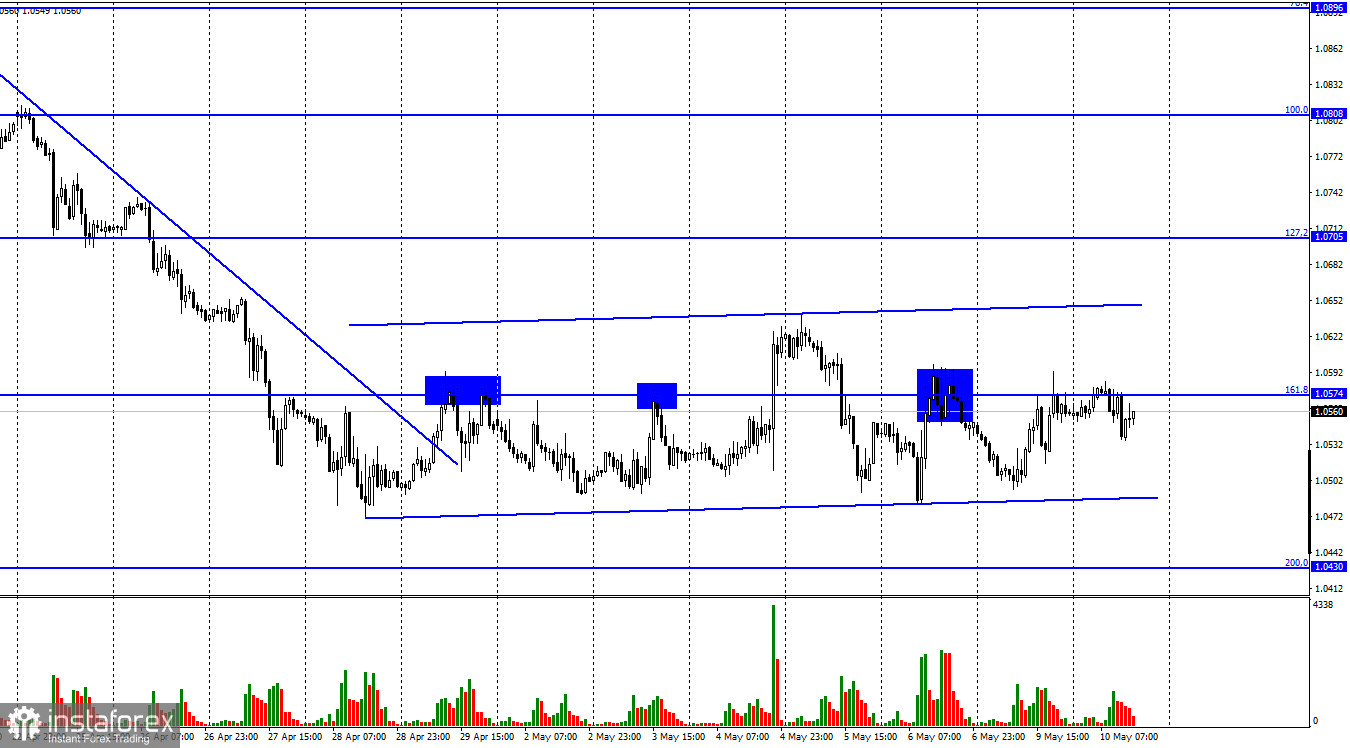

The EUR/USD pair on Monday performed an increase to the corrective level of 161.8% (1.0574). And on Tuesday, the pair's quotes are near this level and are not able to show a strong movement. For more than a week, the pair has been trading inside a sideways trend corridor, which is only slightly upward. But I consider it as an aside. One could conclude that the mood of traders is "neutral" now, but the European currency has been falling for a long time in a pair with the American currency, so it is impossible to draw such a conclusion. Most likely, now we are talking about a respite in the foreign exchange market to gather strength and decide what to do next with the euro/dollar. Let me remind you that last week the Fed raised the rate by 0.50%. In June and July, the regulator is going to raise the rate twice more by 0.50%. It would seem that such an information background should lead to new purchases of the dollar. But at the current levels, bear traders are no longer so active. After all, the pair have already fallen very much and is near its long-term low.

Thus, the main weapon of traders now is graphical analysis. As long as the pair is inside the designated corridor, it is impossible to count on either strong growth or a strong fall. That is, first you need to wait until the pair leaves the corridor, and only after that analyze which border it left the corridor and what prospects there are. An important inflation report will be released in America tomorrow and, according to expectations, this indicator may begin to slow down for the first time in a long time. Traders may react quite violently to the first slowdown in the last year and a half, which may help the pair to leave the corridor. I believe that there are prospects for a new fall and they are quite good. This is because bull traders do not show any initiative at this time and even at very low price values are in no hurry to buy a pair. Thus, the initiative is still in the hands of the bears.

