While US stocks are on their worst trading day since 2020 and the S&P 500 falls below 4000 for the first time since March 2021, EURUSD remains remarkably resilient. Usually, the debacle in the US stock market is perceived as a deterioration in global risk appetite and leads to a weakening of the euro. Moreover, China's foreign trade shows the worst dynamics in three years. This time everything is different, which, in my opinion, is due to the conjuncture of the commodity market.

If in the late 1970s, the US dollar, against the backdrop of high inflation, sank by 40% against the German mark, now the euro, the heir to that very currency, is heading towards parity. The status of the participating countries plays an important role in this process. Four decades ago, the United States was a net importer of oil, and rising prices for it had a detrimental effect on the US economy. Everything has now been turned upside down. Americans are net exporters of energy goods, and their old place was taken by the eurozone and Japan. The trade balance of these regions is rapidly deteriorating, which causes EURUSD to sag by 7%, and USDJPY to soar to a 20-year high.

In this regard, the 6% drop in Brent at the beginning of the week by May 13 compensates for the factor of American stocks flying into the abyss for the euro. In fact, Europe is saving itself by delaying the process of adopting the 6th package of anti-Russian sanctions. More precisely, making them smaller than originally intended. Another thing is that the North Sea variety cannot fall indefinitely, because no matter how the epidemiological shutdown develops in China, supply problems will not disappear anywhere. This circumstance allows us to speak about the limited potential for EURUSD correction. If it happens, of course.

