The GBP/USD pair is moving somehow sideways in the short term. The price action signaled exhausted buyers but it's premature to talk about a new leg down as long as the rate stands above the near-term support levels.

Fundamentally, the UK is to release the Net Lending to Individuals, Mortgage Approvals, and the M4 Money Supply. Still, only the US CB Consumer Confidence and the Chicago PMI could really shake the markets tomorrow. Better-than-expected US figures should lift the greenback. Also, the FOMC on Wednesday, BOE on Thursday, and the NFP on Friday could have a big impact.

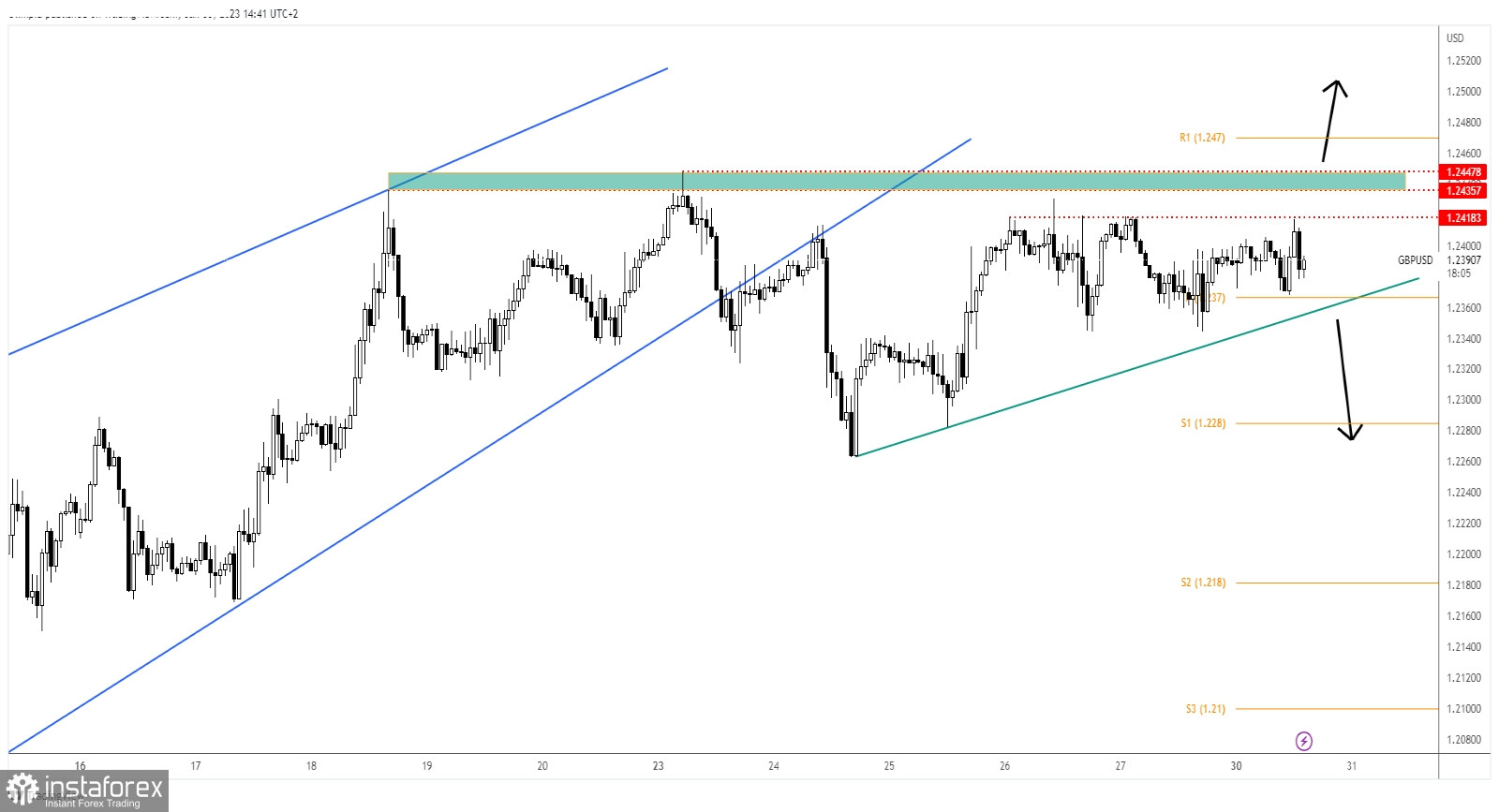

GBP/USD Uptrend Line As Key Support!

Technically, the GBP/USD pair tried to rebound after its last sell-off. Now, it has found resistance at 1.2418 and it moves somehow sideways. It has failed to come back to test and retest the 1.2435 - 1.2447 resistance zone.

The weekly pivot point of 1.2370 and the uptrend line represent downside obstacles. As long as it stays above these levels, it could resume its growth anytime.

GBP/USD Forecast!

A valid breakdown below the uptrend line and a new lower low activates a downside movement and brings new selling opportunities.

Only staying above the uptrend line and making a bullish closure above 1.2447 may announce an upside continuation.