Yesterday's stock rally showed signs of easing today as inflation fears resurfaced even after the Federal Reserve raised rates by half a point to curb rampant price increases.Jerome Powell eased fears that the central bank will raise rates more sharply, against this background the S&P 500 and Nasdaq 100 futures yesterday posted their highest daily gains in 2 months.

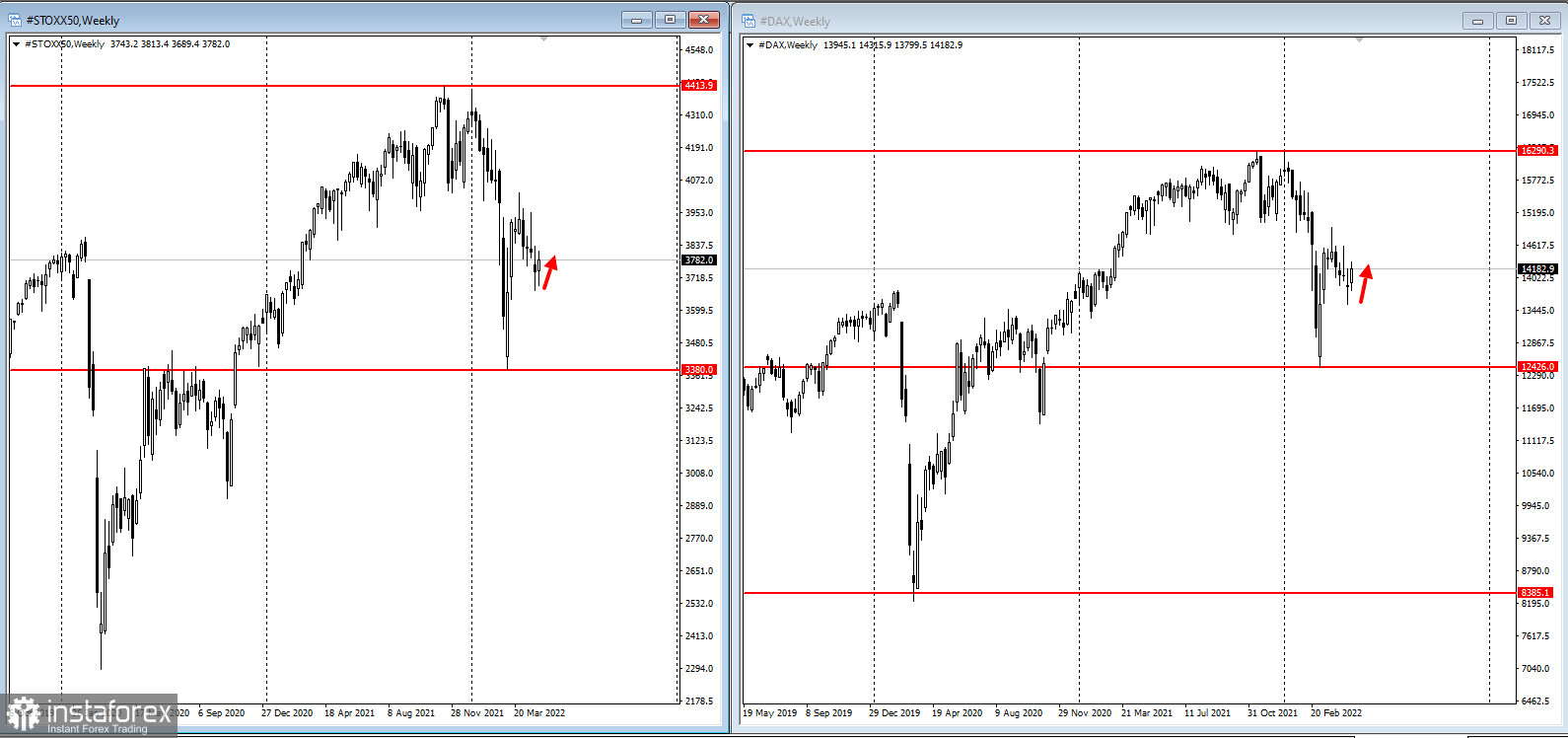

"We are puzzled why the market thinks that Fed hikes are going to stop inflation," Nancy Davis, founder of Quadratic Capital Management, said. "We see inflation as driven by massive government spending, supply chain disruptions and, more recently, by Russia's invasion of Ukraine."Politicians try to manipulate the need to suppress the fastest inflation in four decades against hard-won economic growth. In Europe, German factory orders have plummeted, underscoring the losses from the war. Rising commodity prices further complicate efforts to contain price pressures.The pound fell after the Bank of England raised interest rates to their highest level since the financial crisis and warned that the economy was going into recession under pressure from double-digit inflation.This followed a 50 basis point increase by the Fed, the biggest move since 2000. Powell signalled similar moves at subsequent meetings but denied a larger increase of 75 basis points.In Europe, the Stoxx50 index was up more than 1%, led by the property and technology industry. Positive results from large capitals including Airbus SE, Shell Plc, UniCredit SpA and ArcelorMittal SA also helped lift sentiment.

Key events this week:

- OPEC+ convenes virtually for a regular meeting, Thursday

- US April jobs report, Friday