When gold jumped 10% during the stock market crash of 1987 and after the September 11 attacks in 2001, no one was surprised. At that time, the precious metal was perceived as a safe haven asset, the demand for which increased in the event of major bad events. The times have changed. The main beneficiary of the COVID-19 outbreak in China, the armed conflict in Ukraine, and fears of a recession in the US economy due to the Fed's aggressive monetary restriction is the US dollar. Gold is in its shadow and falls when stocks fall.

The Nasdaq Composite's move into the bear market territory, which suggests a drop of 20% or more from recent highs, and the S&P 500's willingness to do the same, is bad news for XAUUSD bulls. To maintain losing positions in stocks, which requires additional liquidity, investors are dumping other assets, including the precious metal. This was the case at the peak of the recession in 2020, and this is happening now.

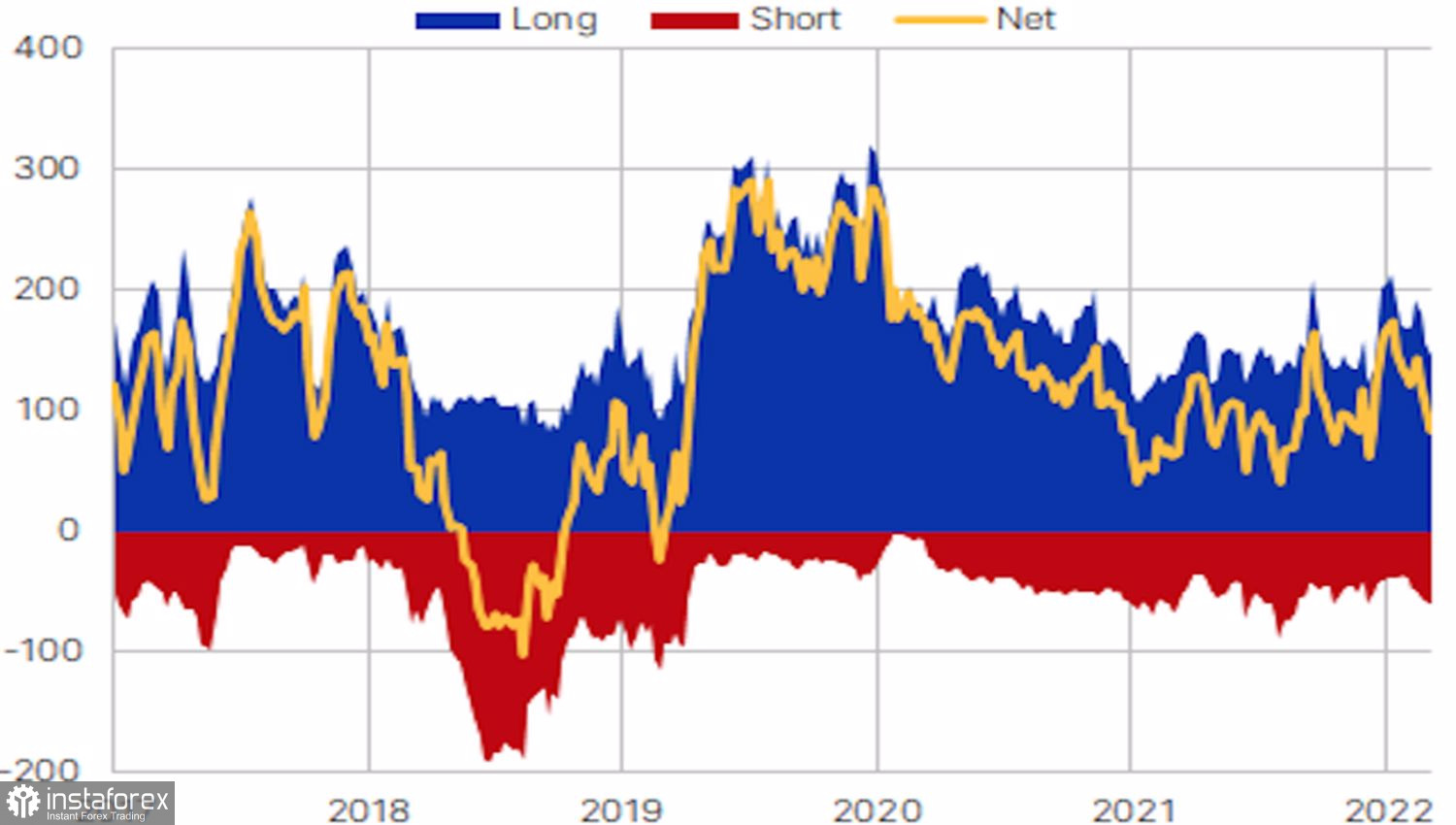

Everyone is getting rid of gold: equity holders, hedge funds, which reduced their bullish positions in the week to May 3, and even ETF holders. Specialized ETF holdings rose 43 tonnes in April to 3,869 tonnes, equivalent to $238 billion, according to the Worl Gold Council (WGC). Capital inflows were 77% higher in March, increasing for the fourth month in a row, but risk reversing in May. Gold is dropping too fast.