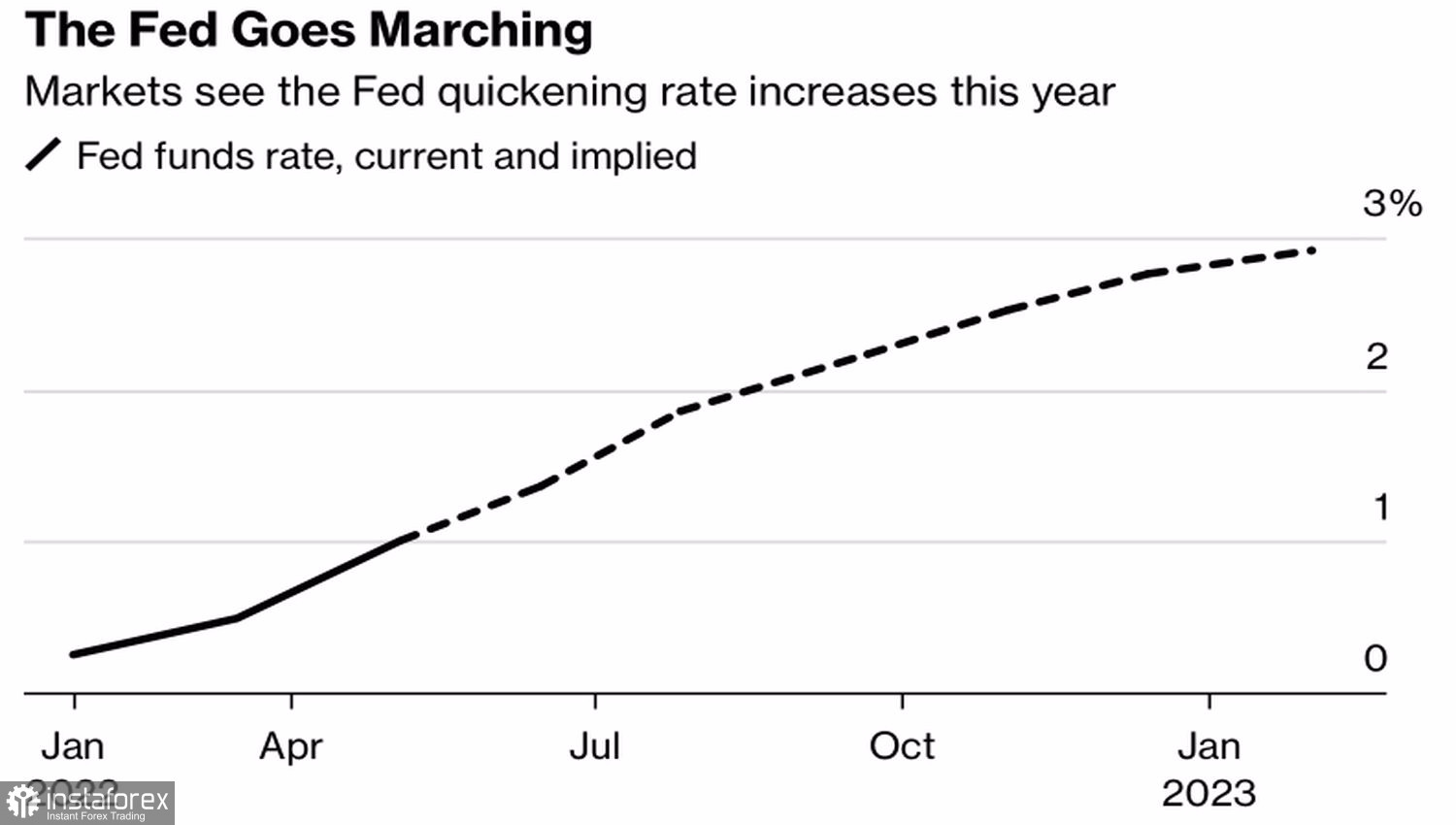

The rhetoric of FOMC officials seems too aggressive for competing currencies to resist the US dollar for a long time. Even such a "dove" as the president of the Federal Reserve Bank of Minneapolis, Neel Kashkari, argues that the federal funds rate should be raised above the neutral level.

