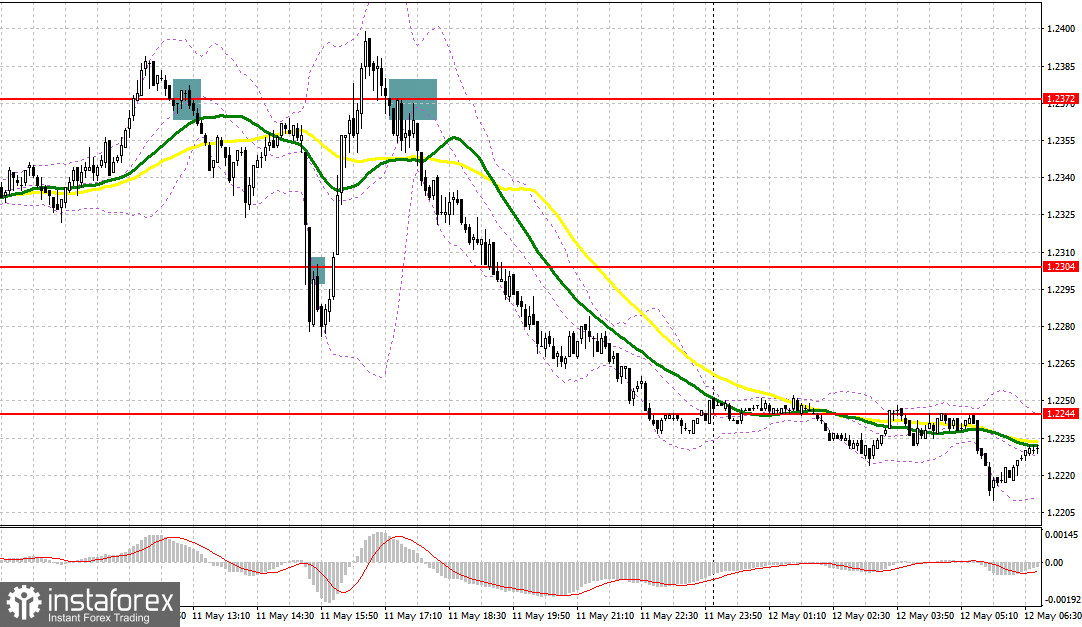

Yesterday, several profitable market entry signals were formed. Let's take a look at the 5-minute chart and see what happened. In my morning forecast, I paid attention to the level of 1.2372 and advised you to make a decision on entering the market from it. The lack of fundamental statistics helped the pound bulls as expected, however, it was not possible to settle above 1.2372. Forming a false breakout at this level in the first half of the day created an excellent sell signal, which resulted in the pair falling by 70 points. Closer to the US session, the bears tried to move below 1.2304 and it seemed that they succeeded. A reverse test from the bottom up of this range gave a signal for short positions, which led to consolidating losses. After the release of the US inflation report and the growth of the pound, a similar false breakout was formed at 1.2372, by analogy with the first signal, led to another entry point into shorts, followed by a sell-off by 130 points.

When to go long on GBP/USD:

For many, it is now obvious that the Federal Reserve will continue to increase the pace of tightening monetary policy. Yesterday's data on US inflation once again proved the existence of serious problems with this indicator. And despite the fact that the overall consumer price index has slowed its growth, core inflation, which the Fed is focusing on, continued to strengthen year on year. Today, the focus will shift to important economic indicators in the UK, which may push the pound to the next annual lows. For this reason, I do not advise you to rush into opening long positions against the largest bearish trend for the pair.

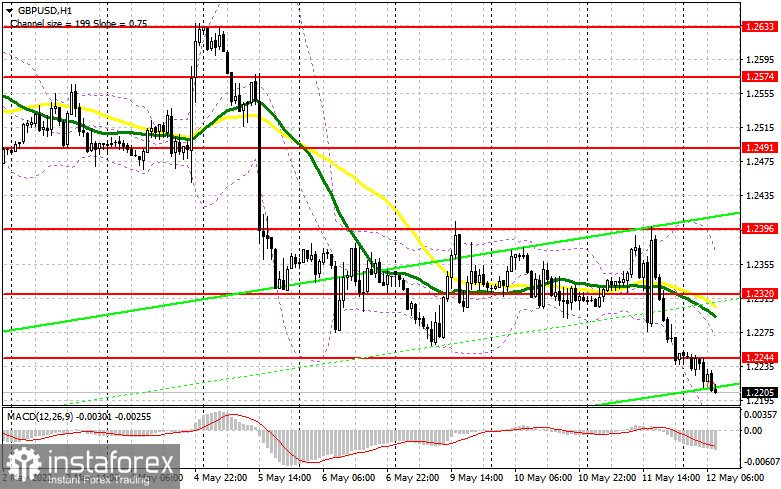

The bulls have a very important task, which is to keep the pair above the level of 1.2185, to which the pound is likely to fall after the UK GDP report for the first quarter of this year. The change in the volume of industrial production and the index of activity in the service sector in the UK will also play a rather important role, and in case of weak data, the pound will continue to fall. Forming a false breakout at 1.2185 can create the first entry point into long positions, counting on at least some correction in the pound in the short term. In this case, the target will be the nearest resistance at 1.2244. Surpassing this range depends entirely on removing a number of bearish stop orders and on data on economic growth rates. Bears not being active at 1.2244, as well as a test of this level from top to bottom, will provide an entry point into long positions with the goal of a sharper breakthrough to the area of 1.2320, where I recommend taking profits. If the pair goes down and there are no bulls at 1.2185, and such a scenario is more likely, given the Bank of England's wait-and-see position, I advise you not to rush into buying. It is possible to open long positions only in the area of 1.2122 and subject to forming a false breakout. I advise you to buy GBP/USD immediately on a rebound only in the area of 1.2074, or even lower - around 1.2030, based on an upward correction of 25-30 points within the day.

