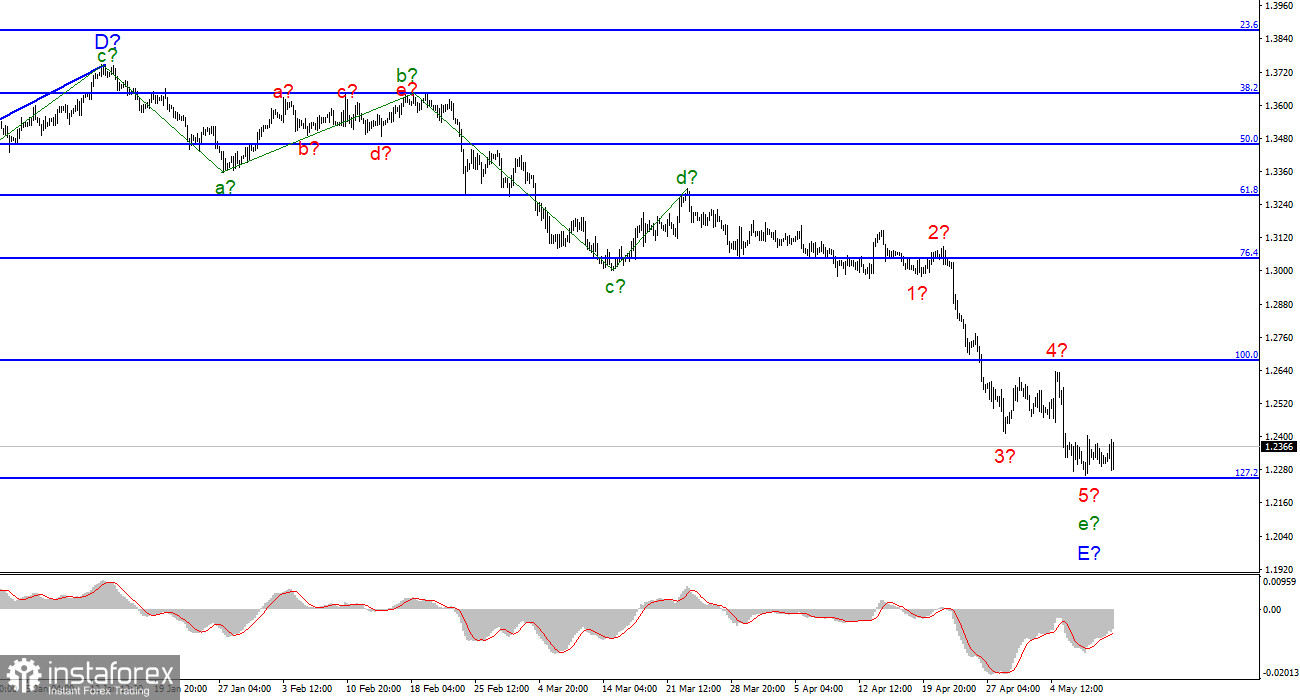

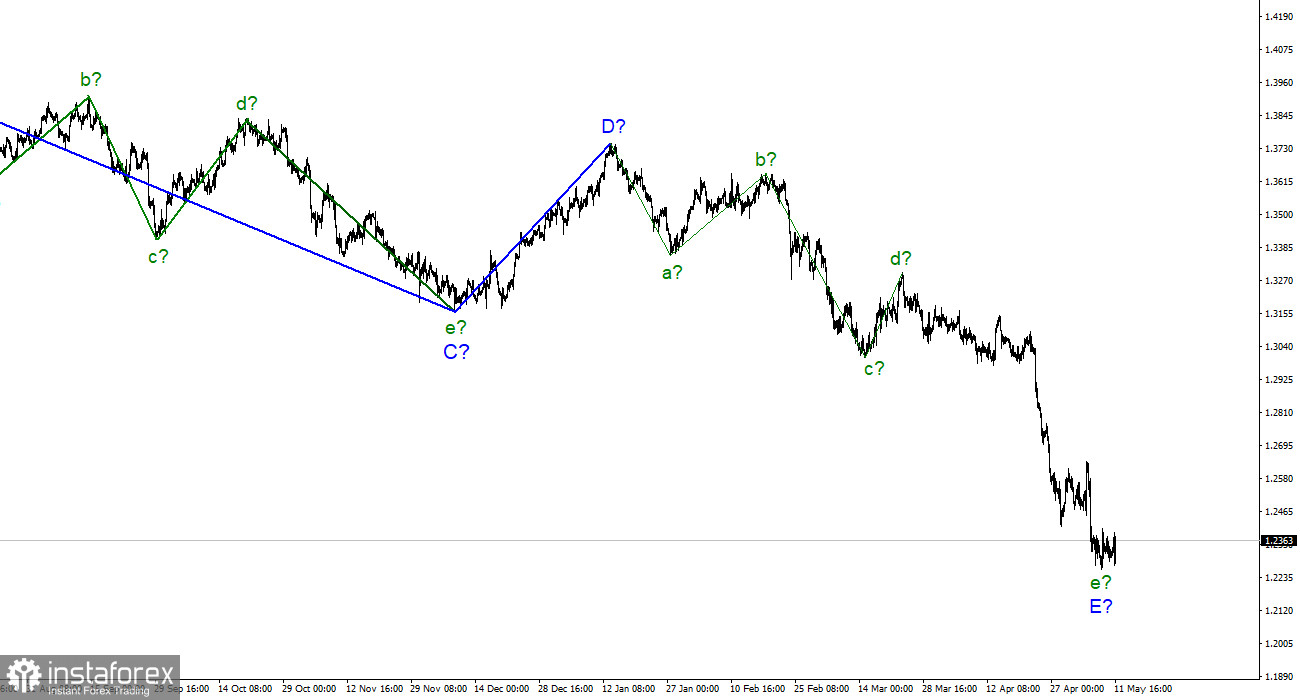

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require adjustments. The downward section of the trend continues its construction within the framework of the wave e-E, and its internal wave marking looks quite complicated. Nevertheless, I have identified five waves inside this wave and, if my markup is correct, then wave 5, the last internal wave, is being built at this time. Thus, we get almost identical wave markings for the British and the European, each of which indicates the possible imminent completion of the downward trend section. Or everyone will have to take a much more complex and extended view, which can be facilitated by a weak news background or a complex geopolitical one. The wave5-e-E may already be completed, and an unsuccessful attempt to break through the 1.2245 mark, which corresponds to 127.2% Fibonacci, indirectly indicates this. If the current wave marking does not become more complicated, then the decline in the British dollar may be completed during the current week.

Inflation has passed by, and GDP remains.

The exchange rate of the pound/dollar instrument increased by 70 basis points on May 11, although it decreased by 40 during the day (from the opening levels of the day). Nevertheless, even such a good growth so far does not mean anything at all for the instrument. It is still near its annual low. Since the current wave marking of the downward trend section can be considered completed, now the demand for the British should begin to increase. Otherwise, the construction of an upward trend simply will not begin. And this seems to be the main problem of the pound at the moment. Demand should grow based on some factors or events. If there are none, then demand will grow very sluggishly, which is what we are seeing now. If the British dollar has been declining in recent months against a certain news background and this news background has not changed over the past few days, then how can we expect the British dollar to increase? However, I believe that before a successful attempt to break through the 1.2245 mark, we can assume that the downtrend has completed its construction.

