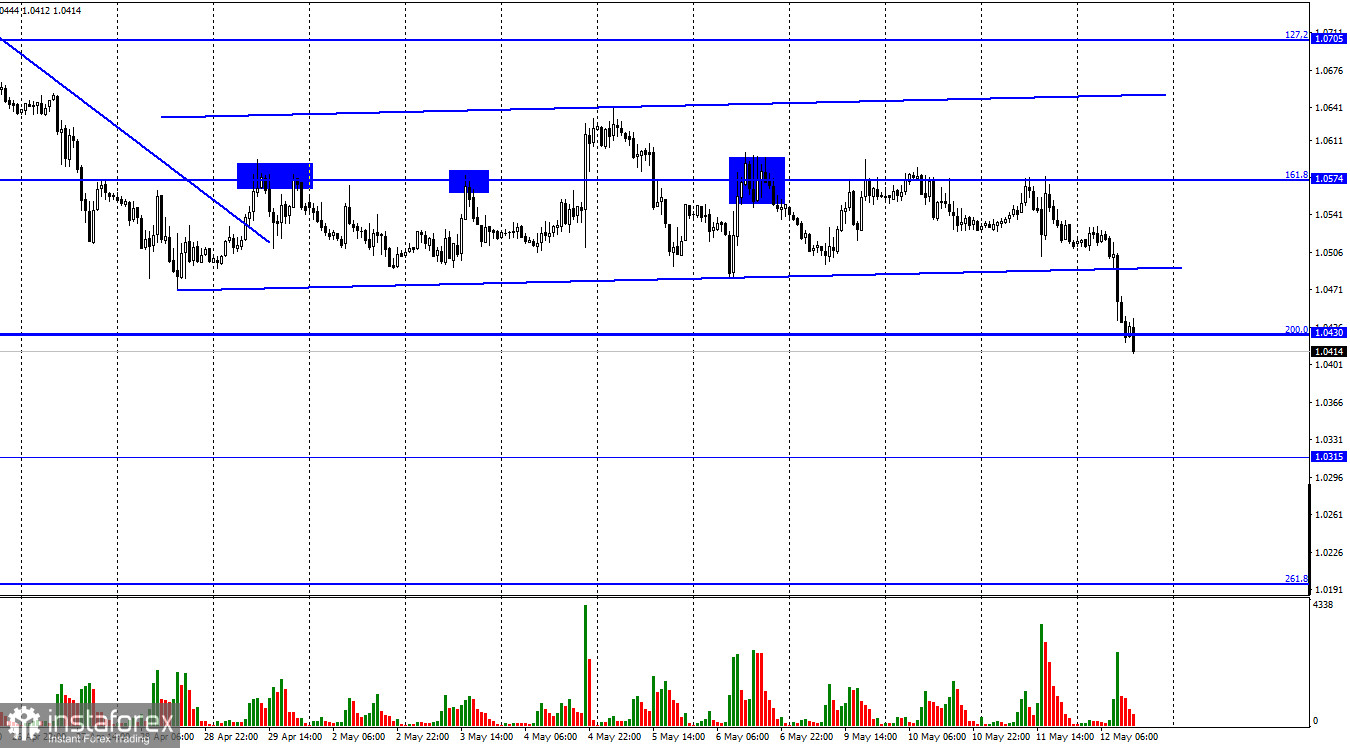

EUR/USD was trading in the range between 1.0500 and 1.0574 on Wednesday. However, today, the quotes continued to fall and settled below the sideways channel under the 200.0% Fibonacci retracement level at 1.0430. Now, the euro is heading towards the level of 1.0315. In general, the European currency has been declining for a year and a half, with the last few months being the hardest ones. Of course, the Ukrainian-Russian conflict has considerably undermined the position of the euro. However, I would like to remind you that the worst-case scenario for the European economy has not yet come true. Who knows what happens when Europe faces the consequences of the military conflict in Ukraine. Besides, the policies of the Fed and the ECB are completely opposite, or at least it has been so until recently. For instance, some ECB officials are now talking about a possibility of a rate hike in July this year. Even so, such hawkish comments do not support the euro in any way as it keeps moving lower.

