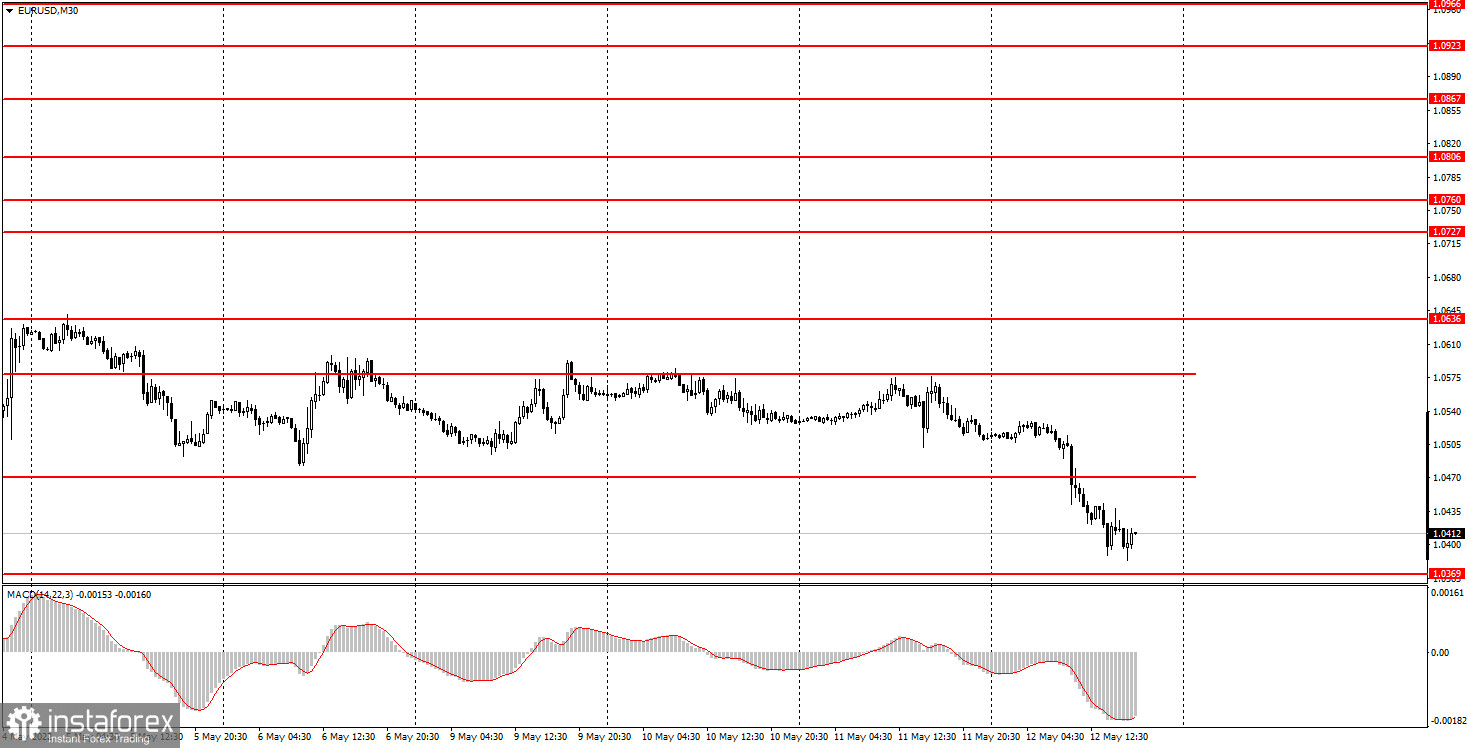

Analysis of Thursday's trades: 30M chart of EUR/USD

On Thursday, EUR/USD left the sideways channel. As it turned out, the pair did not even need a strong fundamental or macroeconomic background for this. Not a single important macro report came out in the eurozone and the US during the day. ECB President Lagarde has recently hinted at the possibility of a rate hike a few weeks after the end of the QE program. As a reminder, the ECB's benchmark refinancing rate and the interest rate on the deposit facility are at 0.00% and -0.50% respectively. This means not a bank but you pay interest when putting money into a bank account. Such monetary policy is supposed to promote investment growth in the economy and production. Due to record inflation, the ECB needs to tighten its monetary policy. However, it has been reluctant to do this so far. It has not even concluded net asset purchases under its APP. Consequently, the euro has had no reason for growth. Only an occasional correction can save the euro from falling even deeper.

