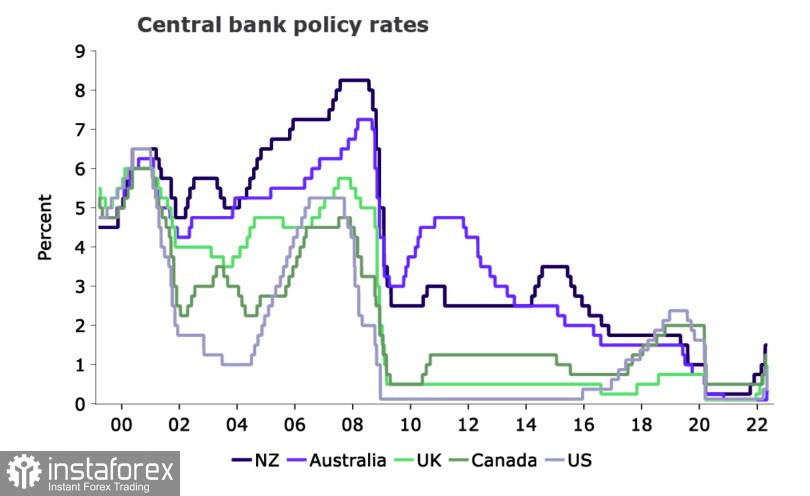

The reaction of stock markets to the tightening of some central bank policies came soon. On Monday, the S&P500 fell by 3.5% to its lowest level since March 2021 and the Nasdaq lost 4.3%. The fall continued in Europe and Asia-Pacific countries, with only the Shanghai Composite on the positive side of the major countries.Oil prices corrected downwards after the EU lifted its own ban on Russian oil transported by its ships to third countries. Russia, on the other hand, announced an increase in production as it sees new buyers.In the foreign exchange market, commodity currencies are performing worse on the back of falling energy prices and increasing risks.Federal Reserve Bank of Atlanta President Raphael Bostic said that the Fed was not considering a rate hike of 75 points. There is no need for more aggressive action. Saunders from the Bank of England, on the other hand, says that a more aggressive policy is needed because otherwise inflation could pull back too far to the 2% target. Central banks are just beginning the process of tightening. Global rates are extremely low compared to historical standards.

It is assumed that the need for further rate hikes will increase pressure on stock indices and the threat of a global recession will grow. In this environment, defensive assets, primarily the US dollar, will remain the most in demand.

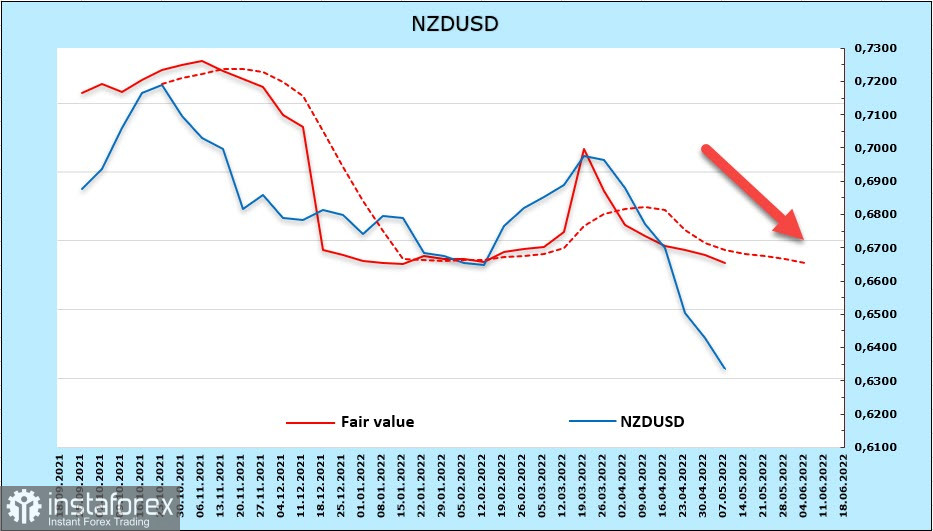

NZDUSD

On Thursday, the RBNZ inflation expectations for Q2 will be published. A slight easing of price pressures from 5.2% to 4.8% is forecast, primarily due to a strong decline in house prices. The stance of the RBNZ seems clear to the markets. Rates will rise at a rate slightly lower than the Fed intends to do, which will create some bearish pressure on the kiwi. However, a lot will depend on how the real incomes of citizens change. Average wage growth of +5.3% YoY looks strong, but is still below inflation and growth is expected to continue. The ANZ bank expects earnings growth to start exceeding inflation already in the second half of this year. The unemployment rate is also expected to fall from 3.2% to 2.9%, which will add further confidence to the RBNZ.Overall, the outlook for the New Zealand economy is favorable, so the NZD/USD decline is largely speculative in nature, based on the Fed's bravura plans and risk aversion. If this outlook is confirmed, the kiwi could start an upward movement at any time.The kiwi, after several weeks of fluctuating around zero, has finally moved, and it is not in favor of the bulls. The CFTC reported a net short position of -425 million at the end of the settlement week. The settlement price is below the long-term average and is directed downwards, indicating a high probability of continued downward movement.