According to the CPI report released yesterday, inflation in the US showed some signs of a slowdown. Previously, running inflation supported the US dollar as traders expected the Fed to take aggressive steps. At the moment, the inflation rate is declining but the greenback is still on top. From my point of view, the euro/dollar pair has been largely oversold. Regardless of whether there is a driver or not, the euro is falling anyway, while the dollar is strengthening. Apparently, traders tend to completely downplay most of the economic reports and events as well as geopolitical factors. No important news has been received from Ukraine for several weeks, and there has been no progress from both sides. It would be ridiculous to suggest that the euro will keep plunging until the conflict in Ukraine is resolved.

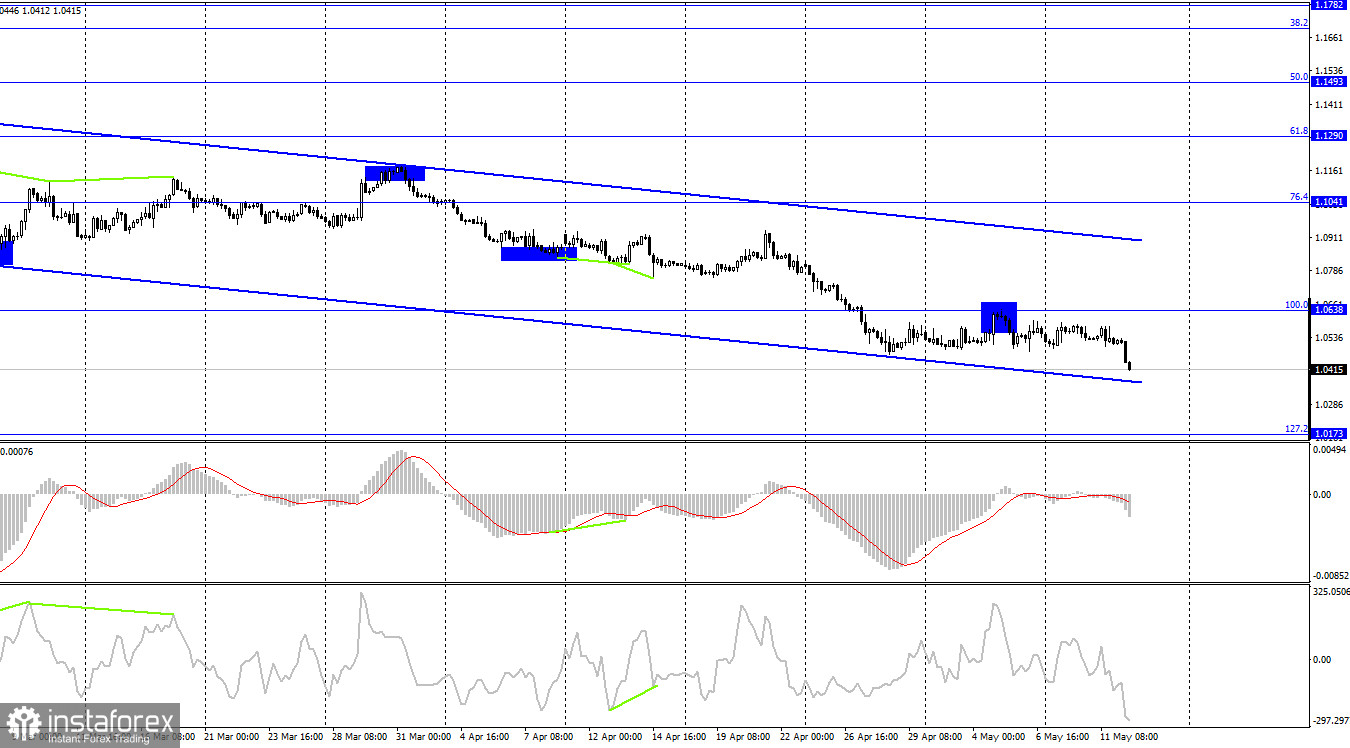

On the 4-hour chart, the pair bounced off the 100.0% Fibonacci retracement level at 1.0638 and reversed, thus supporting the US currency. So, the price continues to fall towards the next retracement level of 127.2% at 1.0173. The descending channel confirms that the market sentiment remains bearish. Consolidation above the level of 1.0638 will suggest growth to the upper boundary of the descending channel.

