The spectacle, titled "FOMC Meeting," went exactly as expected. Profit-taking on short positions on EURUSD against the backdrop of a rally of relief in the US stock market took out quotes of the pair above 1.06. But the euro turned out to be too weak to take advantage of the competitor's problems. Talk of a recession and weak statistics on German industrial orders have returned fans of the single European currency from heaven to earth.

The increase in the federal funds rate to 1%, the announcement of the start of balance sheet reduction, and the words of Fed Chairman Jerome Powell that a 50 basis points increase in borrowing costs would be discussed at subsequent meetings of the Committee should have allowed the US dollar to shine with new brilliance. In fact, all this news was taken into account in the quotes of the currency pairs associated with it, which gave the green light to the "buy the rumor, sell the fact" principle. Investors saw "dovish" notes in Powell's speech, and the sale of bonds from the accounts of the central bank will not go as fast as it was originally expected: at $47.5 billion a month during June–August, after which the amount will increase to $95 billion from September.

As a result, the S&P 500 bounced and US Treasury yields declined, creating the perfect setting for a bullish counterattack on the EURUSD. The pair climbed to 1.064, but the buyers very quickly felt that they had the guts not only to break the downward trend, but at least organize a full-fledged pullback. The reason for the sale of the euro was the disappointing statistics on German manufacturing orders and the speech of a member of the ECB Governing Council Fabio Panetta, who said that the eurozone economy is de facto in stagnation. As for the indicator from Germany, its fall by 4.7% turned out to be worse than all but one of the forecasts of Bloomberg experts. The consensus estimate was -1.1%.

Dynamics of German production orders

While Hungary opposed the EU proposal to ban Russian oil imports, this could only help delay a eurozone recession, not avoid it. All European economies, due to their proximity to the epicenter of the armed conflict in Ukraine, are more or less subject to the risks of a recession. In this regard, the statement of the Bank of England that Britain will fall into recession by the end of 2022 was painfully received not only by sterling, but also by the euro. The fall of the GBPUSD in response to the announcement of the results of the BoE meeting dragged the EURUSD bulls into the abyss.

