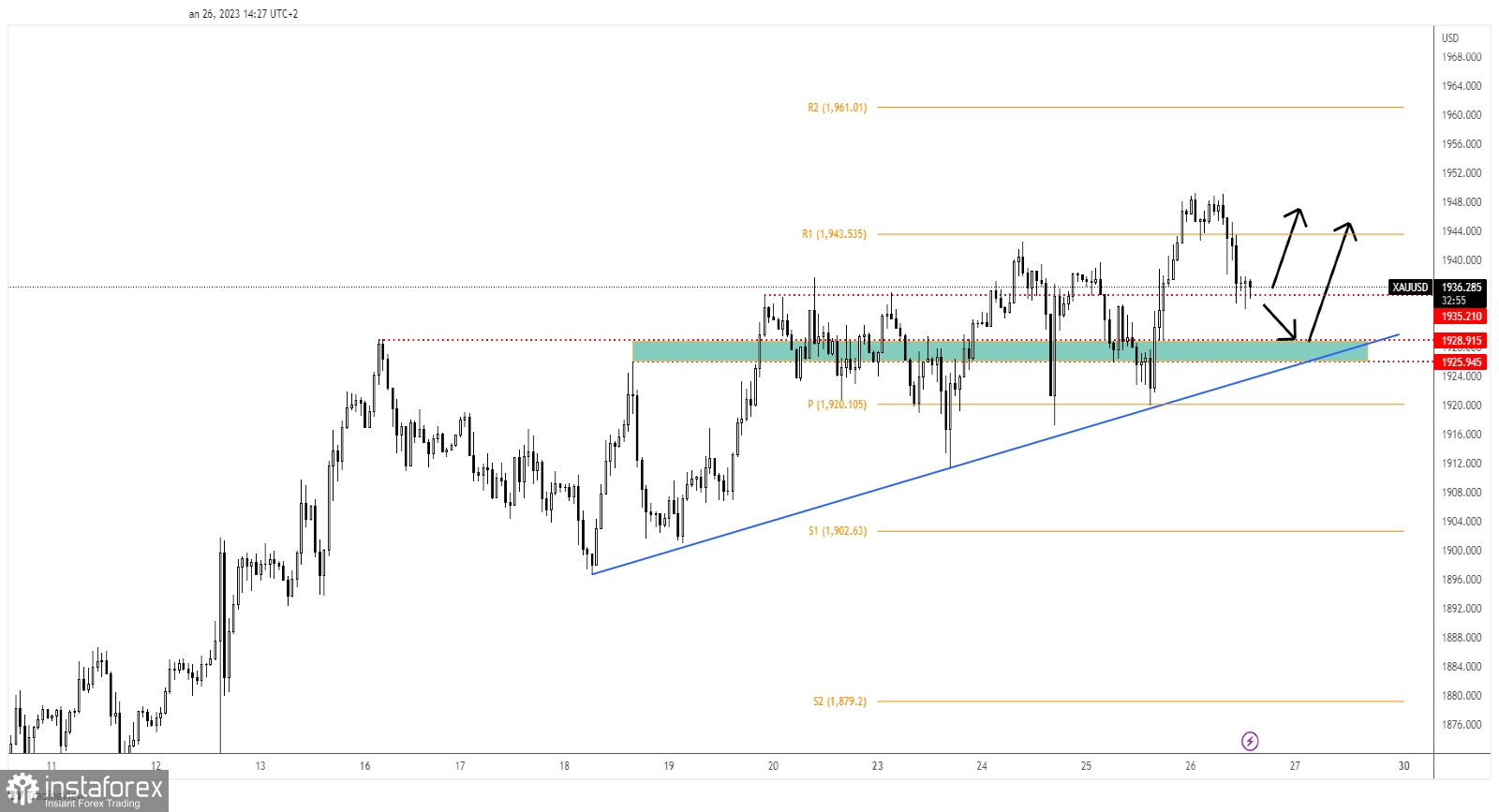

XAU/USD crashed after failing to take out the 1,949 former high. Now, it was trading at 1,936 and it seems undecided. The bias remains bullish despite the current drop. Still, traders are waiting for the US data before taking action.

Later, the US figures should have a big impact on XAU/USD. The most important event of the day is represented by the Advance GDP publication which is expected to report a 2.6% growth. Moreover, Unemployment Claims could jump to 203K in the previous week, New Home Sales could drop to 610K from 640K, Durable Goods Orders could increase by 2.4%, Core Durable Goods Orders could drop by 0.2%, while Advance GDP Price Index may deliver a 3.2% growth. In my opinion, better-than-expected US data should lift the USD and could punish XAU/USD.

XAU/USD Retesting The Buyers!

The rate extended its sell-off in the short term after failing to stay above the weekly R1 of 1,943. Now, it challenges the 1,935 downside obstacle. Closing below it may signal more declines.

The 1,925 - 1,928 zone (historical level) and the uptrend line represent downside obstacles. As long as the instrument stays above these support levels, the price could develop a new bullish momentum and it could approach and reach the former high.

XAU/USD Forecast!

Gold stands above 1,935 support. Only false breakdowns may announce a new bullish momentum if the US data comes in worse than expected. Still, coming back to test and retest the 1,928 - 1,925 zone could bring us good long opportunities.