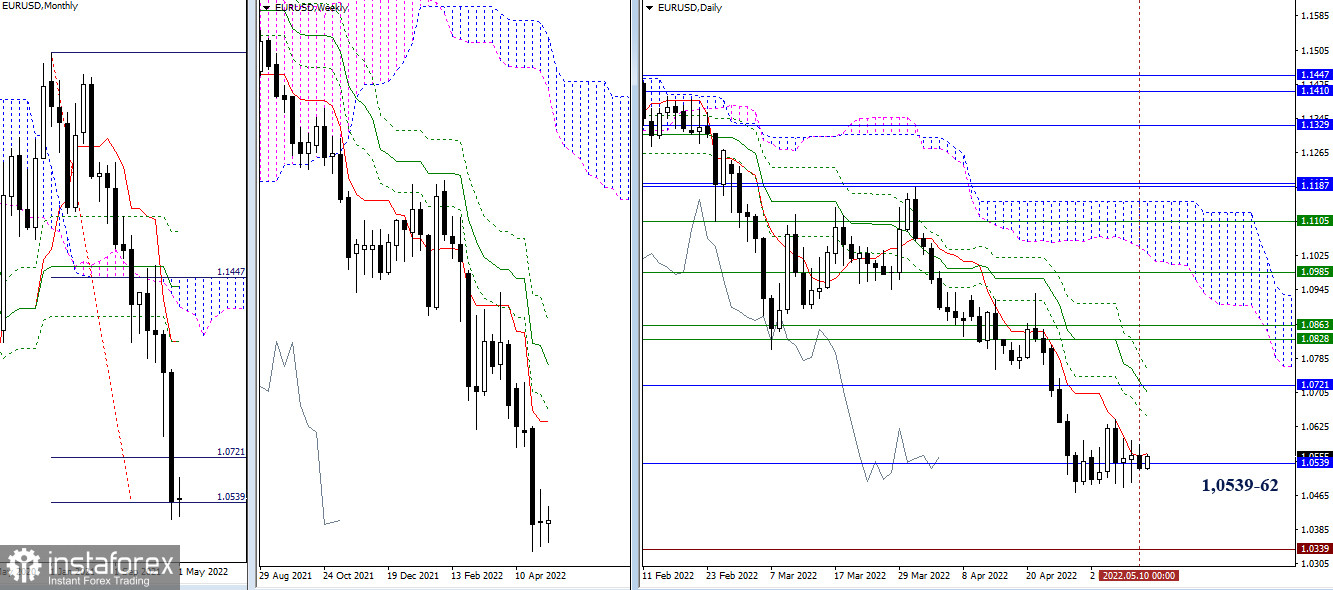

EUR/USD

Higher timeframes

In recent days, the pair has been consolidating in the area of the fulfillment of the monthly Ichimoku target (1.0539), the daily short-term trend (1.0562) has also descended here. As a result, these two levels, by their influence and attraction, restrain the development of the situation. When leaving the zone of uncertainty and the emergence of a dominant directional movement, attention will again be focused on landmarks. For bears, the nearest benchmark is the minimum extremum of 2017 (1.0339). For bulls, the primary tasks are to eliminate the daily Ichimoku death cross (1.0650 – 1.0705 – 1.0760 ).

