The cryptocurrency market continues to fall and give investors unprecedented discounts. Over the past day, the capitalization of digital assets has decreased by 4.5%, and there is every reason to believe that this is not the limit. On the daily timeframe, the total capitalization of the crypto market still has room before falling to the $1.2 trillion area. Therefore, it is likely that in the coming days we should expect a continuation of the downward rally with the renewal of the local bottom.

The main culprit behind the market fall was Bitcoin, which finally took root in the minds of investors as a high-risk tool. This is best seen by the percentage of the fall of the cryptocurrency market and Bitcoin. Both markets fell by about 55%, which once again confirms the huge dependence of the altcoin market on Bitcoin. However, the current fall has shown a few more sad, but confirmed facts.

The first is that Bitcoin is not suitable for the role of a risk hedging instrument, because due to the cyclical nature of the markets during drawdowns, capital is "eaten up" much more than any inflation. However, many crypto enthusiasts remained hopeful of Bitcoin strengthening as a backup. Indeed, in early to mid-March, many institutional funds started talking about Bitcoin as a safe and profitable means of storing capital. First of all, such an assessment was associated with the freezing of dollar assets of the Russian Federation. Large investors were alarmed by the possibility of losing most of their savings.

But after the start of the USD strengthening policy from the Fed and the birth of the second stage of the bear market, interest in Bitcoin as a reserve asset faded into the background. However, the situation with the algorithmic stablecoin UST forced a return to talk about the expediency of BTC as a backup. And apparently, the answer was unequivocal. Due to a severe drawdown of the main cryptocurrency and a massive sell-off, the UST collateral fell seriously and the asset began to lose its peg to the US dollar. Subsequently, LFG got rid of Bitcoin and recorded losses to stabilize the price with the stability of the USD. This is a direct confirmation of the failure of the idea of using BTC as a reserve.

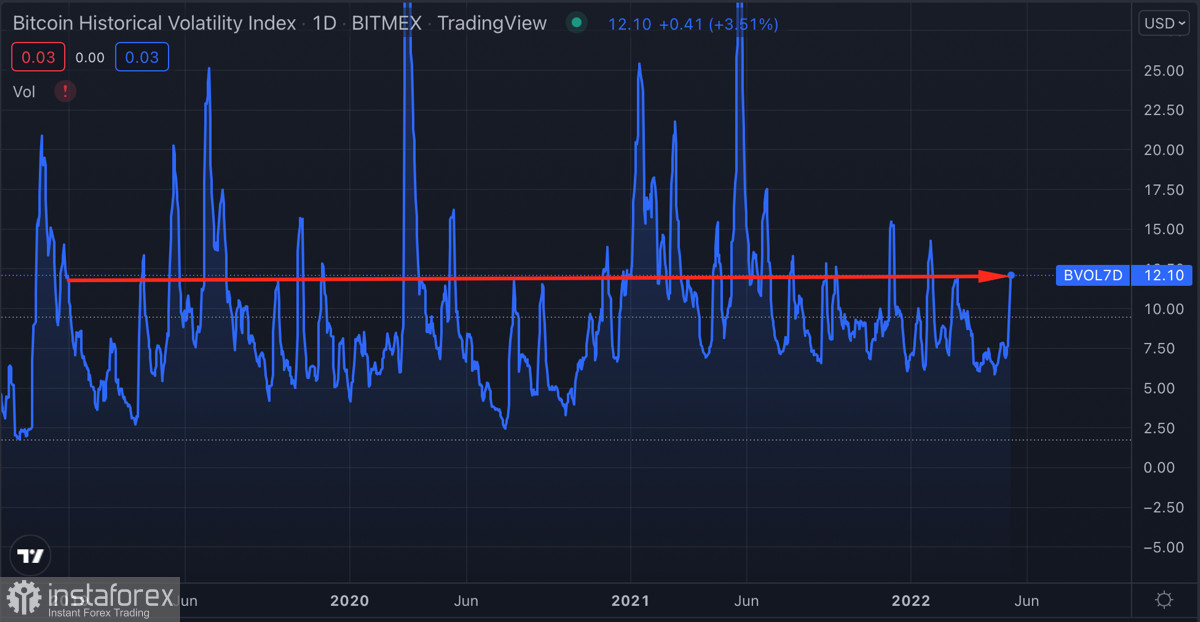

The main problem of the asset, as before, is the issue of volatility. On the one hand, it brings big profits in a bull market, but on the other hand, it collapses massively and rapidly during a downward rally. It is likely that investors will react to this by completely ignoring the cryptocurrency as a reserve until the onset of a long period of consolidation with the further development of a bull market.

Hard times have come for Bitcoin, as the asset is perceived solely as a high-risk instrument. And this means that BTC quotes will fall commensurate with stock indices. At the same time, a massive sell-off has significantly increased the level of volatility, and therefore falls can be especially painful.

As of May 11, the asset is at $30.8k, trying to stabilize. Technical indicators do not show the prerequisites for a reversal, and the number of coins on the exchanges continues to grow, putting additional pressure on the price. Expect BTC/USD to drop below $30k, where mastodons like MicroStrategy will step in to protect their asses from rising creditor resentment.