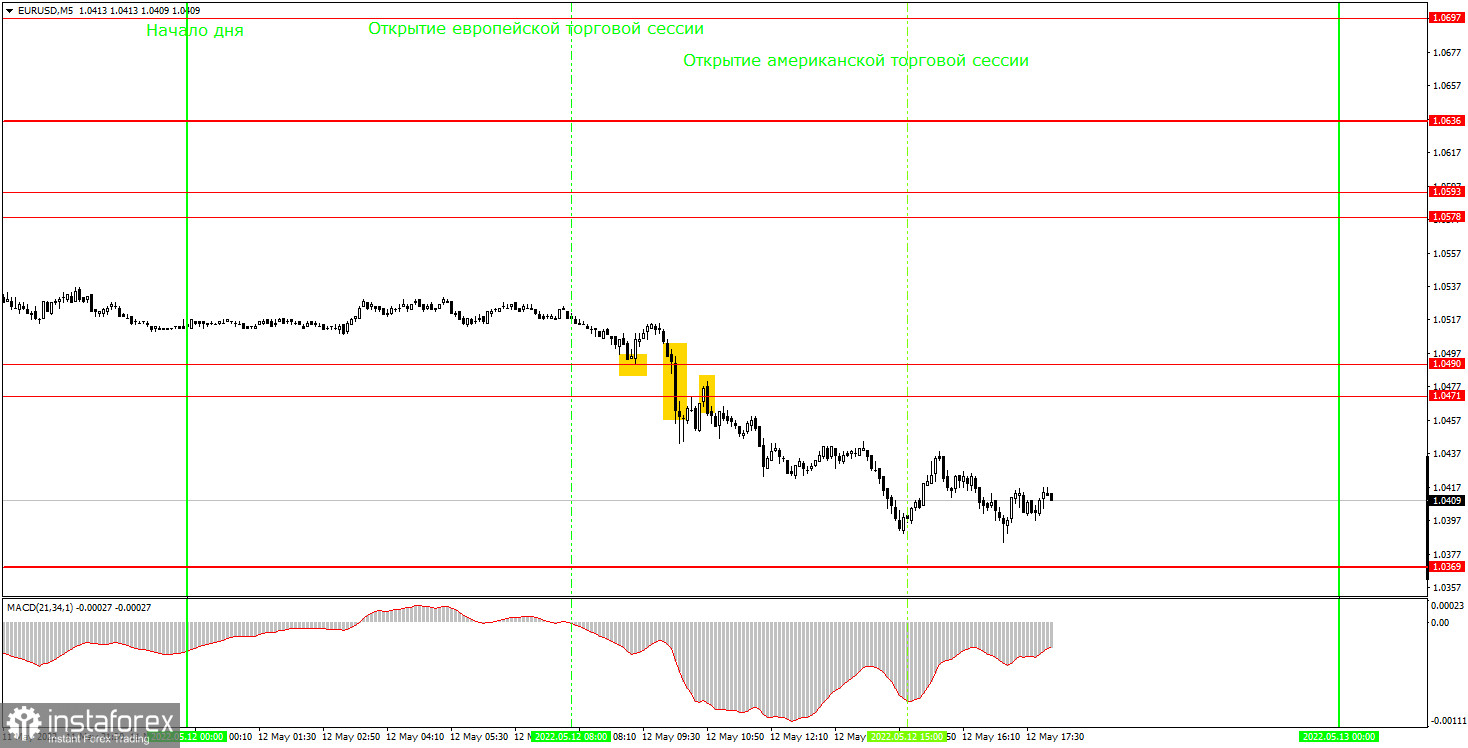

5M chart of EUR/USD

In the M5 time frame, the technical picture looks rather simple. On Thursday, the pair settled below the 1.0471-1.0490 and then extended the downtrend. The quote rebounded from 1.0490, producing a buy signal. Yet, it failed to retrace up by 15 pips needed to set Stop Loss at the breakeven point. The pair then plunged and consolidated below 1.0471, making a sell signal. Consequently, a long position turned out to be unprofitable. In a while, the quote almost reached 1.0369. A short position should have been closed manually by the end of the trading day. It brought about 50 pips of profit, offsetting the losses on the first trade. All in all, it was a profitable day.

Trading plan for Friday:

In the M30 time frame, there is a downtrend, with the price leaving the sideways channel. It is possible that the euro will plunge. The currency is now a few dozen pips away from its 20-year lows. If the quote breaks through 1.0369, a move towards parity with the dollar will appear likely. In the M5 time frame, levels 1.0369, 1.0471-1.0490, and 1.0578-1.0593 stand as targets. A stop-loss order should be set at the breakeven point as soon as the price passes 15 pips in the right direction. On Friday, the eurozone will see the release of a report on industrial production. In the US, Michigan consumer sentiment will be published. These reports are unlikely to somehow affect the market against the current backdrop. The downtrend may well extend on Friday as the price has left the sideways channel. Notably, the pair has not fallen below 1.0369 for 20 years.

Basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to the Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or produce no signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to interpret charts:

Support and resistance levels can serve as targets when buying or selling. You can place Take Profit near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginner traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management is the key to success in long-term trading.