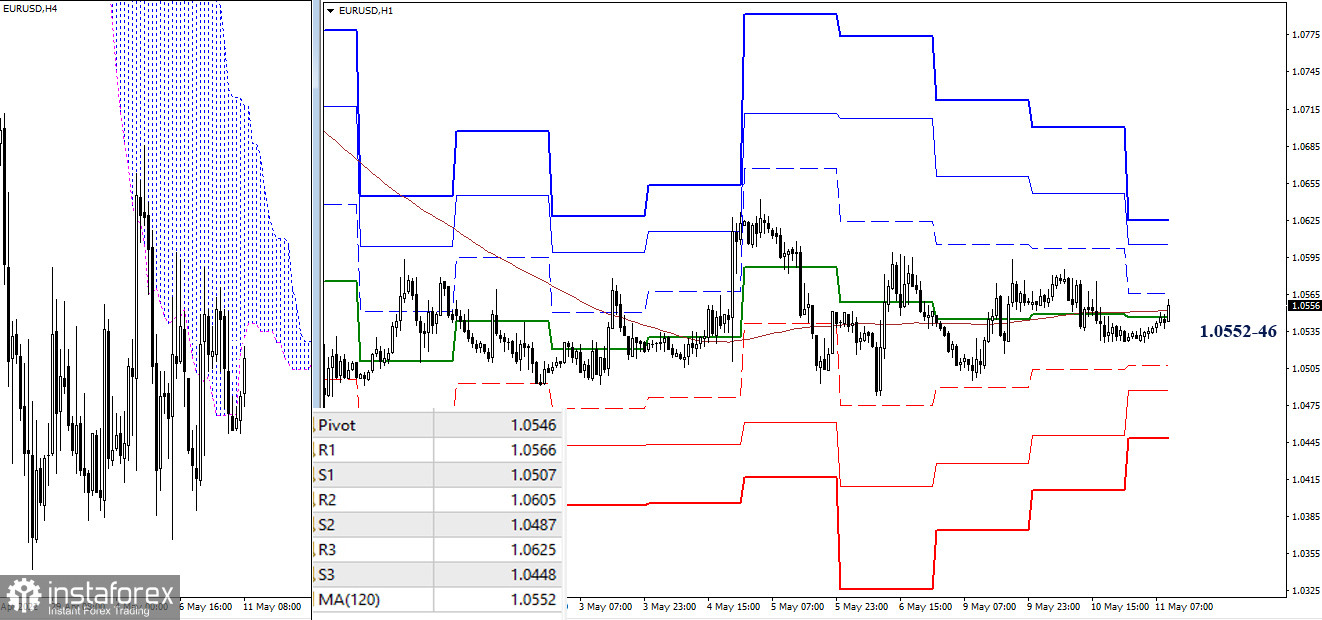

H4 - H1

The uncertainty of the higher timeframes is well read on the charts of the lower timeframes. The pair works around key levels without moving away from them for long distances. At the same time, the key levels are in a horizontal arrangement, without giving a clear advantage to either side. Today they are joining forces in the area of 1.0552–46 (weekly long-term trend + central pivot point of the day).

Despite the absence of a clear preponderance of forces, the side that owns the key levels always has some increase in opportunities. Therefore, the location above 1.0552–46 will now contribute to the development of bullish sentiment, their benchmarks within the day today can be noted at 1.0566 – 1.0605 – 1.0625. Consolidation below key levels will lead to increased opportunities for continued decline, the bears' benchmarks inside the day are now at 1.0507 – 1.0487 – 1.0448.

