Yesterday, the US Bureau of Labor Statistics (BLS) released the latest data on the consumer price index for April 2022. As expected, the report showed inflation staying at extremely high levels. According to the report, the consumer price index increased by 0.3% in April on a seasonally adjusted basis after rising by 1.2% in March. On an annual basis, the CPI fell from 8.5% to 8.3%.

According to forecasts, the CPI for April was supposed to decline from 8.5% to 8.1%. The fact that the actual reading confirmed persistent inflation while the forecast predicted a better result caused strong fluctuations in a group of assets.

Thus, US stock indices extended their decline, with the NASDAQ Composite Index falling by more than 3%:

Standard & Poor's 500 went down by 1.65%:

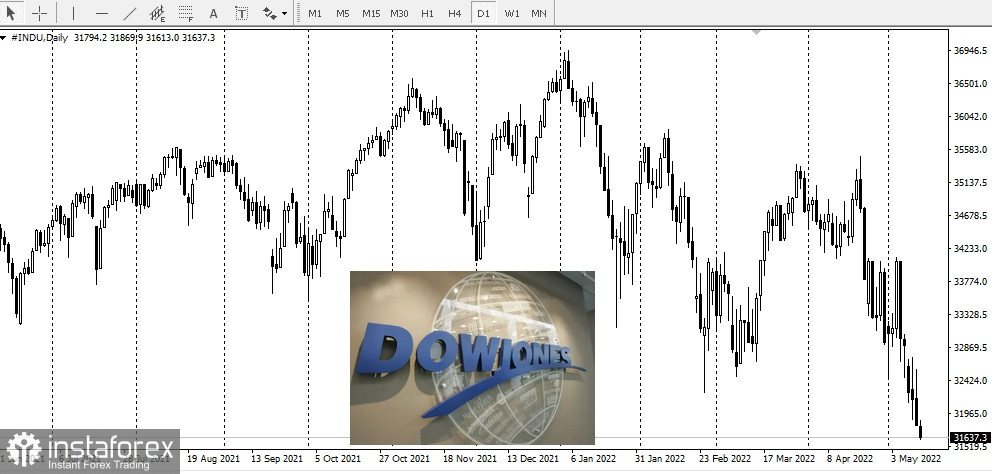

The Dow Jones Industrial Average lost 1.02%:

Yesterday's decline in all major US indices was part of the strong correction that has been going on for the past six weeks.

Both gold and the US dollar also showed high volatility before and after the publication of the CPI report for April.

The Bureau of Labor Statistics report on consumer prices consists of 37 pages, and it takes some time to analyze it thoroughly. This could explain a strong market reaction and a price reversal in both gold and the US dollar, which lasted for about an hour after the release.

Yet, the conclusion is simple. In the coming months, inflation will remain extremely high and persistent. There is no indication in yesterday's report that prices have reached their peak levels. Despite a slight decline, the current rate of 8.3% is compared to the same period in 2021, when inflation had already begun to accelerate. The report also showed that the core consumer price index, which excludes food and energy, rose by 0.6% in April.

Some analysts expected the Fed to take a more hawkish stance and raise the rate by 75 basis points. However, this contradicts Chairman Powell's statement at the FOMC meeting last week who said that a rate hike of 75 basis points was not under consideration.

While the Fed will maintain its aggressive approach, I believe that it will continue to raise the rate by half a percentage point if necessary instead of implementing a rapid hike at its next meetings throughout the year.

The Federal Reserve still faces a dilemma as the key reason for inflationary pressures is not just a by-product of demand. The current inflation rate stems from the disruption to supply chains, including the ones from China, and geopolitical tensions in Ukraine. Aggressive monetary policy alone is unlikely to solve these problems.