The Kiwi is a little short of support at 0.6223, but it's getting closer and the chances of seeing prices at that level this week remain high. Upside attempts will be used to sell off. A strong resistance zone is 0.6520/60, but there is no fundamental reason to go up to this zone yet.

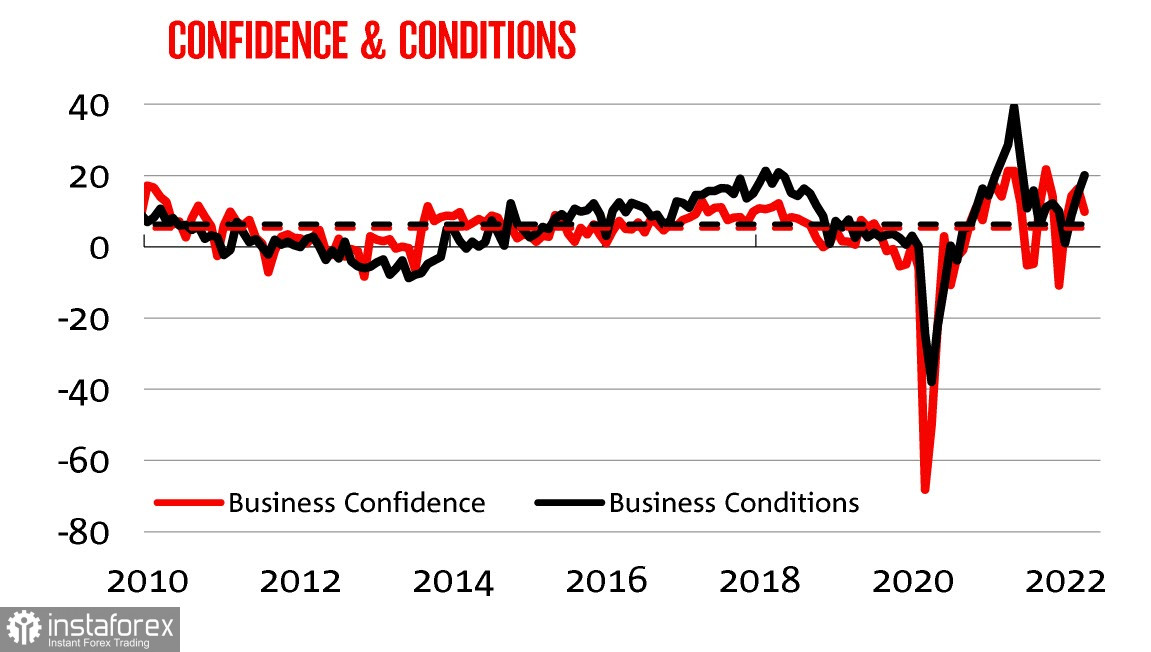

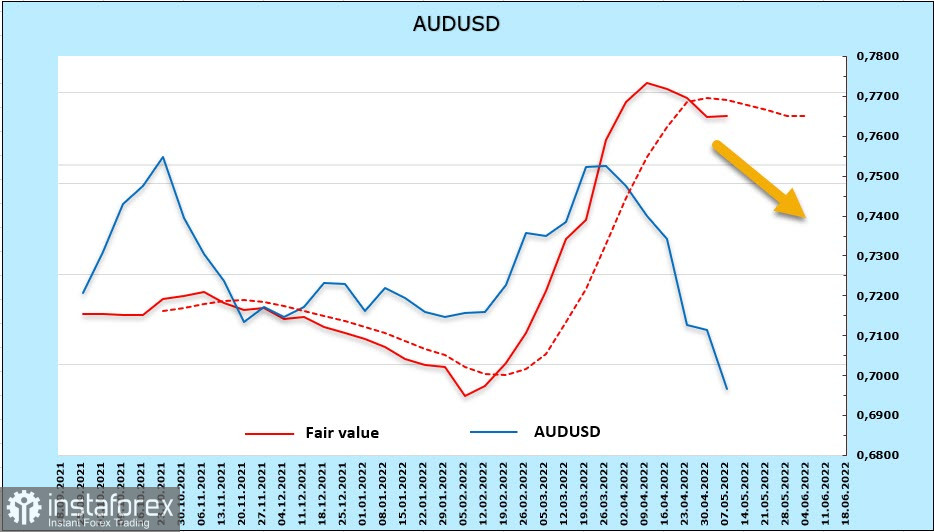

AUDUSD

According to the NAB, business conditions continued to improve in April, with confidence dropping slightly but remaining above the long-term average. Both confidence and conditions are now looking fairly robust.

Inflation remains a major concern, with both producer and retail prices rising at the fastest rate in survey history, suggesting that inflationary pressures will increase in the coming months.The change in the net short position of the AUD during the reporting week was minimal. The accumulated outperformance is -2.023 billion. Against the background of the strong declines of several other currencies, the Australian dollar is performing well. The settlement price is well above the spot and there is also a slowdown, which gives some support for a corrective rise.

As expected, support at 0.6970 failed to hold. The low has been updated. The trend remains bearish, but there is some chance of corrective growth. Targets 0.7030 and 0.7090, upon reaching which the sell-off is likely to resume. The main target is the technical level of 0.6760.