Dynamics of speculative positions in gold

Theoretically, fears about a global economic slowdown and the threat of a global recession could support the XAUUSD bulls. The armed conflict in Ukraine and the associated energy crisis are putting pressure on Europe, the COVID-19 epidemic on China, and the Fed's aggressive monetary restriction on the United States. Alas, it is the American dollar that benefits from all this.

The USD index rally is sad news for the precious metal. The outpacing dynamics of the nominal yield of US Treasury bonds over inflationary expectations also put spokes in the wheels of the latter. As a result, real debt rates go up, the negative value of which has served XAUUSD buyers faithfully for many years.

Investors are looking forward to the release of US inflation data for April. Its significant slowdown from 8.5% in March could mean a less aggressive tightening of the Fed's monetary policy, which will help not only stocks, but also gold. On the contrary, a fact close to the forecast of 8.1% will return interest in the US dollar, allow the yield of Treasury bonds to continue to rally, and provoke a new wave of XAUUSD sales.

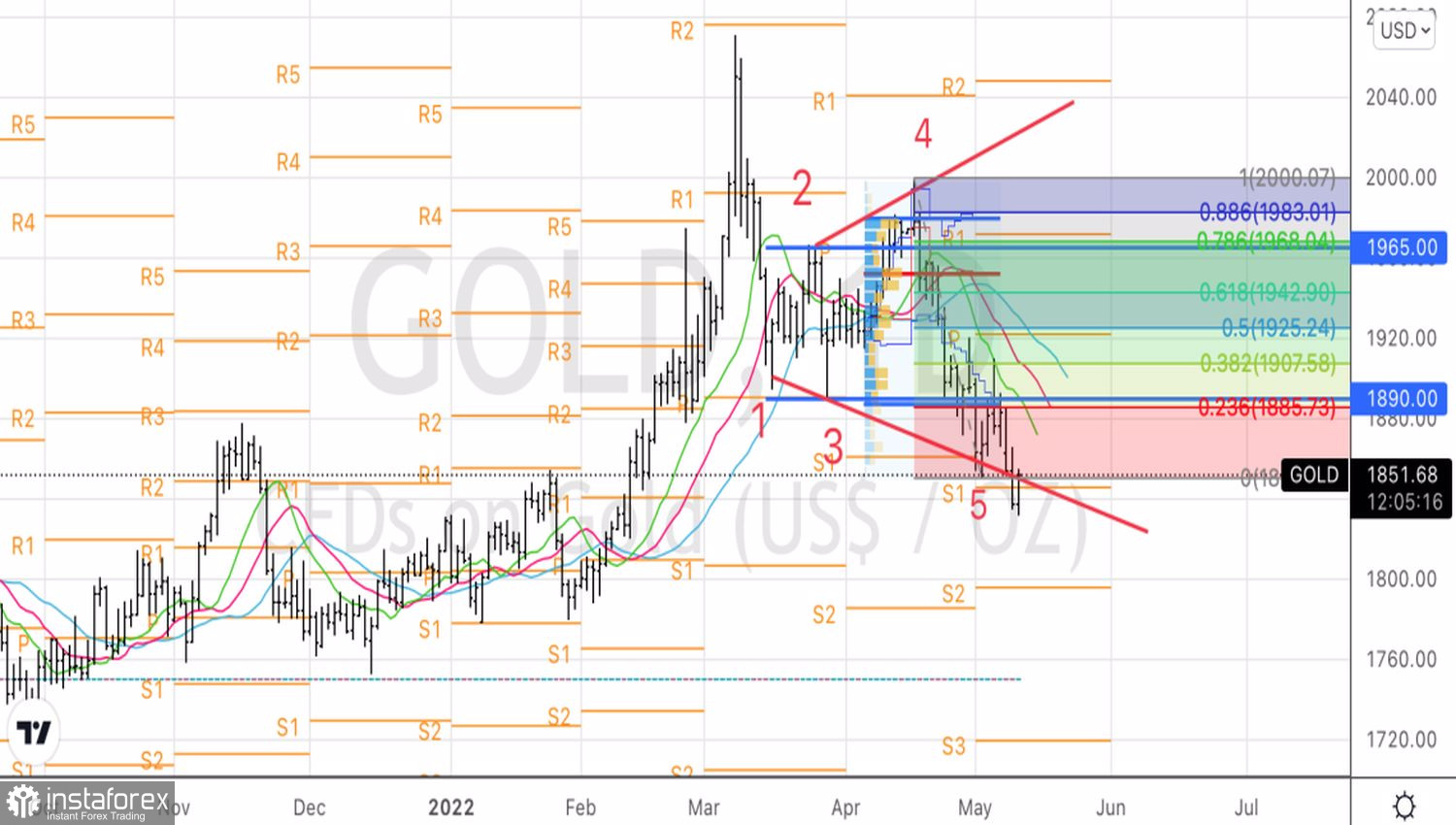

In technical terms, after a clear development of the Broadening wedge pattern, gold quotes are confidently heading towards the targets indicated in the previous material at $1805 and $1795 per ounce. To achieve them, prices need to fall below the supports at $1850 and $1830. At the same time, this may become a reason for building up previously formed short positions. As an alternative, there are sales of the precious metal on pullbacks.Gold, Daily chart