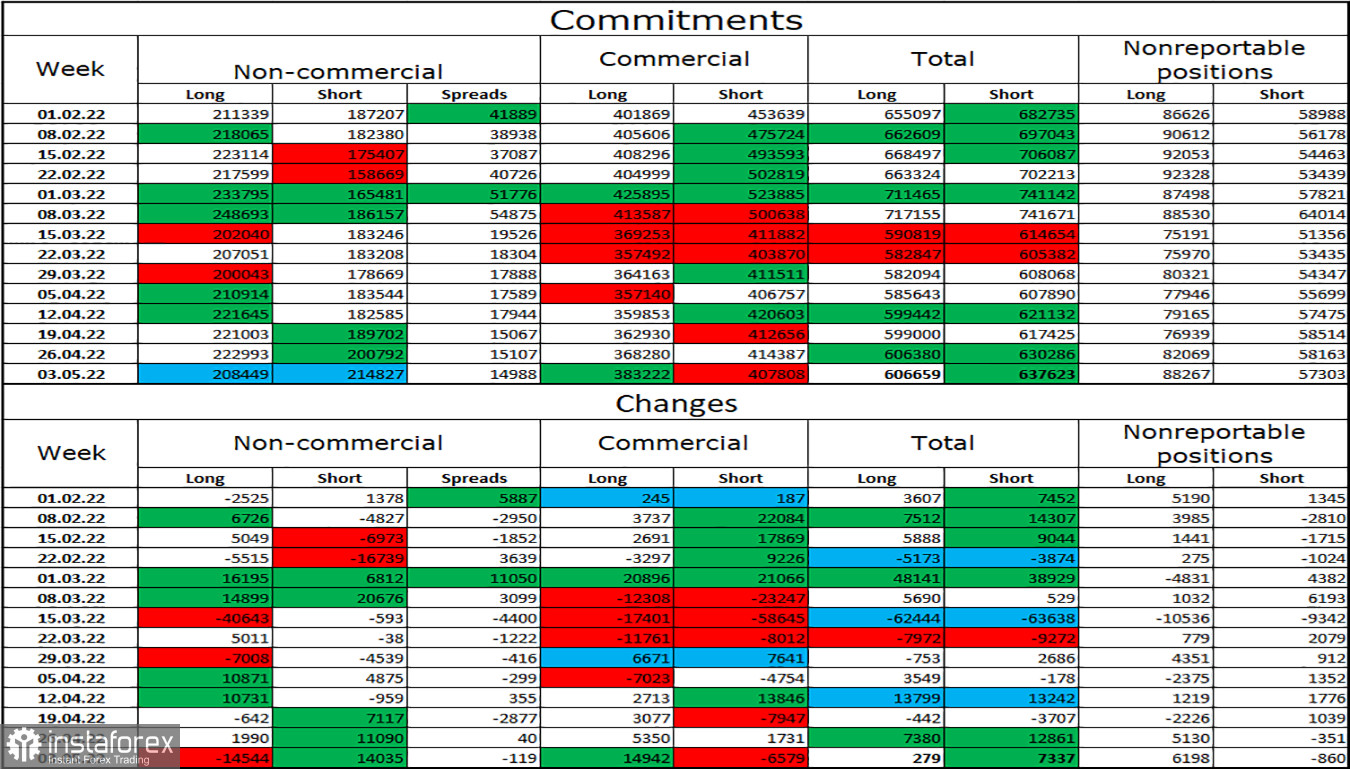

Commitments of Traders (COT) report:

Last week, traders closed 14,544 long contracts and opened 14,035 short contracts. This means that the bullish sentiment of the big market players has weakened significantly, and this will be the third week in a row. The total number of long contracts stands at 208k and short contracts - at 214k. For the first time in quite a long time, the non-commercial category of traders is bearish on the pair, while the euro continues to fall against the dollar. For several months in a row, the COT data suggested that the euro should recover soon. That is why I cannot say for sure that everything became clear now. Such factors as the ongoing conflict in Ukraine, escalation of tensions between Europe and Russia, new sanctions, and the weakness of the ECB's position have a very strong impact on the market.

Economic calendar for US and EU:United States - Initial Jobless Claims (12-30 UTC).

On May 12, the economic calendar has only one important event to show both in the US and the EU. One report is unlikely to shape traders' sentiment, so there will be no information background today.

EUR/USD forecast and trading recommendations:

I recommended selling the pair in case the price rebounds from the level of 1.0574 on H1 and heads towards the lower boundary of the sideways channel. However, the pair dropped below the channel and stayed under the level of 1.0430. Therefore, traders should keep their short positions open. It is better to wait before buying the pair as the downward movement is really very strong.