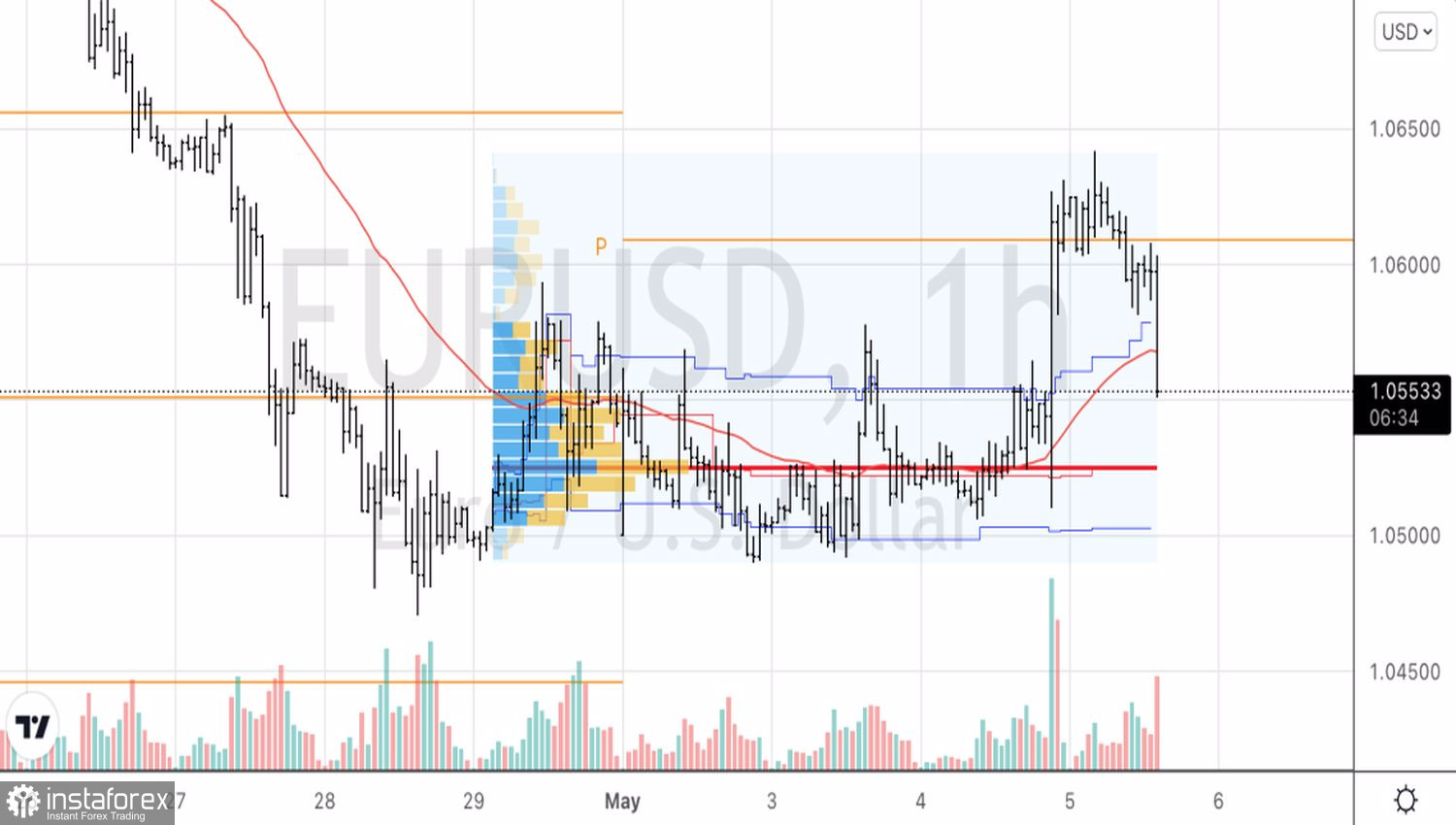

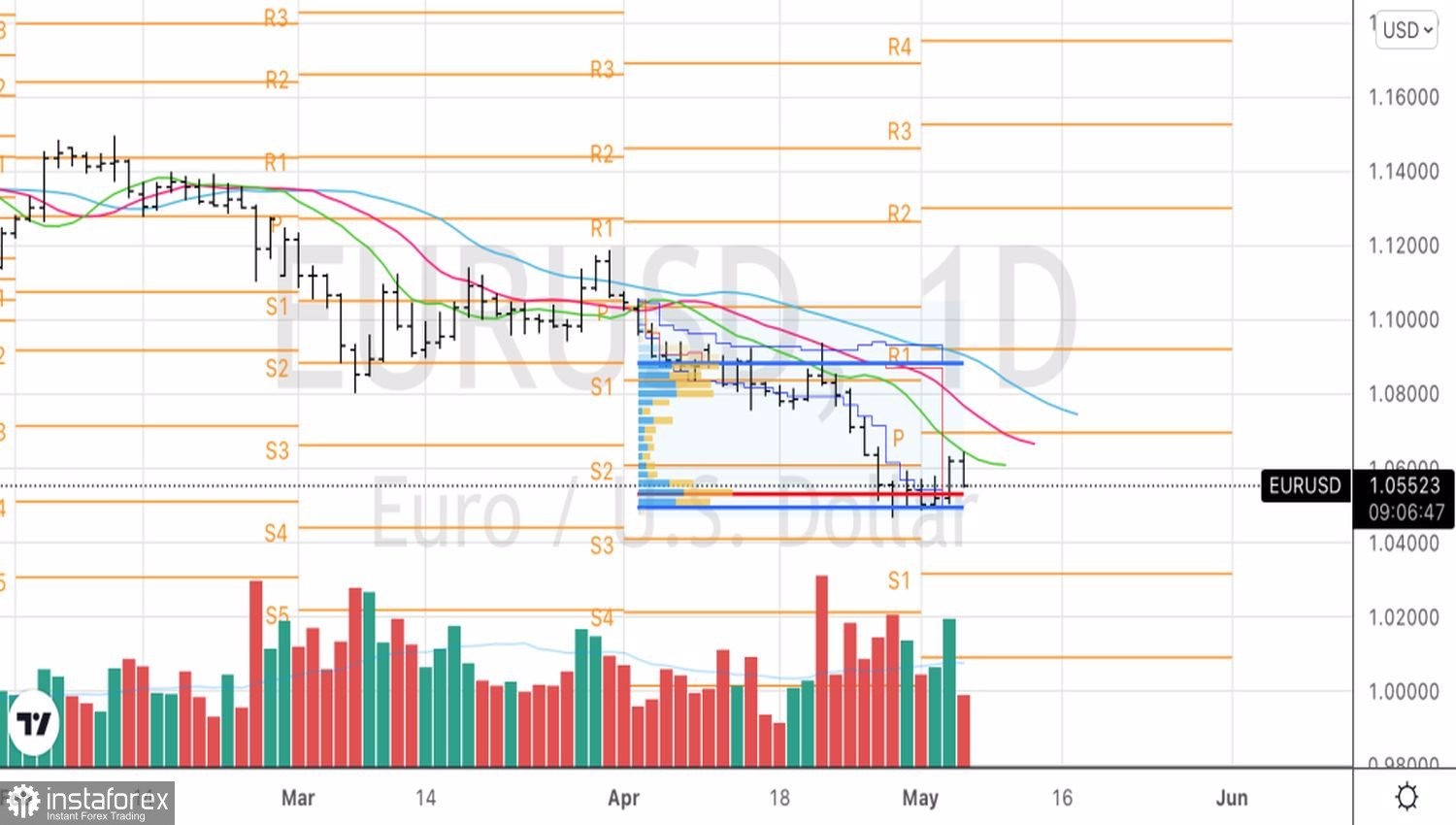

Technically, on the daily chart of the main currency pair, there was a rebound from the resistance in the form of a moving average, which should have been used for sales in a downward trend. The targets are the pivot points at 1.042 and 1.032. On the hourly timeframe, the return of EURUSD to the range of 1.0505–1.058 is evidence of the weakness of the bulls. Their inability to keep the euro above the EMA near $1.056 is the basis for the formation of shorts. They can be increased on a break of the fair value at 1.0525.

EURUSD, Daily chart

EURUSD, Hourly chart