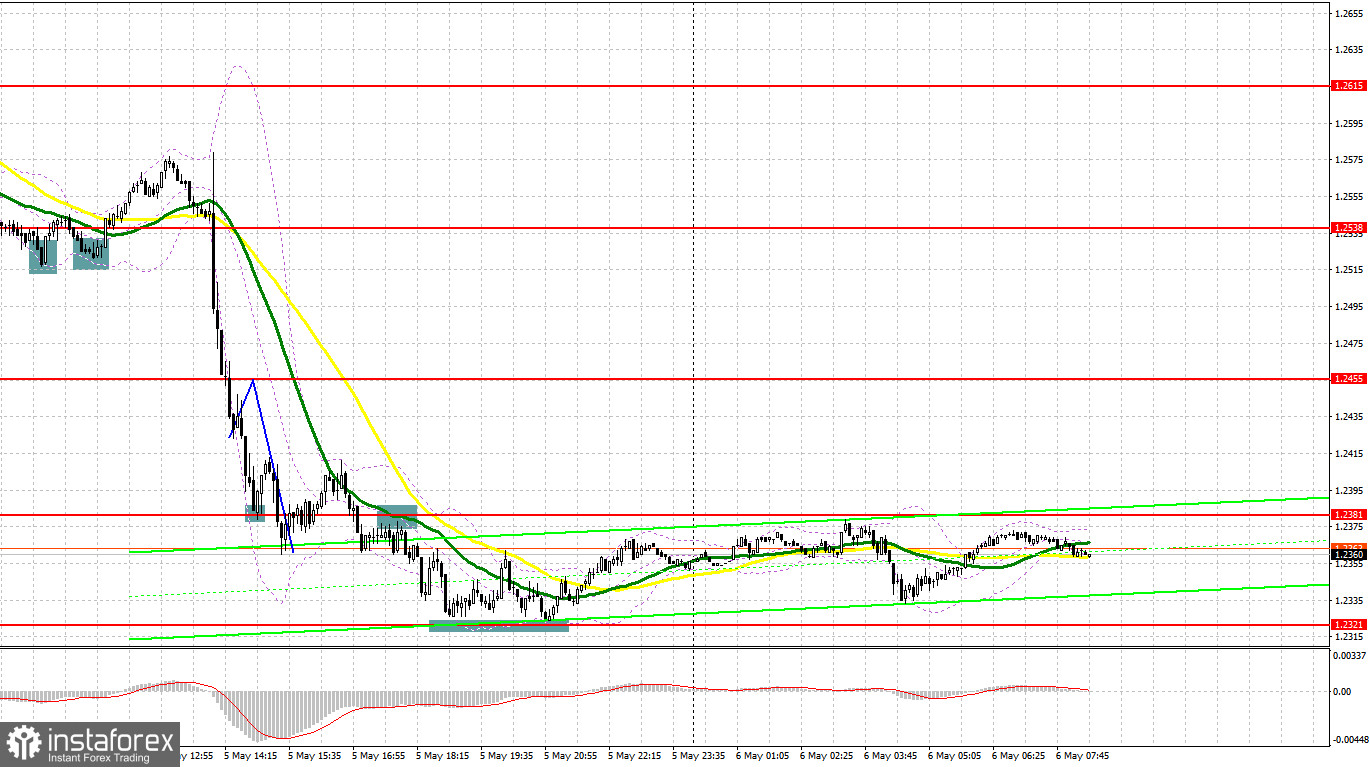

Yesterday, several profitable market entry signals were formed. Let's take a look at the 5-minute chart and see what happened. In my morning forecast, I paid attention to the 1.2531 level and advised you to make a decision on entering the market from it. A decline and forming a false breakout at 1.2531 were expected in the first half of the day. And if the first time you failed to enter long positions, then it could be done without any problems in case bears failed to break through below 1.2531. As a result, the pair went up by almost 45 points, after which the demand for the pound decreased. After the Bank of England announced its decision on interest rates, the pound collapsed. A breakthrough of 1.2455 occurred without a reverse test from the bottom up, so I did not have time to enter the market on the newly formed trend. Only a rebound from 1.2381 made it possible to take about 20 points from the market. In the middle of the US session, a breakdown of this level also took place. The reverse test from the bottom up gave a signal to sell, which resulted in a fall by another 60 points.

