When to go long on EUR/USD:

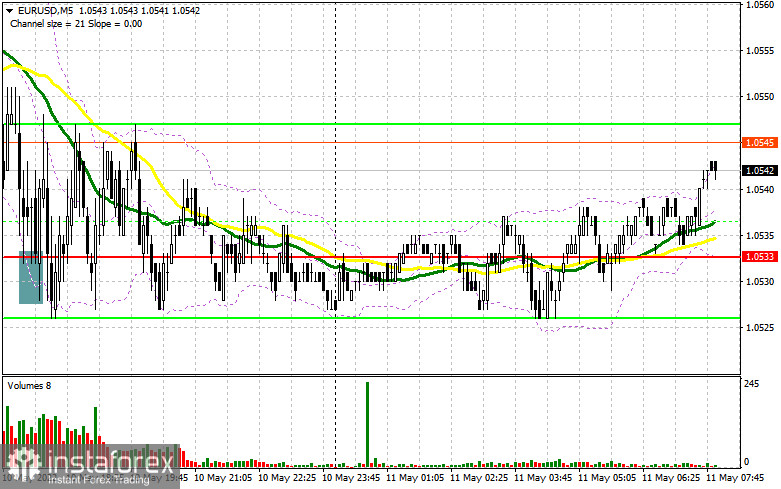

Yesterday only one signal was formed to enter the market during the US session. I suggest you take a look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the level of 1.0533 and advised you to make decisions on entering the market from it. The expected downward movement to the area of 1.0533 took place, but just a couple of points were missing before this range was updated. For this reason, no signals were formed from 1.0533. In the afternoon, we still saw a test of 1.0533 and a false breakout at this level. However, this did not lead to a sharp upward movement. I did not wait for other market entry points amid the low volatility.

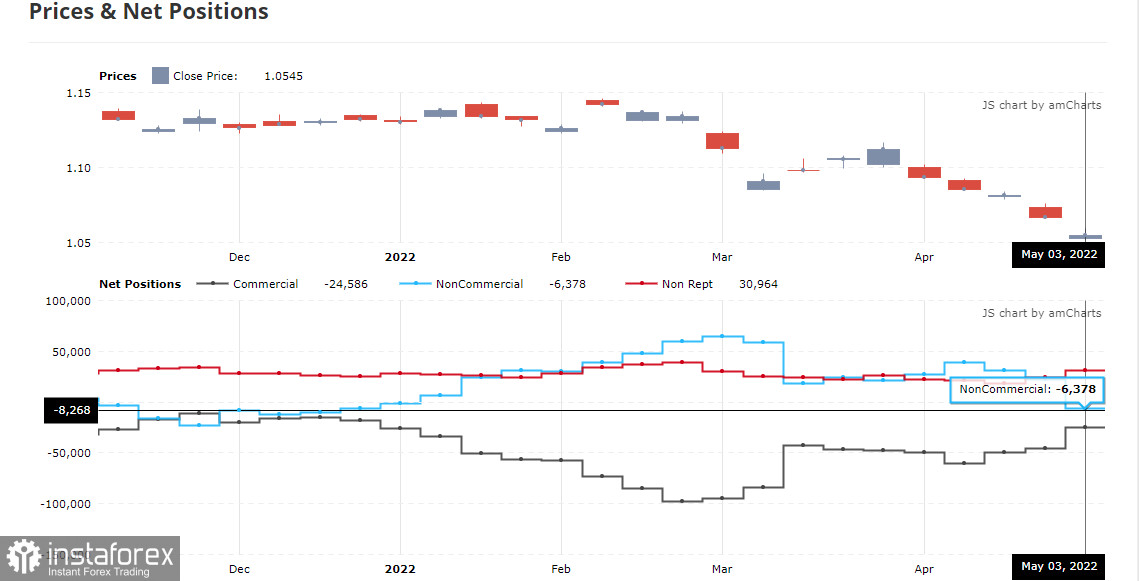

COT report:

