Ahead of the FOMC meeting, volatility in the crypto market, as well as daily trading volumes, decreased to swing lows. Investors were actively selling bitcoin-based products and other digital assets. In April 2022, the crypto market saw a record outflow of capital. Likewise, the equity market dropped to swing lows. However, high-risk assets showed growth and reached important resistance zones right after the FOMC meeting.

During the opening of the Nort American session the following day, bitcoin quotes fell sharply by 8% to the $35.5K low. On the daily chart, a strong bearish engulfing pattern was formed, and the price started to consolidate around levels of completion of the candlestick body. It was a negative signal indicating the continuation of the bearish market in the short term. We may expect a swing bullish correction before the next bearish stage. So far, we can say that bitcoin has experienced the biggest crash since early March 2022.

Technical indicators signal stabilization of quotes around $36.4K, in line with the swing support zone. The Stochastic Oscillator formed a bullish crossover but failed to develop the impulse. The Relative Strength Index confirms the bearish market. In the long term, this plunge does not change anything because the price is still in the $32K-$48K range. As expected, the outcome of the FOMC meeting has had an impact on the direction of the bullish wedge pattern in the daily time frame of BTC.

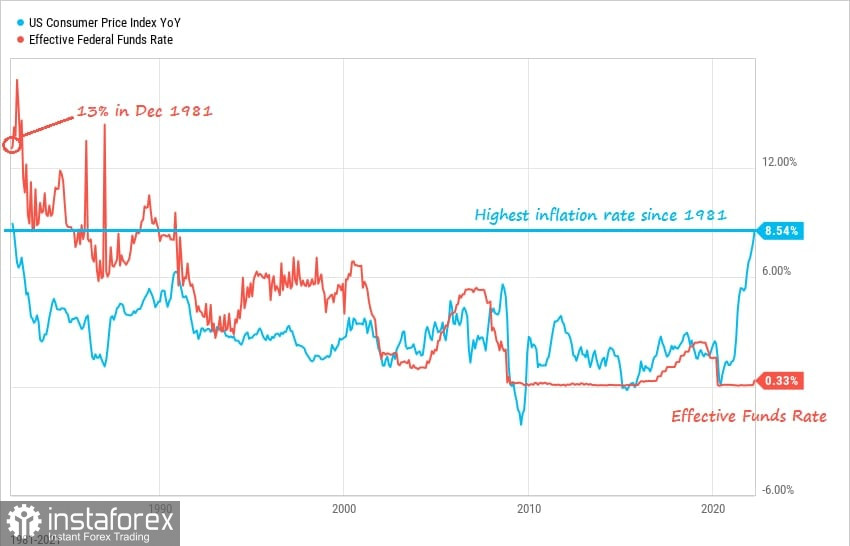

Let's now discuss possible reasons for a steep fall in bitcoin quotes after the swing bullish impulse. Firstly, the Fed announced a rate hike and the key rate range moved to the area of 0.75% to 1%. Above all else, the Fed will reduce its bond holdings at a pace of $45 billion a month in June. The pace will then accelerate to $95 billion a month. For Treasury securities and mortgage-backed securities, the cap will increase to $60 billion and $35 billion respectively.

On May 11, the US inflation report will be released. So far, there have been no reasons to believe in a slowdown in figures. Markets are dealing with excess liquidity. After the fall in the price of Bitcoin, the number of coins in profit fell below 60%.

There is every reason to believe that large investors are trying to squeeze out weak hands from the BTC market. We have seen a mass sell-off when the price broke the $37K barrier. As the asset continues to decline, there will be more losing coins in the market, as well as investors wishing to sell BTC to offset losses.

To trigger another sell-off, bitcoin should enter the range between $32K and $35K, with a trough formed there. The premature market reaction right after the FOMC meeting was misleading. There was a certain group of investors who took advantage of it to collect additional liquidity. In the short term, this will be a negative factor for bitcoin. In the long term, however, this will be the precursor to growth.