Tomorrow morning, the pound can get the push it needs so much. In the morning, reports on industrial production, GDP, visible trade balance, and others will be released in the UK. By far, the most important one can be considered the GDP report. Therefore, we should expect values higher than market expectations, which are 1.0% q/q. Unfortunately, it is far from a fact that the British economy grew by more than 1% in the first quarter. We have already seen the GDP of the European Union and the United States over the same period. In America, the economy shrank by 1.4%, and in the European Union, it grew by 0.2%. Thus, it is not necessary to expect strong growth. Probably, even we will see a value below 1%, which means that the construction of the first wave of a new upward trend will be postponed again. Nothing interesting is planned in America tomorrow. On Friday, there will be no reports at all in either the US or Britain. Until the end of the week, the tool can move freely horizontally.

General conclusions.

The wave pattern of the pound/dollar instrument still assumes the completion of the construction of wave E. Now I also advise selling the instrument with targets located near the level of 1,1704, which corresponds to 161.8% Fibonacci, but only in case of a successful attempt to break through the level of 1,2246. From my point of view, the construction of a downward section of the trend is nearing its completion and the mark of 1.2246 looks very good for the trend to end right around it.

At the higher scale, the entire downward trend section looks fully equipped. Therefore, the continuation of the decline of the instrument below the 22nd figure is far from obvious. Wave E has taken a five-wave form and looks quite complete.