When to go long on GBP/USD:

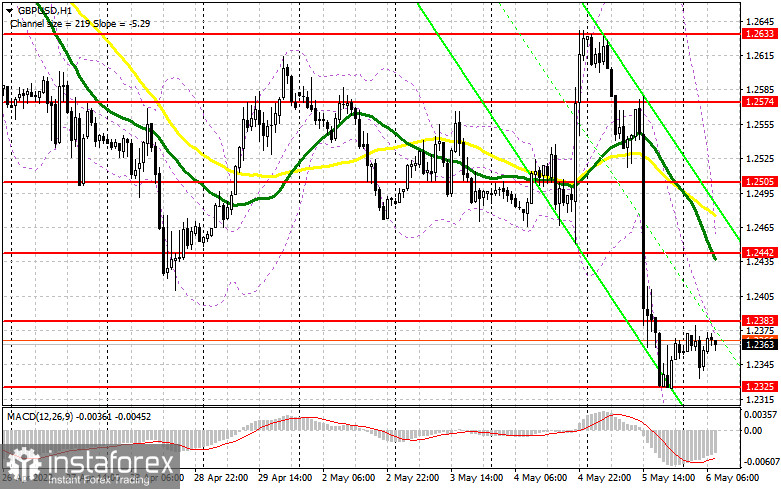

Pound bulls tried to somehow influence the situation, but little came of it. Most likely, we will see little change before the release of data on the US labor market, but the bulls can count on the divergence of the MACD indicator in the first half of the day and on long positions from 1.2325. This requires forming a false breakout and good data on the PMI index for the UK construction sector, as well as support from the Bank of England MPC member Katherine Mann, who will be interviewed today. As I noted, forming a false breakout at 1.2325 will result in creating the first entry point into long positions, counting on the pound's return to the intermediate resistance at 1.2383. A breakthrough of this range is entirely dependent on the demolition of a number of bearish stop orders, counting on further downward movement of the pound. Bears not being active at 1.2383, as well as a test of this level from top to bottom will provide an entry point into long positions with the goal of a sharper breakthrough to the area of 1.2442, where I recommend taking profits. There are moving averages, playing on the bears' side. A breakthrough of this range is possible only in case of weak data on the US labor market, which will open the way to 1.2505. In case the pair falls and the lack of activity of the bulls at 1.2325, and such a scenario is more possible - given the wait-and-see position of the Bank of England, I advise you not to rush into long positions. You can open long positions only in the area of 1.2256 and if a false breakout is formed. I advise you to buy GBP/USD immediately on a rebound only in the area of 1.2185, or even lower - around 1.2122, based on an upward correction of 25-30 points within the day.

When to go short on EUR/USD:

The bears' main goal for today is a breakthrough of the nearest support at 1.2325, which is the annual low. But, before selling on a breakthrough, look at the divergence of the MACD indicator, which can largely limit the pound's downside potential in the first half of the day, especially ahead of key data on the US labor market. A breakthrough and reverse test of 1.2325 from below creates a sell signal which, together with dovish rhetoric from BoE MPC member Katherine Mann, will quickly push GBP/USD to the 1.2256 area, a major new support level. A breakthrough of this range also creates another sell signal with the prospect of reaching a low like 1.2185, where I recommend taking profits. A more distant target will be the 1.2122 area, but the opportunity to update it will appear only in case of very strong indicators on the growth of the number of employed in the US non-farm sector. In case GBP/USD grows, the bears will try to do everything to prevent the exit above the resistance of 1.2383. A breakthrough of this range will strengthen the upward correction and lead to the demolition of a number of stop orders. Therefore, forming a false breakout, there will be a signal to sell in order to continue the bear market. If there is no activity around 1.2383, I advise you to postpone short positions until the next major resistance at 1.2442, where the moving averages pass. I also advise you to open short positions there only in case of a false breakout. You can sell GBP/USD immediately for a rebound from the high of 1.2505, counting on the pair's rebound down by 30-35 points within the day.

