The euro and the pound both went up following the FOMC meeting and Chairman Powell's press conference. The head of the US Fed said the regulator would do everything it takes to tame inflation. He also noted that the bank might face some challenges after the highest rate hike in a decade.

Yesterday, the US Fed raised the interest rate by 50 basis points for the first time since 2000. What is more, similar steps are planned for June and July. Meanwhile, investors were concerned the central bank might make some unexpected moves, like a 75 basis points rate hike. Nevertheless, the chairman made it clear that such a possibility had not been even discussed. At the beginning of the press conference, Powell addressed the American people. "My colleagues and I are acutely aware that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials like food, housing, and transportation," he said, reassuring that the regulator does everything possible to bring high inflation under control. The Fed hopes the combination of rising borrowing costs and the shrinking balance sheet will have a positive effect on the American economy, which is now exposed to serious recession risks due to excessively high inflationary pressures and supply chain issues.

The Fed has recently been dealing with strong criticism of its slow response to record inflation in the country. Thus, consumer inflation soared to its 40-year high of 8.5% in March. Yesterday, Mr. Powell asserted the central bank had adjusted to changes and would continue to do so.

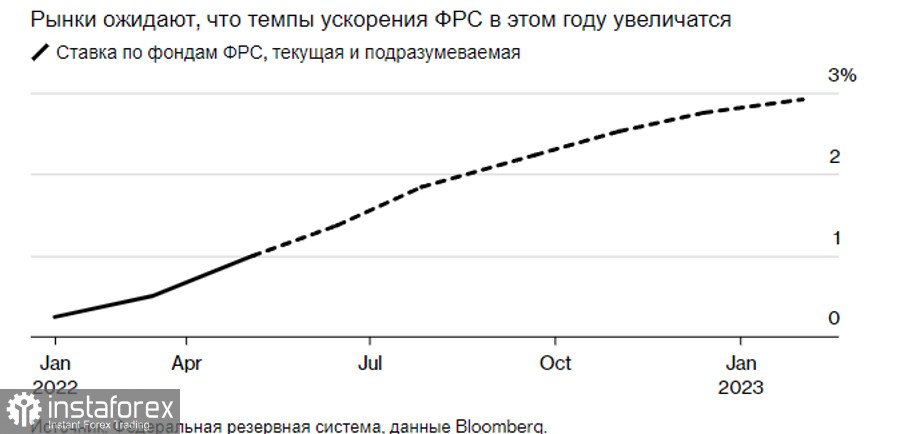

The Fed is now expected to hike rates by 50 basis points at the next two meetings. If inflationary pressure goes down, the central bank will be increasing rates by 25 basis points starting in September. There would be hikes for as long as the interest rate reaches the neutral level. Notably, the neutral level could be of a different range. In March, it was estimated between 2% and 3%.

As for the balance sheet, the reduction will start in June from $47.5 billion dollars a month and accelerate to $95 billion dollars in three months.

Technical picture of EUR/USD

The price stabilized at 1.0470, and bulls started to accumulate positions after the FOMC meeting, which turned out to be the right decision. Demand for the euro is increasing on expectations of the aggressive ECB. However, due to the tense geopolitical situation in Ukraine and supply chain issues in the eurozone, the growth potential of risk assets will be limited. In the short term, we may count on a deep bullish correction. It emerged amid profit taking triggered by the release of US macroeconomic data. To stop the bearish trend, bulls need to protect support at 1.0580. Otherwise, bears are highly likely to push the instrument to new highs at 1.0520 and 1.0470. A more distant target stands at the support level of 1.0420. Since bulls have already reached 1.0580, the euro may retrace up, break through 1.0640, and head towards 1.0690 and 1.0740.

Speaking of the British pound, the Bank of England is expected to raise interest rates for the fourth time today. However, it will unlikely help stop the bearish market. In March, the bank hiked rates to 0.75%. Today, they may be increased by another 0.25% to 1%. A lot will depend on Andrew Bailey's rhetoric. Amid a slowdown in economic growth, he is unlikely to announce aggressive measures, which will only harm GDP.

Technical picture of GBPUSD

Bulls were able to protect the level of 1.2530. They are now pushing the pound higher. It should be noted, however, that the bearish trend continues in the medium terms, and the ongoing correction may come to an end right after Governor Biley's speech. In the short term, the pound could be bought on pullbacks as bullish activity could increase. Resistance is seen near 1.2620. In case of a breakout, the price will skyrocket to 1.2690 and 1.2730. Meanwhile, the bearish trend will strengthen if the quote breaks through 1.2530. In such a case, targets will stand at the lows of 1.2455 and 1.2380. Against the current backdrop, support is seen at 1.2320. Should the state of the UK economy get worse, this level would be updated.