Before talking about the further prospects for the EUR/USD movement, let's look at what happened in the futures market and how the Commitment of Traders positions have changed. The Commitment of Traders (COT) report for May 3 logged a sharp increase in short positions and a decline in long positions. Recent statements by representatives of central banks have led to a new active sale of risky assets, as it is obvious to everyone that serious problems in the economies of developed countries cannot be avoided this year. The sharp increase in US interest rates by 0.5% at once also forces investors to look at the US dollar as a safe haven asset. High inflation is a problem not only in the US, but throughout the world, and the active tightening of monetary policy by the US central bank makes the dollar a more attractive asset. The president of the European Central Bank also repeatedly noted in her speeches the need for more active changes in policy. It is expected that the bond purchase program will be completed by the end of the second quarter of this year, and the first rate increase will occur this fall. While the ECB is planning, the Federal Reserve is acting. Hence the dollar's appeal. Much will depend on US inflation and market reaction. In the event of a slight decrease this week, the pressure on the euro will ease, which will lead to the strengthening of risky assets and will provide an opportunity to build a slight upward correction in EUR/USD. The COT report shows that long non-commercial positions decreased from 221,003 to 208,449, while short non-commercial positions rose sharply from 189,702 to 214,827. Even against the backdrop of changes in the balance of power in favor of the bears, this asset remains quite attractive for medium-term investors. As a result of the week, the total non-commercial net position decreased and amounted to -6,378. The weekly closing price collapsed and amounted to 1.0545 against 1.0667.

As long as trading is carried out above the middle of the horizontal channel, there will be chances for the euro to recover. German inflation data and speeches from the ECB will be the key events this morning, which could help the euro get to the top of the horizontal channel. Much will depend on whether the bulls show themselves around 1.0571 or not. Only very strong data on the German CPI and statements from ECB President Christine Lagarde that it is necessary to act more aggressively will allow the bulls to attempt to return to the control of the 1.0571 resistance. But this will be quite difficult to do.

In addition to a large number of bears being concentrated there, moving averages are slightly lower, playing on the bears' side. Only a breakthrough and reverse test from top to bottom of this level will lead to the first signal to buy the euro with the goal of returning to the large resistance at 1.0638, which really limits the pair's potential to rise. Going beyond 1.0638 will hit the bears' stop-orders, making it possible to build a stronger correction towards the highs: 1.0691 and 1.0736. However, such an increase will be possible only in the case of aggressive statements from Lagarde, who lately more and more often hints at an increase in interest rates in the eurozone this autumn. In case the pair falls, the bulls' main task is to protect the middle of the horizontal channel at 1.0519, with which the bulls did an excellent job yesterday. A second fall to this level can occur at any moment, as traders are now clearly not optimistic about everything that is happening in the world. The reaction to inflation in Germany can be anything. Therefore, only a false breakout at 1.0519 will give the first signal to enter the market to buy the euro. If the pair falls and there are no bulls at 1.0519, it is best to postpone long positions. The optimal scenario for opening long positions would be a false breakout of the low around 1.0473, but you can buy EUR/USD immediately for a rebound only from 1.0426, or even lower - around 1.0394, counting on an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

Bears coped with all the tasks yesterday, but failed to achieve a real advantage in their favor. The fact that we are at the lows of the year clearly keeps the pair down. However, do not rush to sell the euro for a breakthrough, as you can easily get into a market reversal and correction after the release of US inflation data, which we will talk about in the forecast for the second half of the day. As long as the trading will be conducted below 1.0571, the probability of the euro falling will be quite high, but if the bears lose this level, everything will turn upside down.

Forming a false breakout at 1.0571 after the inflation data in Germany and the release of forecasts from the European Commission can create a sell signal with a subsequent decline to the support area of 1.0519, on which quite a lot depends. This level was repeatedly tested yesterday, and, as we can see, people were not especially willing to buy the euro. Returning to this range could seriously hurt the bulls' plans, forcing them to move lower. A breakthrough and reverse test of 1.0519 will provide a signal to open short positions with the prospect of a decline to a low like 1.0473. A more distant target will be the area of 1.0426, I recommend taking profits. If the euro rises and there are no bears at 1.0571, the bulls will try to build up long positions in anticipation of an upward correction in the pair. Much of today will depend on the European Central Bank President Christine Lagarde's statements, which can help the euro in the current environment. The optimal scenario would be short positions during a false breakout in the area of 1.0638. You can sell EUR/USD immediately on a rebound from 1.0691, or even higher - in the area of 1.0736, counting on a downward correction of 25-30 points.

Indicator signals:

Trading is below 30 and 50 moving averages, which indicates a further decline in the pair on the trend.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.0519 will lead to a fall in the euro. Surpassing the upper border of the indicator in the area of 1.0550 can push the euro to rise.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.