On the 4-hour chart, the pair performed a rebound from the corrective level of 100.0% (1.0638) and a reversal in favor of the US currency. Thus, the fall may now continue in the direction of the next corrective level of 127.2% (1.0173), as the downward trend corridor continues to characterize the current mood of traders as "bearish". Fixing the pair's rate above the level of 1.0638 will allow us to expect growth to the upper limit of the descending corridor.

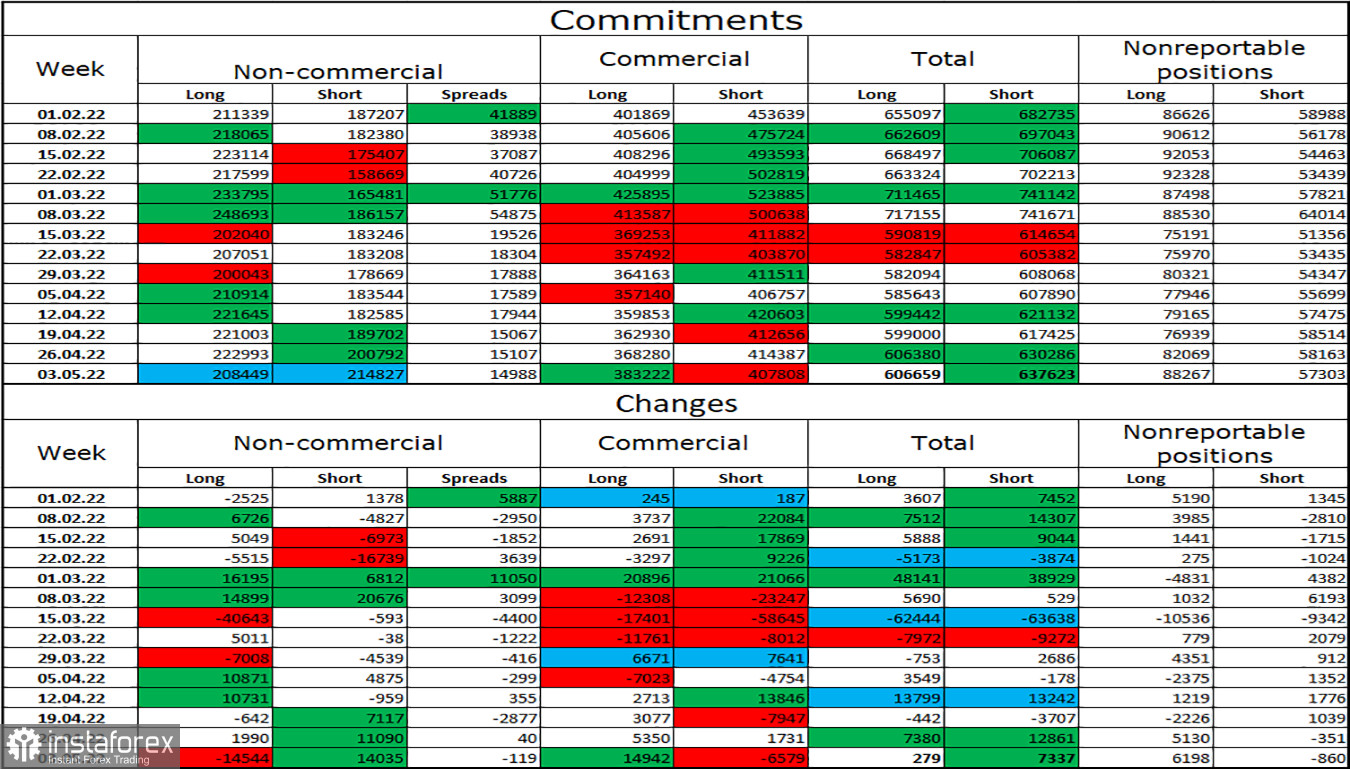

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 14,544 long contracts and opened 14,035 short contracts. This means that the bullish mood of the major players has significantly weakened, for the third week in a row. The total number of long contracts concentrated on their hands now amounts to 208 thousand, and short contracts - 214 thousand. For the first time in quite a long time, the mood of the "Non-commercial" category of traders is characterized as "bearish", and the European currency continues its decline in pair with the dollar. For several months in a row, the COT data indicated that the euro should grow, so now I can't say unequivocally that everything has fallen into place now. The continuation of hostilities in Ukraine, the deterioration of relations between Europe and the Russian Federation, new sanctions against Russia, and the weakness of the ECB's position has a very strong influence on the mood of traders.

News calendar for the USA and the European Union:

EU - an index of business sentiment from the ZEW Institute (09:00 UTC).

On May 10, the calendars of economic events in the European Union and the United States do not contain a single interesting entry. The information background today will not have any effect on the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair if there is a rebound from the 1.0574 level on the hourly chart with a target of 1.0430. However, bear traders are unlikely to be able to reach this level in the near future, given the side corridor on the hourly chart. With purchases, it is also better to wait until the sideways trend on the hourly chart is canceled.