When there is no agreement among the comrades, their business will not go well. EU discussions of the sixth package of sanctions against Russia, including the oil embargo, contributed to the growth of Brent quotes. However, when the votes of all interested parties are needed to make a decision, and there are more than two dozen of them, there is still one black sheep in the herd. The final package could be far less formidable than the original, leading to a drop in the North Sea grade. It seems that traders will have to get used to its movements in the form of a pendulum up and down.

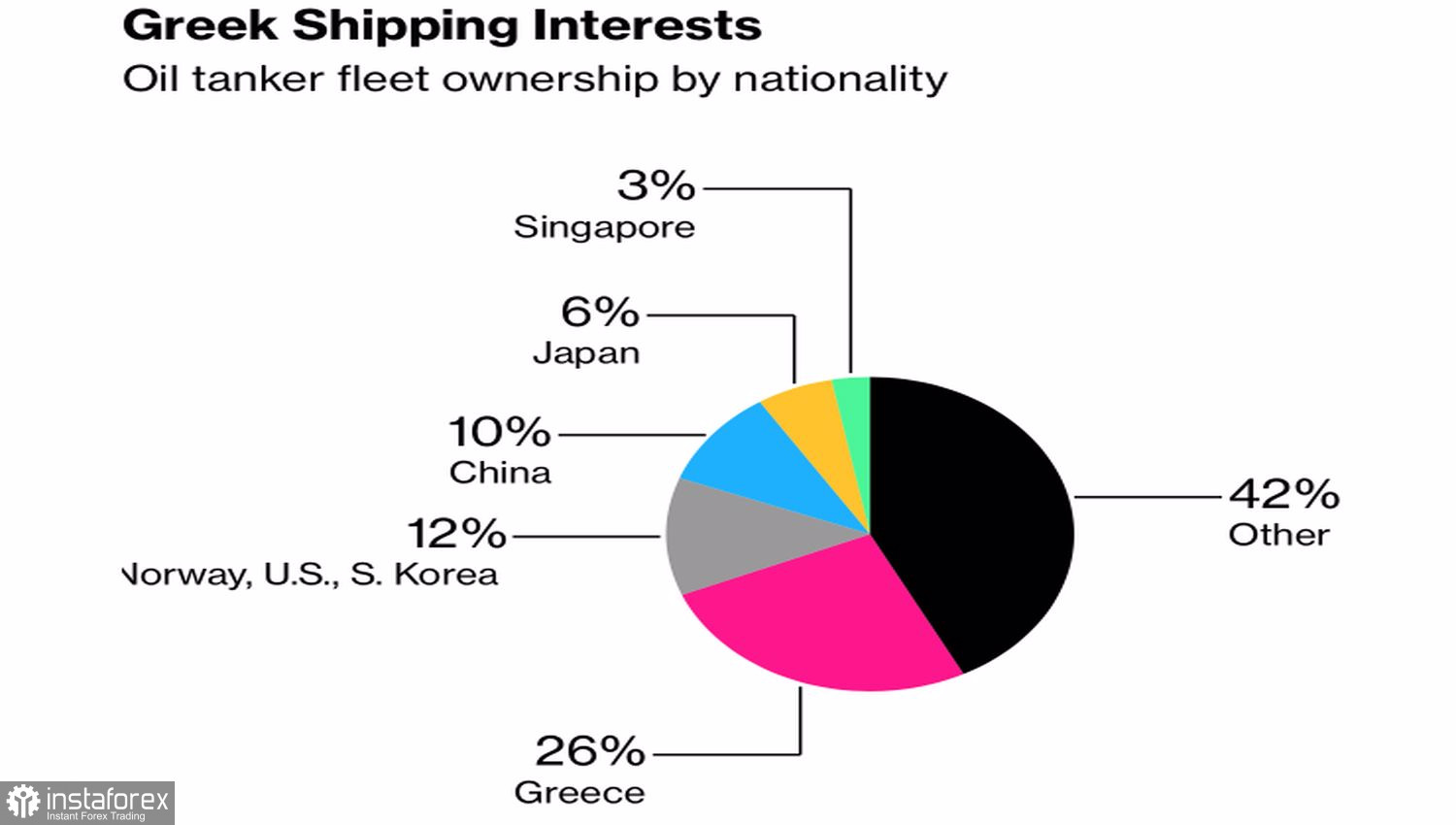

Benefits for everyone or no one. Unexpectedly, Bulgaria announced its readiness to veto the EU agreement banning the import of Russian oil. Say, why Hungary, Slovakia and the Czech Republic can get a deferral, but we can't? And if earlier Budapest put spokes in the wheels of a collective decision, now Sofia can do it too. Brussels' proposal to ban the transportation of oil from the Russian Federation to third countries had to be thrown into the trash because of the disagreement of Greece, Cyprus and Malta. Athens was especially zealous in its disagreement, because the economy of their country is significantly dependent on shipping.

Ownership of a fleet of oil tankers

The best that the EU can do is to ban the insurance of such transportation, which is also considered a very effective measure, but still less serious than a veto on transportation.