***

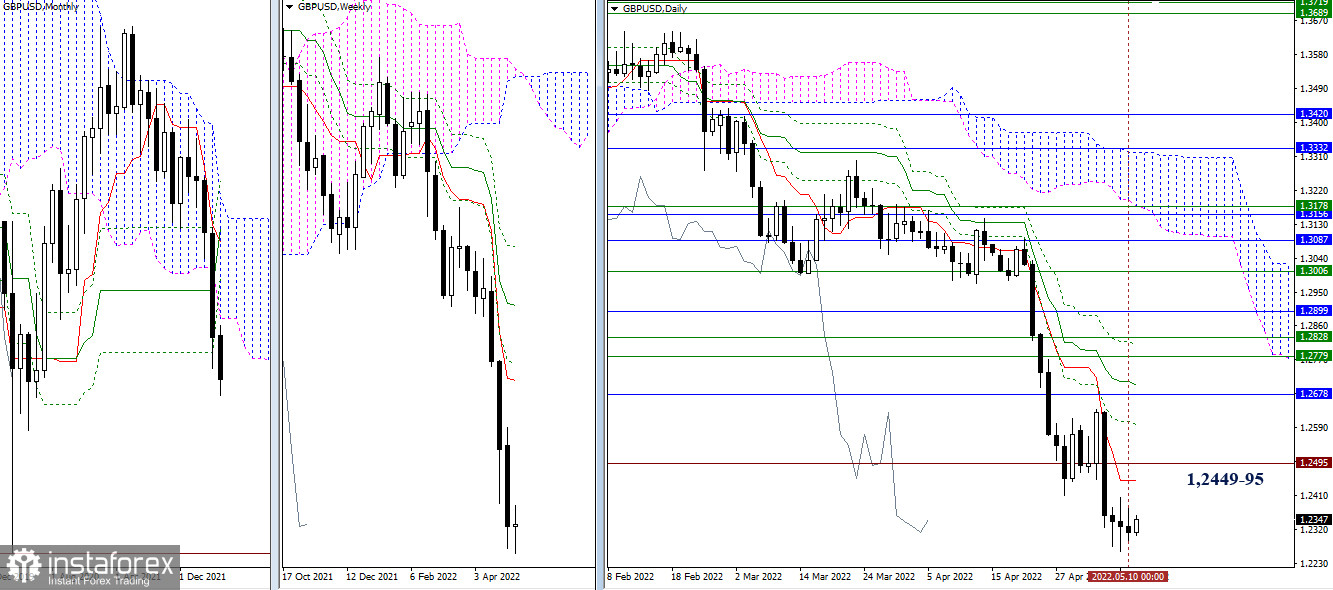

GBP/USD

Higher timeframes

Last week's minimum extremum has been updated, but the effectiveness of the decline is very insignificant. We are seeing a slowdown. The benchmarks of the bears remain the same, they were noted earlier at the boundaries of the 2020 minimum (1.1411) and psychological levels (1.2000 – 1.1500). For bulls, in the current conditions, the nearest resistance area is the combination of levels in the area of 1.2449–95 (daily short-term trend + historical weekly level).

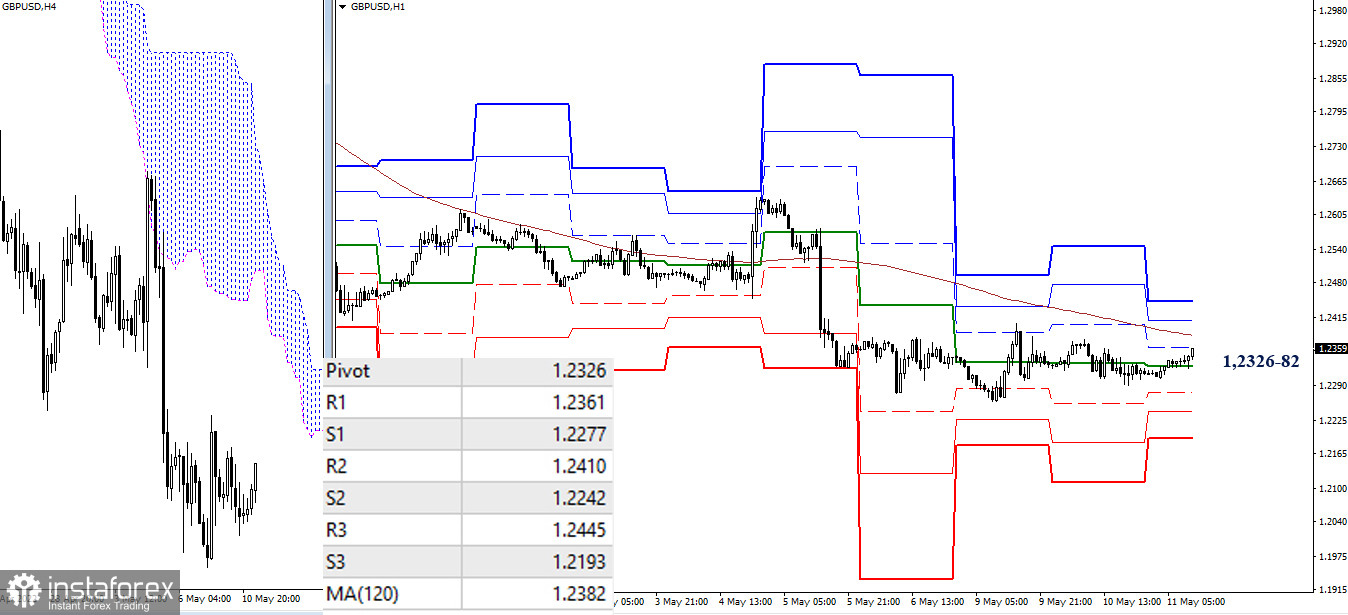

H4 - H1

In the lower timeframes, the pair has been in the correction zone for a long time. After overcoming the resistance of the central pivot point of the day (1.2326), the next benchmark for the bulls is the weekly long-term trend (1.2382). In addition to the key levels, other classic pivot points are also benchmarks for movement within the day. Today their support can be noted at 1.2277 – 1.2242 – 1.2193, and resistances are at 1.2361 – 1.2410 – 1.2445.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)