When to go short on EUR/USD:

The bears completely control the market and their main goal for today will be a breakthrough of the nearest support at 1.2185. There is no more divergence on the MACD indicator, so there are no reasons to keep the pair in the horizontal channel. Fundamental data will certainly disappoint the markets. A breakthrough and reverse test of 1.2185 from below creates a sell signal, which will quickly push the GBP/USD to the 1.2122 area, a new major support level. A breakthrough of this range also creates a sell signal with the prospect of reaching a low like 1.2074, where I recommend taking profits. The 1.2030 area will be a more distant target, but the opportunity to update it will appear only in case Fed representatives make very hawkish statements in the afternoon.

In case the GBP/USD grows, the bears will try to do everything to prevent the exit above the resistance of 1.2244. A breakthrough of this range will strengthen the upward correction and lead to dismantling a number of stop orders. Therefore, forming a false breakout there will be a signal to sell in order to continue the bear market. If traders are not active around 1.2244, I advise you to hold back from short positions until the next major resistance at 1.2320, just below which there are moving averages, playing on the bears' side. I also advise you to open short positions there only in case of a false breakout. You can sell GBP/USD immediately for a rebound from the high of 1.2396, counting on the pair's rebound down by 30-35 points within the day.

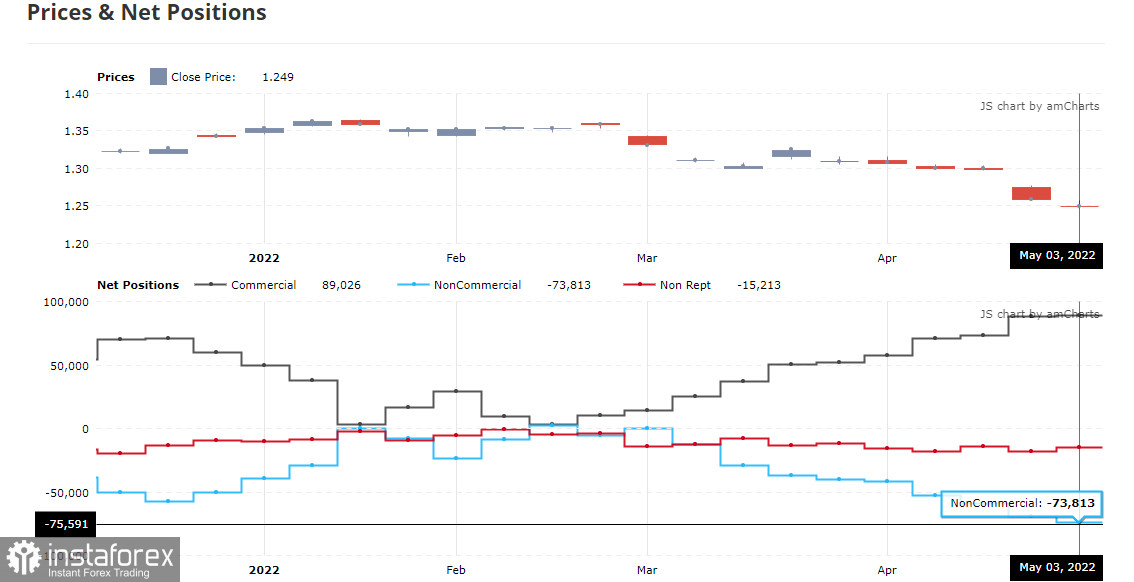

COT report:

The Commitment of Traders (COT) report for May 3 showed that both short and long positions decreased, but the former turned out to be much smaller, which led to another increase in the negative delta. The fact that the UK economy is doing very badly, and the situation with a sharp increase in the cost of living is not changing for the better, makes investors rather cautious about the pound and what lies ahead for it. The monetary policy of the Federal Reserve, aimed at tightening the cost of borrowing, will continue to support the US dollar, pulling the British pound lower and lower. The only thing we can count on now is a slight decrease in inflationary pressure in the US, which could lead to an upward correction. The Bank of England's recent actions to raise interest rates have not yet brought the desired result, as the policy remains very restrained in the face of high inflationary pressures observed in the UK. Taking into account that recently BoE Governor Andrew Bailey confirmed that the economy is moving towards recession, nothing good can be expected in the near future, just as one should not count on a strong growth from the pound. The situation will only get worse, as future inflationary risks are now quite difficult to assess also due to the difficult geopolitical situation, but it is clear that the consumer price index will continue to rise in the coming months. The situation in the UK labor market, where employers are forced to fight for each employee, offering ever higher wages, is also pushing inflation higher and higher. The COT report for May 3 indicated that long non-commercial positions decreased by 6,900 to 33,536, while short non-commercial positions decreased by only 2,708 to 107,349. This led to an increase in the negative value of the non-commercial net position from -69 621 to -73,813. The weekly closing price fell from 1.2587 to 1.2490.

Indicator signals:

Trading is below the 30 and 50-day moving averages, indicating a continuation of the bear market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator around 1.2370 will act as resistance. In case of a decline, the lower border of the indicator around 1.2170 will act as support.

Description of indicators:

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.