based on the current market situation is a losing strategy of an intraday trader.