Fed Rate Expectations

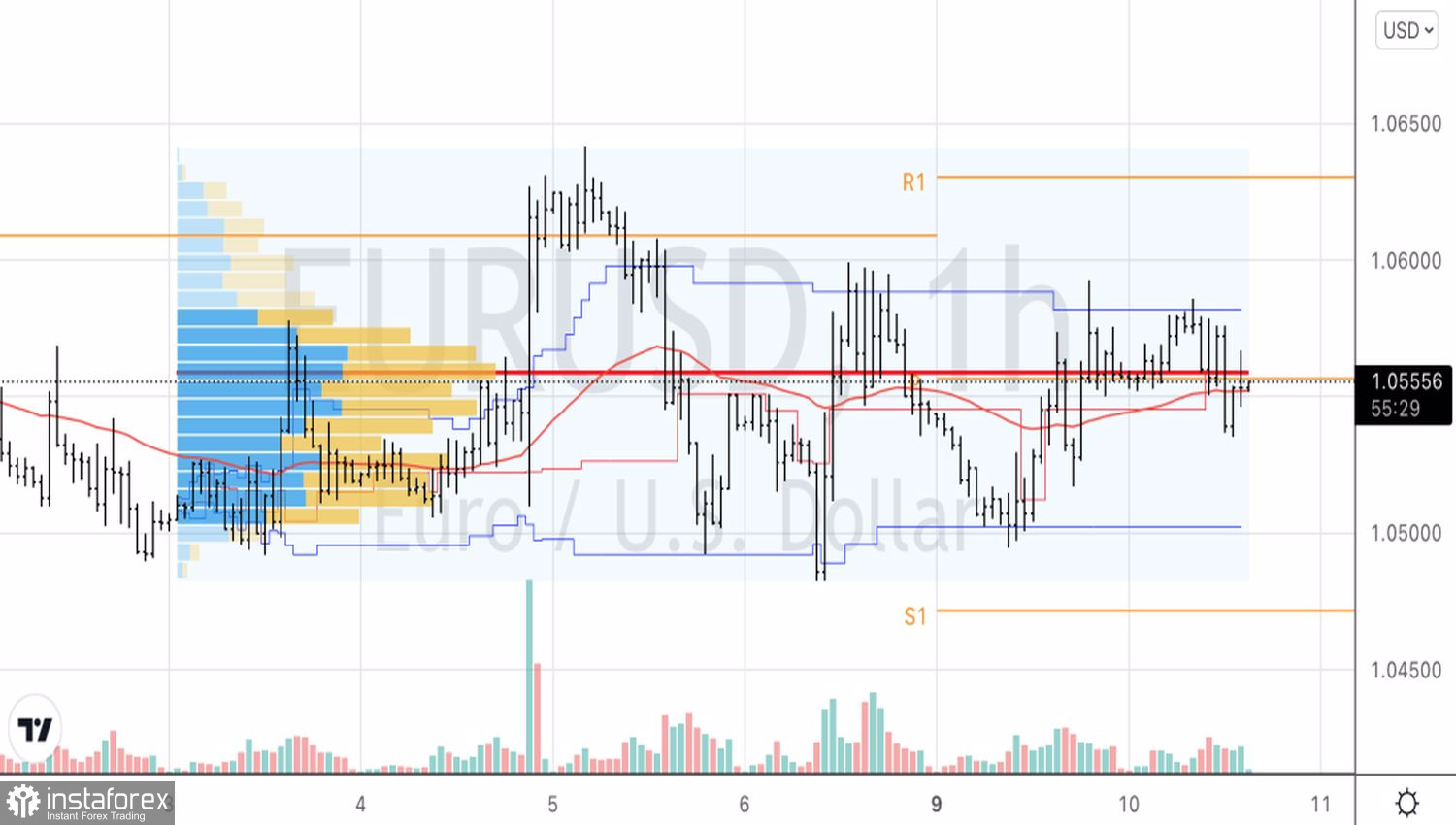

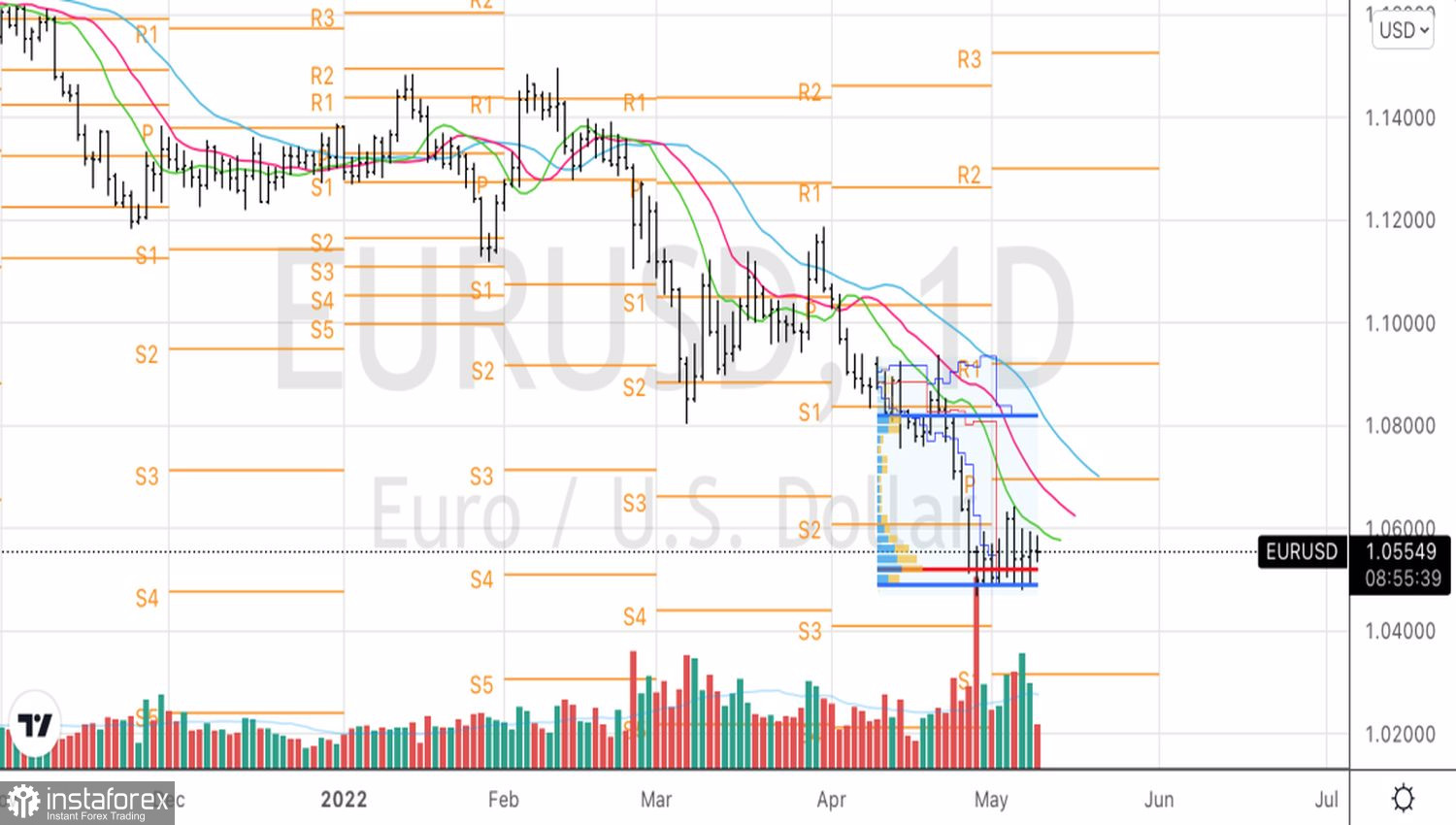

The current consolidation of EURUSD in the range of 1.049–1.061, in my opinion, may be related to the expectations of the release of US inflation data for April. Starting from this month last year, consumer prices jumped strongly, and due to the high base, they will slow down in 2022. The question is, how serious will it be? If, within slight deviations from the 8.1% predicted by Bloomberg experts, the dollar will have the opportunity to continue the rally. If the inflation rate falls significantly lower, the chances of an aggressive monetary restriction will decrease, and the euro will be able to go beyond the upper boundary of the trading channel.

Technically, there were no changes on the daily or hourly charts of EURUSD compared to the previous trading day. The main currency pair is bored in the 1.049–1.061 consolidation range, and even the renewal of local highs near 1.058 does not inspire the bulls to feats. The recommendation is to exit the market.

EURUSD, Daily chart

EURUSD, Hourly chart