Hi, dear traders!

Yesterday, the Federal Reserve agreed on increasing the interest rate by 50 basis points. Furthermore, the Fed began to gradually reduce the balance sheet by $47.5 billion per month in June. Overall, the regulator's policy decisions matched market expectations. Jerome Powell, the chairman of the Federal Reserve, stated at the postmeeting press conference that the US economy could easily withstand such aggressive monetary tightening, which was necessary to bring soaring inflation back to the target level of 2%. "There is a broad sense on the committee that additional 50 basis point increases should be on the table at the next couple of meetings," Powell said. However, it should be noted that the FOMC could consider a 75 basis point hike if these measures prove to be insufficient. During the press conference, Jerome Powell noted the labor market was strong and extremely tight. With wages rising at the fastest pace in many years, job creation would likely slow and unemployment would go down further, the Fed chairman added.

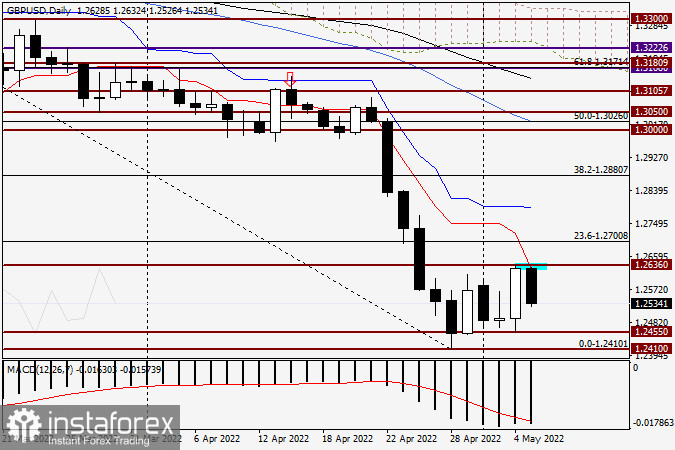

Daily

Yesterday, investors again followed the old "buy the rumor, sell the fact" trading rule. Despite the interest rate hike, USD still went down against GBP, similar to the slump after the first 25 basis point increase. GBP/USD found support near the strong technical level of 1.2455 and reversed upwards, closing at 1.2628. However, the pair has failed to extend the upside early on Thursday - GBP/USD failed to regain yesterday's high of 1.2636 and reversed downwards. At the time of writing, the pair's downward momentum continued. The pair's further trajectory would be determined by the results of the meeting of the Bank of England. The UK central bank is set to announce its monetary policy decision today.

According to consensus estimates, the regulator is expected to increase the key interest rate by 25 basis points. Due to the weaker state of the UK economy and lower economic growth, the Bank of England cannot afford the Fed's highly aggressive course of action to quell high inflation. On the technical side, the BoE's decision and the monetary policy report would significantly influence today's session. However, the market reaction to this policy decision will play a crucial role. If GBP/USD closes above the red Tenkan-Sen line, and particularly the strong technical level of 1.2700, the pound sterling could rise further against the US dollar afterwards. Otherwise, it could reverse southwards once again.Good luck!