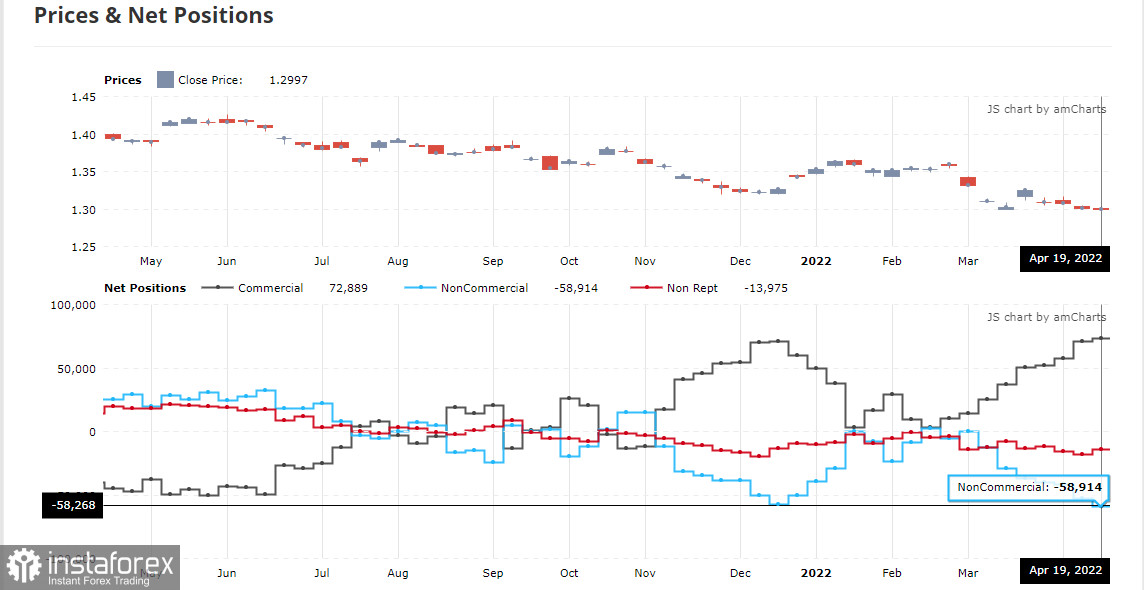

COT report:

The Commitment of Traders (COT) report for April 19 showed that both short and long positions have increased, but there were much more of the former, which is obvious if you look at the GBP/USD chart. The UK economy is in very bad shape, as Bank of England Governor Andrew Bailey confirmed last week. His statements that the economy is heading into recession were the last straw holding back pound bears in the second half of April. As a result, surpassing the annual low and a new major sell-off of the pound has already driven the trading instrument below the 26th figure, and it seems that this is not the end. The consumer price index is climbing steadily into double digits, and a worsening global situation due to disruptions to supply chains amid a new wave of Covid-19 in China creates even more problems. The situation will only get worse, as future inflationary risks are now quite difficult to assess also due to the difficult geopolitical situation, but it is clear that the consumer price index will continue to rise in the coming months. The situation in the UK labor market, where employers are forced to fight for each employee, offering ever higher wages, is also pushing inflation higher and higher. The pressure on the pound is also growing for another reason - the aggressive policy of the Federal Reserve. The Committee may announce an increase in interest rates immediately by 0.75% during the May meeting - they do not have such problems as in the UK with the economy yet. The April 19 COT report indicated that long non-commercial positions rose from 35,514 to 36,811, while short non-commercial positions jumped from 88,568 to 95,727. This led to an increase in the negative value of the non-commercial net position from - 53,054 to -58,268. The weekly closing price fell from 1.3022 to 1.2997.

Indicator signals:

Trading is below the 30 and 50-day moving averages, indicating a renewed bear market for the pound.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator around 1.2383 will act as resistance. In case of a decline, the lower border of the indicator around 1.2325 will act as support.

Description of indicators:

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.