The decision on sanctions is being delayed also because the risks for the German economy if Moscow responds in the format of "an eye for an eye, tit for tat" and turns off the gas, looks very impressive. Before the armed conflict in Ukraine, Russia's share in German gas imports was 55%, then Berlin managed to reduce it to 35%. At the same time, according to studies by government advisers, the cessation of gas supplies will cost Germany €429 billion, which is equivalent to 12% of GDP. As a result, the largest economy of the eurozone is waiting for the same recession in scale as in 2008 and 2020.

Less stringent EU sanctions, the continued tense epidemiological situation in China, and fears that the Fed's aggressive monetary restriction will provoke a recession in the US economy contribute to the decline in Brent quotes. At the same time, the oil market continues to be in contango, and the spread between nearby contracts increased from $1.24 to $1.44 over the week. This indicates that the "bulls" in the North Sea variety are still in the game. In my opinion, this is due to the lack of supply. Even if the outbreak of COVID-19 in China stops, production problems will remain relevant. As a result, oil runs the risk of remaining in the trading range of $98–114 per barrel for a long time.

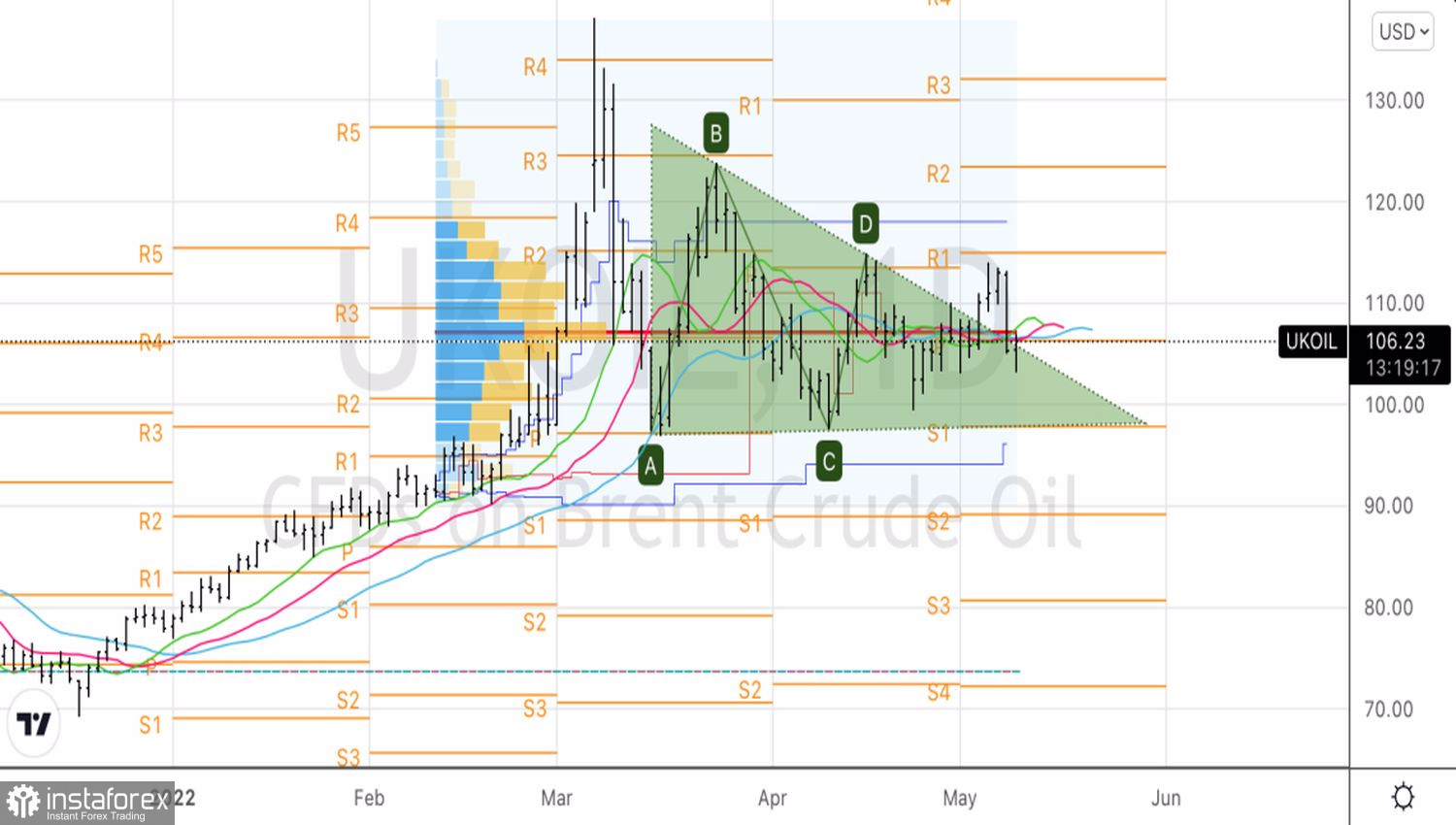

Technically, the triangle and the associated Brent buying strategy from $108.5 followed by profit-taking when the target was reached at $113.4 played out with a bang. We have skimmed the cream off the market and now, continuing to believe in consolidation, we are getting ready to buy the North Sea variety on a decline in quotes, followed by a rebound from supports at $100.6 and $98 per barrel.

Brent, Daily chart