Analysis of trades and trading tips on EUR

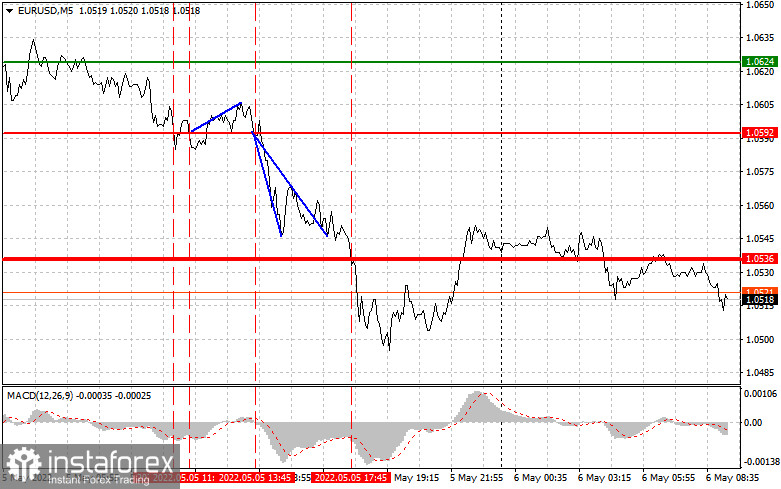

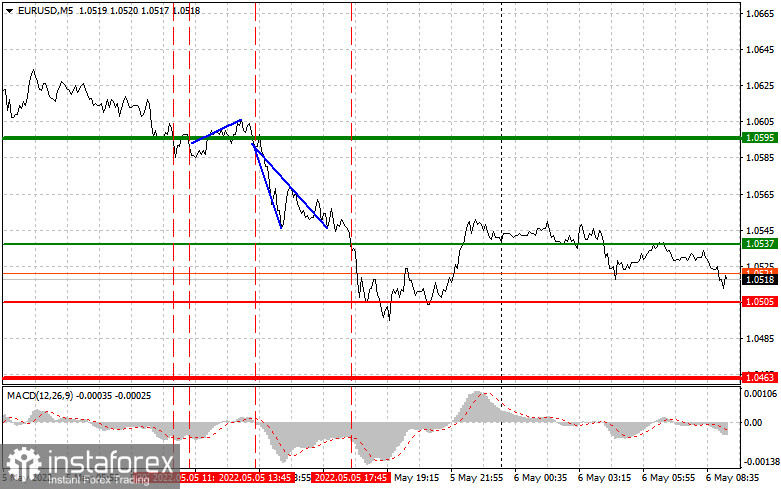

The first test of the 1.0592 level occurred when the MACD indicator went down significantly from the zero level. It limited the downward movement of the pair. For this reason, I did not sell the euro, waiting for a buy signal according to scenario No. 2. Shortly after, the pair made a new attempt to break through this level. At that time, the MACD indicator was in the oversold area. It was a confirmation of the correct entry for long positions. As a result, the pair rose by about 15 pips. Closer to the middle of the day, the pair undertook another test of 1.0592. At that moment, the MACD had just started to move down from the zero level. I decided to sell the euro at the current price. As a result, the pair declined by more than 50 pips. Long trades for a rebound from 1.0536 in the afternoon were closed to avoid losses as the pair failed to grow from this level.

The euro lost ground in the first half of the day due to weak reports on factory orders in Germany and Italy. Today, industrial production data for Germany is on tap. Italy will unveil the retail sales report. ECB Governing Council member Joachim Nagel will make a speech. However, these reports as well as Nagel's speech will hardly impact the trajectory of the euro. To start with, macro stats will deliver the March figures. They are of little importance to traders. Besides, they are anticipating the release of a more crucial report in the second half of the day. The US will reveal the Nonfarm Payrolls report for April of this year. The unemployment rate is expected to decrease. However, if the reading indicates a slowdown in employment, it may adversely affect the US dollar. An increase in the average hourly wage in April will signal inflationary pressure in the United States. This will be extremely bullish for the US currency. The speeches of FOMC members John Williams and Raphael Bostic scheduled for at the end of the day will hardly contain anything new. Therefore, in my opinion, it is better to open long positions on the US dollar and short ones on the euro.

Buy signal

Scenario No.1: it is recommended to open long positions on the euro today if the price reaches 1.0537 (the green line on the chart) with an upward target of 1.0595. It is better to close long positions at 1.0595 and open short ones, keeping in mind a downward correction of 20-25 pips from the given level. The euro may slightly rise in the first half of the day. However, further correction looks unlikely due to the release of the Nonfarm Payrolls report. Important! Before opening long positions, make sure that the MACD indicator is above the zero level and it has just started to grow from it.

Scenario No.2: it is also possible to buy the euro today if the price approaches 1.0505. At this moment, the MACD indicator should be in the oversold area. It may limit the downward movement of the pair. It could also trigger an upward reversal. The pair is expected to touch theopposite levels of 1.0537 and 1.0595.

Sell signal

Scenario No.1: it is recommended to open short positions on the euro if the price hits the level of 1.0505 (the red line on the chart). The target level will be 1.0463 where I would advise you to lock in profits. It is also better to close short positions and open long ones, keeping in mind an upward correction of 20-25 pips. Bears may take control over the euro if the EU data is discouraging and the NFP report is strong. If the jobs report confirms a further rise in employment, it will indicate that the US economy remains strong. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from it.

Scenario No.2: it is also possible to sell the euro today if the price slides to 1.0537. At this moment the MACD indicator should be in the overbought area. It will limit the upward movement of the pair. It may also trigger a downward reversal. The pair is likely to decrease to the opposite levels of 1.0505 and 1.0463.

Description of the chart:

The thin green line shows the entry price at which you can buy a trading instrument.

The thick green line is the estimated price where you can place a Take profit order or lock in profit manually as the price is unlikelyto rise above this level.

The thin red line shows the entry price where you can sell a trading instrument.

The thick red line is the estimated price where you can place a Take profit order or lock in profit manually as the price is unlikelyto decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to the overbought and oversold zones. Important.

Novice traders need to make very careful decisions when entering the market. It is better to stay out of the market before the release of important fundamentalreports. It helps avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, then always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that if you want to succeed in trading, it is necessary to have a trading plan, following the example of the one I presented above. Relying on spontaneous trading decisions based on the current market situation is a losing strategy of an intraday trader.